The July–August 2007 crisis in subprime mortgage markets precipitated the collapse of the market for asset-backed securities, forcing huge write-downs of more than $45 billion on the balance sheets of major banks. In the aftershock, interbank lending dried up. Bond insurers and money market funds were beset by a loss of confidence as the credit squeeze spread. The plunge in stock markets in January 2008 suggests that the repercussions of the collapse of the subprime mortgage market are still working their way through financial markets. With over 170,000 jobs lost and the expected spate of foreclosures, many observers believe that the credit crunch has pushed the economy towards a recession.

The collapse of the subprime market may put at risk the new model of bank operations, which allows banks to earn profits through the securitization of loans, whereby loans are chopped up, repackaged into new securities, and sold in the capital market. This process, also called the “slicing and dicing of risk,” allows banks to increase liquidity through lending levels that go beyond the regulatory constraints imposed by monetary authorities. Lending in this context depends on the willingness of capital markets to buy these securitized loans. The complex and opaque debt instruments created (such as “collateralized debt obligations” and “structured products”) were supposed to disperse risk across capital investors. In fact, the process helped obscure the actual sources of exposures and losses in the markets. The statistical models for pricing risk and rating these repackaged securities failed adequately to account for the true risk. When it came, the fall then spread like contagion as investors retreated from these markets.

The securitization of loans furthered the globalization of finance by creating financial products that were bought and sold globally. Buyers across the globe have been investing in these assets, and over a trillion dollars of funds from around the globe—in particular from East Asia and the oil-exporting countries—were swallowed up by the U.S. subprime markets, helping finance the purchase of homes all over the country and enabling the growth of consumption spending.1 As a consequence of this globalization of finance, subprime problems spread around the world quickly—from a German bank (IKB) that required a bailout in July to problems in BNP Paribas (France’s biggest bank) to a run on the Northern Rock Bank in the United Kingdom.

Apart from the losses in the banking system and the signs of a recession in the United States, the fate of the dollar too may hang in the balance as the credit crisis has led to speculative sell-offs of the dollar. The dollar plunged sharply following five years of decline in which it lost about 25 percent of its value against a basket of currencies. It plunged to an unprecedented low of around $1.48 against the euro in January 2008, a fall of about 40 percent from its 2002 peak. With signals that oil exporters in the Middle East might unhitch the dollar peg (by pricing oil in a currency other than the dollar) and with fears that the falling dollar is fuelling inflation globally (by raising the prices of exports to the United States), what appear to be cracks in the financial edifice of the dollar empire are becoming visible.

Predictions about the imminent collapse of the dollar are hardly new. The dollar has survived two decades of growing U.S. deficits and debts (and two cycles of appreciation and depreciation). The puzzle of the ability of the United States to sustain growing external deficits without a major speculative attack is explained by the dominant role of the dollar in the settlement of international transactions. The dollar today enters on one side of 86 percent of all foreign exchange transactions, while its closest competitor, the euro, enters on one side of 37 percent of foreign exchange transactions. About 66 percent of foreign exchange reserves are held in dollars, while the euro share of foreign exchange reserves is about 25 percent.2 Dollar holders are tied into their positions since dollar sales would lead to a plummeting of the dollar and an erosion of the value of their dollar holdings.

But to comprehend the resilience of the dollar’s role as international money we need to explore the roots of its role in the mechanisms of U.S. imperialist hegemony. These mechanisms are embedded in the global pattern of credit relations mediated by the international financial system. The development of global capitalism in the recent decades has seen the phenomenal growth of what is called financialization. This refers to the growing political and economic power of finance along with the explosion of financial trading that facilitates a pattern of accumulation where profit making is engineered increasingly through financial channels.3 The increasing dominance of finance has helped the United States establish and preserve its pivotal place at the center of international financial markets. The puzzle is that in contrast to the traditional formulations based on Lenin, the imperialist system today is dominated by a country, the United States, which is a large capital importer rather than an exporter of capital. The external debt of the United States has mounted to nearly 25 percent of its GDP, and the United States today absorbs about 60 percent of the world’s capital imports, about 37 percent of which comes from developing countries. This global imbalance allows the United States to play the role of the world’s banker, drawing toward it the surpluses from Asia and the oil exporting countries, and recycling these to emerging markets in the periphery.

Boosted by both financial innovations and the growth of finance, this pattern of recycling surpluses has enabled the tremendous growth of international capital flows over the past three decades, and allowed the United States to continue to sustain growing external debt and deficits. It has also fuelled cheap credit in the United States (by increasing the amount of money that can be loaned out). What is more, financial fragility in emerging markets—engendered by dollar recycling—has buttressed the resilience of the dollar by providing a cushion of defense against speculative attacks on the dollar. The establishment of this pattern of recycling, which depends crucially upon the role of the dollar as international currency, has played a significant part in the perpetuation of U.S. economic imperialism.4

Establishing the Dollar Standard

In the aftermath of the Second World War, Britain’s imperial position was greatly weakened and it was facing significant payments pressures (owing more to the rest of the world than was owed to it). The United States, unscathed physically by the war, emerged as the largest creditor country with substantial foreign exchange reserves. However, in order for the dollar to play the role of the dominant currency, there had to be enough dollars to go around. Means had to be found by which war-ravaged Europe could finance (by accumulating dollars) its dependence on U.S. imports for reconstruction. The postwar world thus saw intense economic negotiations that reflected the tensions and contradictions of reshaping the international monetary system. Most prominent was the Bretton Woods Conference, which laid the basis for the new international order and the building of international institutions that, whatever their original purpose, institutionalized the dominance of the United States. This also involved preempting any resurgence of the British pound.5

The International Monetary Fund (IMF) was initially conceived as an instrument to facilitate expansionary national economic policies that would enable member countries to overcome temporary liquidity problems, such as a shortage of loan funds. However, the IMF would play only a small role in this regard, in large part due to U.S. efforts to marginalize its role to prevent the emergence of any true multilateralism.6 Instead, the postwar reconstruction plans with regard to Europe and Japan facilitated the financing of balance of payments deficits and the easing of the problem of the dollar shortage.7 This, along with economic and military aid by the United States, helped buttress the role of the dollar. Later the IMF would be refashioned into a means to impose deflationary discipline on debtor countries.

The 1956 Suez Crisis was an important milestone in the forging of the dollar standard. It signaled the effective eclipse of the pound’s role as international money and also marked a shift in Washington’s attitude toward the IMF. The IMF was drafted into the rescue of the pound from speculative attacks that threatened to deplete Britain’s dollar reserves in the aftermath of the nationalization of the Suez Canal.8 The United States was able to use the promise of an IMF bailout to effect the ouster of Britain from the Suez, while minimizing its own direct financial contribution to the rescue. The reinstatement of capital controls following this crisis restricted the use of the pound by British banks to finance trade between countries outside the sterling area. British financiers began to resort to offering dollar loans against their dollar deposits, drawing Britain more closely “into American imperial embrace.”9 Thus the role of London as a financial center was preserved, while cementing its ties to the international hegemony of the dollar.

With the dissolution of the European Payments Union and the restoration of currency convertibility (on current account) in Europe in 1958, the U.S. attempt to forge an international monetary order pegged on the dollar was brought to fruition. However, as Europe and Japan emerged as industrial competitors of the United States, U.S. current account balances began deteriorating through the 1960s, and the possibility of a speculative run on the U.S. gold stock (as the nations holding dollars began to demand gold in exchange for them) posed a threat to the international payments mechanism. The sterling devaluation in 1967 (followed by the franc in 1969), the upward speculative pressure on gold prices, and the contingent demands of financing the war in Vietnam brought the crisis to a head.

However, the closing of the gold window in 1971 (with the United States refusing to give up gold for dollars at a fixed price) and the subsequent “floating” of the dollar in 1973 did not result in the displacement of the dollar as the international reserve currency.10 Instead, developments in international monetary arrangements over the past three decades enabled the preservation of the role of the dollar as an international reserve currency. At the heart of this process was the emergence and rapid growth of parallel, unregulated monetary mechanisms.

Financialization and Unregulated Private Capital Flows

Even during the Bretton Woods negotiations, there were powerful players in the United States that promoted dollar-denominated private capital flows as an alternative to official channels for solving the problem of international liquidity.11 The strong opposition from New York bankers to the provisions for capital controls (which could limit the movement of dollars around the world) in the Bretton Woods agreement stemmed from (1) their fears of the erosion of the profitable business of receiving money fleeing Europe, and (2) the possibility that London could use exchange controls to preempt the ascendancy of the dollar in the international monetary system.12 The U.S. agenda for a post-Bretton Woods refashioning of the international monetary system as a “pure” dollar standard was rooted in the aggressive pursuit of liberalized financial markets and the dismantling of capital controls, thus encouraging private international capital flows denominated in dollars.

The capital controls instituted by the United States after 1964 to curb the speculative flight from the dollar were not particularly successful. They did, however, pave the way for the creation of the Eurodollar market. This market consisted of dollar-denominated bank deposit liabilities held in foreign banks or in foreign branches of U.S. banks and emerged in the 1960s, even as the U.S. government was attempting to restrict capital outflows. This growing offshore market, which was both liquid and unregulated, proved an important means for encouraging foreign investors to finance the U.S. deficit—by giving them a place to put their dollars to interest-bearing use rather than selling them. Once the United States eliminated capital controls in 1974, U.S. transnationals increasingly began to finance overseas operations through this growing market.

After the 1973 oil shock, U.S. political and economic power ensured that OPEC surpluses were recycled through the private channels of the Eurodollar markets. Proposals to channel these surpluses through official IMF channels were blocked. As the dollar denominated surpluses of the OPEC countries came to be recycled through this market in the 1970s, the market grew to be a full-fledged capital market, expanding from $9 billion in 1964 to $145 billion 1971 and to $1.4 trillion in 1981 just before the debt crisis unraveled in Latin America.

The massive growth of this offshore market signaled the decisive shift away from the restrictive Bretton Woods system. It also foreshadowed the concerted advocacy of financial openness and integration in the interests of preserving dollar dominance. The 1979 economic shock engineered by Federal Reserve chairman Paul Volcker was a defining moment in the changing balance of class forces in favor of financialization. In the context of the continuing surge in the U.S. external deficit and growing inflationary pressures in the 1970s, the United States adopted austerity measures, in order to stabilize the dollar by tightening monetary policy and sharply raising interest rates. This had significant implications in buttressing and promoting the dominance of finance and signaled the onset of the era of neoliberalism, in what has been christened the coup of finance.13 Pension funds, mutual funds, and insurance grew through this period as important players in the financial markets. By the late 1990s, new actors like hedge funds and private equity groups also acquired greater financial clout.

It is worth noting that this period witnessed the process of a restructuring of class relations in the United States.14 Income was redistributed away from workers as wages were squeezed and hefty earnings were made from financial speculation, proprietary trading, and risk arbitrage. The top 1 percent of the population received 14 percent of the national after-tax income in 2004, nearly double its 7.5 percent share in 1979. In the same period the share of the bottom fifth fell from 6.8 to 4.9 percent.15 And yet the United States has sustained its role as the engine of world demand.

Personal savings, which had been on average about 10 percent of GDP in the 1970s, fell to an average rate of 2 percent between 1999 and 2004 and turned negative in 2005. The inflow of capital brought on by escalating global imbalances allowed for a surge of consumer credit as the mass of employees and consumers have sunk deeper into debt, and this also sustained demand. The credit card debt of an average American family increased by 53 percent during the 1990s. About 67 percent of families with annual incomes less than $10,000 faced credit card debt, and the debt of this group saw the largest increase—184 percent compared to a 28 percent increase for families with incomes above $100,000.16

Exporting Crisis to the Periphery

Financial innovations led to a proliferation of financial instruments. Financial assets (the sum of bonds, equity, and bank assets) grew to about 425 percent of U.S. GDP.17 This deepening of financial markets domestically helped preserve the role of the dollar internationally. In parallel with deregulation in the United States were the moves to liberate economies in Latin America from the yoke of “financial repression.” Disinflation, deregulation, and the freeing of interest rates in these countries fuelled the inflow of private foreign capital. The oil surpluses that were absorbed into the international banking system were recycled to the emerging markets in Latin America through sovereign loans. The debt of developing countries doubled from 8 percent of GDP at the beginning of the 1970s to about 22 percent of GDP in 1982. Mexico, Brazil, Venezuela, and Argentina together accounted for nearly 75 percent of total third world debt in this period.18

The Volcker shock also marked an important juncture in U.S. imperial relations, and would serve to bring the countries of the periphery deeper into the embrace of the dollar empire. The steep hike in interest rates precipitated payments problems for Latin American debtor countries, leading to the debt crisis of 1982, which brought the bonanza of capital inflows to a stop. This debt crisis became the means by which a further impetus was given to financialization through the terms and conditions imposed by the IMF structural adjustment and stabilization packages. The key element of the Brady Plan for dealing with the debt crisis was the conversion of debt to equity in the form of tradable bonds. The sale of these bonds would allow creditors to diversify sovereign risk more widely across international capital markets. At the same time emerging market countries would become more dependent on these international capital markets for their financing needs.

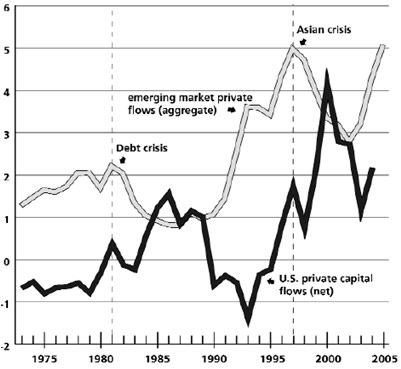

This “lost decade” for Latin America was a period when the tide of private capital flows moved toward the United States (see chart 1). With the waning of the OPEC surpluses in the 1980s and the persistent increase of the U.S. trade deficit, the United States brokered the Plaza and Louvre Accords (in 1985 and 1987 respectively) in order to bring about an orderly devaluation of the dollar. These agreements also ensured the commitment of foreign central banks to the defense of the dollar. In the 1990s, the pattern changed as the United States faced net outflows until 1996, while emerging markets once again witnessed a huge influx of private capital inflows.19 In 1990, dollars accounted for only 50 percent of reserves and deposits. Boosted by burgeoning private capital inflows into developing country markets and the growth of reserve holdings through the 1990s, the U.S. dollar’s share rose by 1998 to about 70 percent of holdings, a level not seen since the 1970s.

Chart 1. Private flows (as a percent of GDP) to the United States and emerging markets,* 1973–2005

Source: Bank of International Settlements, http://www.bis.org/statistics/ar2005stats.htm; Global Development Finance Online, http://publications.worldbank.org/GDF/”.

* Emerging markets include all developing countries (defined as middle- and low-income countries with GNI per capita in 2006 of less than $11,115) in Latin America and the Caribbean (29 countries), the Middle East and North Africa (14 countries), East Asia and the Pacific (24 countries), Europe and Central Asia (26 countries), Sub-Saharan Africa (48 countries), and South Asia (8 countries).

This second wave of private capital inflows to emerging markets came to an abrupt halt with the Asian Crisis of 1998. An interesting feature of the pattern of private capital flows after 1973 is that as periods of inflows to emerging markets came to a halt in the wake of crisis, a surge of inflows to the United States occurred. The resumption of private flows to emerging markets signaled a fresh outflow of capital from the United States (see chart 1). This suggests that the two flows offset each other and the collapse of flows to emerging markets helped engineer an inflow to the United States.

Through the period 1987–98, emerging markets experienced forty-four episodes of capital inflows compared to nine episodes in open advanced economies, with more than a third of these episodes ending abruptly in a currency crisis or a sudden stop.20 In fact, it would seem that through the period of the floating dollar standard, the brunt of financial fragility was borne disproportionately by countries in the periphery. Between 1973 and 1997, forty-four episodes of financial crisis were witnessed in the advanced capitalist core countries and ninety-five in the periphery (see table 1). In a sense, crisis in the periphery acted like a safety valve for the international monetary system hinged on dollar liquidity. Capital flight into dollars in the aftermath of crisis preserved the role of the dollar. At the same time the responses to the crisis—the bailout packages—were geared to reinforcing the dominance of finance centered in the United States.

The experience of South Korea illustrates these mechanisms. In the 1990s, under pressure from both the G-7 countries and domestic interest groups, financial liberalization was pushed forward there. Short-term capital surged into the country increasing from $12 billion in 1993 to $67 billion in 1996. The overheating of the Korean economy and the ensuing financial stress precipitated the crisis of 1997 as foreign investors began pulling out. The Korean government was on the verge of default and turned to the IMF for assistance. As part of the conditionalities of the IMF loan, South Korea was committed to furthering neoliberal reforms and restructuring Korea’s financial and industrial institutions opening them further to foreign capital inflows. The Korean stock market became “a gambling casino for foreign investors” and by 2004 foreigners owned 43 percent of Korean stock and about 39 percent of the capital of Korean banks.21

The United States is, in effect, the world banker. It has been able to tap into the surpluses of creditor countries in the periphery and recycle surpluses through financial markets to emerging markets in the periphery. Emerging markets have borne the brunt of speculative attacks that in the final analysis helped protect and preserve dollar hegemony through two decades of growing deficits and external debt. Financial integration imparted a greater elasticity to the adjustment mechanisms in the core, and the proliferation of financial instruments and the surge of financial flows played an important role in preserving and extending the role of the dollar as world currency. In recent years these surpluses have also been channeled into the subprime mortgage markets, where the poorest and least credit-worthy borrow money. The collapse of this market is in a sense a reflection of the contradictions of the dollar empire that was established in the postwar period. No doubt, poorer people in the United States will, like emerging nations, bear the brunt of the damage necessary to resolve, at least temporarily, the contradiction.

While many of the mechanisms of the pattern of financial intermediation are new and are intimately linked to the new mechanisms of imperialism in the postwar world, there are striking and surprising analogies to the mechanisms that buttressed the position of Britain, the imperial hegemon, during the heyday of the international gold standard. The development of new financial instruments allowed one country, Britain, to use its colonial empire to establish the dominance of the pound, leading both to the consolidation of its hegemonic position as well as the emergence of mechanisms that exported financial crises to the periphery.

The International Gold Standard

Like the dollar standard, the international gold standard was brought into place by war. The defeat of France and the eclipse of the Paris money market after the Franco-Prussian War concentrated liquidity in London. Germany’s subsequent shift to a gold standard and its use of the war indemnity to acquire sterling claims paved the way for British domination of the international financial system as the largest capital market and trader.

The imperial role of England was fostered by the financial revolution in England—the growth and consolidation of joint stock banks and discount houses. The sterling bill that mediated commerce around the world evolved into a mechanism of finance. The use of sterling bills was not restricted to England and the empire but was also used, for example, to mediate trade between the United States and Continental Europe. A global credit pyramid was created by the trading of sterling bills that was independent of the control of the Bank of England. Even with minimal gold reserves, the Bank of England was able to draw and recycle capital through a parallel unregulated monetary mechanism of sterling bills.22

At the same time, the practice of augmenting gold reserves with convertible foreign exchange, mainly pounds, was prevalent in the prewar world. Countries of the empire all came to adopt some form of the gold-sterling standard, holding sterling to the full extent of the local currency issue while maintaining external convertibility.23 This imparted a greater elasticity to the sterling system as a whole and facilitated credit expansion as long as Britain was able to look with equanimity at the growing sterling claims (as the United States does today with dollar claims). Private capital flows mediated through the financial center in London thus played a pivotal role in regulating and recycling liquidity and sustained a voluminous expansion of trade and finance globally until the outbreak of the First World War.

There was, however, an asymmetry in the adjustment mechanism between the leading financial center and the periphery. While Britain recycled liquidity to the periphery through capital outflows, it could, by sharply curtailing investments and lending, redistribute the real burden of adjustment to the periphery during times of crises. Such liquidity crises occurred in Argentina during the 1890 Barings Crisis, Brazil in the 1890s, and again when the Australian land company bubble burst in 1893. These crises were aggravated by the sudden withdrawal of British deposits.24 These did not, however, threaten currency convertibility in the leading countries of the center.

The “imperial system,” the institutional structure of the credit relations underpinning Britain’s relation to its empire and to primary export producers in the periphery, was integral to this process. The interconnecting network of multilateral trade, revolving around England, whereby England financed its deficits with the United States and Continental Europe through the surpluses of the empire, in particular India, became crucial to the stability of the system. The empire thus provided a critical source of surplus that was recycled through London when countries like France proved less willing to provide the necessary cushion to the Bank of England.

Thus, while India and Japan held their surpluses as deposits in London, providing a source of short-term credit to England, capital was recycled in the form of capital exports to primary exporters in Latin America (and Australia) that bore the brunt of convertibility crises and destabilizing capital flows. Between 1880 and 1913, there were seven episodes of crises in the industrial core, compared to twenty-five in the emerging markets in the periphery (see table 1). The deepening of finance and the pattern of integration of countries into the global financial markets buttressed Britain’s imperial dominance through the gold standard period.

The instability of the interwar period and the ill-fated attempt to restore the “gold standard” reflected the contradictions of the system based on the ability of London to preserve the dominance of the pound in the face of the United Kingdom’s growing deficits and the unraveling of its imperial hegemony. What is interesting is that in this period (1919–39) of hegemonic decline, war, and economic instability in the center, the incidence of crisis in countries in the periphery was less than that in the core (see table 1). This contravened the pattern of both the gold standard period and that of the period after the 1971 collapse of the Bretton Woods arrangements. During the period of de-globalization (1919–39), when the imperial countries lost much of their control over their “possessions,” the absence of the safety valve that the countries of the periphery provided led to the concentration of financial crises in the countries of the capitalist core itself.

Finance and Imperialism

The dominance of finance and the integration of countries in the periphery into the global financial system have historically been the mechanisms by which the leading country has asserted and preserved its position at the center of the global capitalist system. Britain’s role in the gold standard era and the role of the United States in the post-Bretton Woods period were both fostered by growing imperial financial dominance over the periphery. The role of each in succession as banker to the world was buttressed by the ability to draw on surpluses from countries in the periphery. Private capital flows to emerging markets in the periphery also provided a cushion for adjustments in the center, by deflecting the focus of speculative attacks as the currency at the center faced the prospect that capital outflows might undermine its dominant status.

In a context where the monetary liability of a dominant country assumes the roles and functions of “international money,” the generation of international liquidity hinges on the proliferation of finance. While dominance in multilateral trade relations and “creditor” status fosters the increasing recourse to the leading country’s currency in international settlements, it is dominance in the global financial markets that underpins the role of its currency as international money. The generation of international liquidity entails debt creation by the leading imperialist country. However, the growing debt burden necessary to sustain this role undermines the status of the currency as world money, as it faces the prospect of speculative outflows of capital. This is the crux of the contradiction of the use of a country’s currency as international money.

Historically, this contradiction has been resolved by passing the burden of adjustment disproportionately onto the periphery. The mechanisms of the international financial markets have been instrumental in sustaining imperial hegemony. The dominance of finance and the central position of U.S. financial markets in the pyramid of global capital markets have helped preserve the privileged position of the dollar and the structural vulnerability of the periphery. This includes both surplus countries (that are not competing with the dollar as international money like China and Japan), whose export-led growth strategy ties their economies closely to the U.S. appetite for imports, and the debtor countries of the periphery (Latin America and South East Asia), which have borne the brunt of deflationary pressures and fragility.

Cracks in the Empire

In the last five years emerging markets have witnessed another wave of private capital inflows, rising from $152 billion in 2002 to more than $560 billion at the end of 2006 (see chart 1). As investors searched for new profit frontiers in financial innovations, nontraditional financial intermediaries like private equity groups and hedge funds grew by about 14 percent and 20 percent respectively in the first six years of this decade.25 By buying up a range of asset classes, including emerging market bonds and collateralized debt obligations, these institutions enabled banks to extend lending beyond their traditional constraints. But the relentless hunger for financial innovation is bred in the same systemic and imperial processes that mediate the international division of labor in global markets through the generation of dollar liquidity. Global imbalances, the surge of liquidity seeking emerging markets, and the profusion of financial instruments and markets have led to the increasing fragility of the financial system.

In 1866, Overend, Gurney and Co., a leading discount house and a “banker’s bank,” second only to the Bank of England, almost brought London’s banking system down. More than a century later, under the impact of the subprime collapse, London witnessed its first bank run since the fall of Overend, Gurney and Co., as depositors queued up outside the Northern Rock offices. The 1866 crisis was the last major disruption before the sterling-based gold standard system was forged. It was, in a sense, a crisis of the era before the creation of a new financial architecture had integrated the world market and imposed the dominance of the currency of a single country on global capitalism.26

Marx, writing at a time when bullion assumed the role of “world money,” highlighted the inherent deflationary bias of the international payments system, pointing to the contagion effect of payments crises among capitalist countries.27 He was, however, stressing the manner in which these crises were transmitted within the core of advanced capitalist countries. The actual evolution of global capitalism has been shaped by the rising dominance of finance and the emergence of the monetary liability of a single dominant and imperialist country as “world money.” This has allowed the hegemonic country to evade the need for deflationary domestic adjustment in order to address its balance of payments problems. Instead, the burden of deflationary adjustment is imposed disproportionately on the debtor countries in the periphery as financial fragility gets exported to these countries. There is a connection between the functioning of such an international monetary system and the economic mechanisms of imperialist hegemony that can be seen both during Britain’s heyday as manager of the gold standard and in the contemporary period of U.S. hegemony.

The financial press has raised the specter of the end of dollar dominance. The present crisis lays bare the limits and constraints on the imposition of the dollar standard. It is, of course, possible that the present crisis heralds a period of a multipolar currency standard, with, for example, the euro establishing itself as a strong competitor. This might lead to more pronounced contagion effects in the core countries, as in the period between the First and Second World Wars. However, current account surpluses and large reserves have been accruing within most of the emerging market countries. Developing countries have increased their reserve holdings from about 7 percent of GDP to around 30 percent in recent years, and the central banks and sovereign wealth funds in Asia and among oil exporters have emerged as prominent players, and sources of funds in international capital markets.28 In the infusion of funds from sovereign wealth funds to bailout Merrill Lynch and Citibank, we are seeing the new institutional mechanisms for recycling funds from peripheral creditor countries. At the same time, a surge of capital flows into emerging markets has grown unabated since August, and the emerging market index, Morgan Stanley Capital International, has shown greater resilience following the recent credit crisis. As the sharp January 21, 2008, stock market decline suggests, financial contagion and an unraveling in the periphery, that once again re-establishes the dominance of the dollar, still remains a possibility.

Notes

1. Kenneth Rogoff and Carmen Reinhart, “Is the U.S. Sub-Prime market crisis so different” forthcoming in American Economics Review (May 2008).

2. Gabriele Galati and Phillip Wooldridge, “The euro as a reserve currency,” BIS Working Papers: 218 (2006).

3. This gravitational shift in economic activity from production to finance has been addressed for instance in John Bellamy Foster, “The Financialization of Capitalism,” Monthly Review 58, no. 11(April 2007).

4. The argument of this essay focuses on the economic mechanisms that preserve imperial power, but the military power of United States plays a significant role in sustaining its imperialist hegemony and the dominance of the dollar.

5. Fred L. Block, The Origins of International Economic Disorder (Berkeley: University of California Press, 1977).

6. Riccardo Parboni, The Dollar and its Rivals (New York: Verso, 1985).

7. The outbreak of the Korean War was a significant factor in pushing forward the agenda of the Marshal and Dodge Plans in Europe and Japan respectively.

8. James Boughton, “North West of Suez: The 1956 Crisis and the Suez,”IMF Staff Papers 48, 3 (2001): 425–46.

9. Leo Panitch and Sam Gindin, “Finance and the American Empire,” The Socialist Register, 2005 (Monmouth: Merlin Press, 2005).

10. Parboni, The Dollar and its Rivals.

11. Eric Helleiner, States and the Reemergence of Global Finance (Ithaca: Cornell University Press, 1994).

12. Helleiner, “States and the Reemergence of Global Finance,” 39–48.

13. Gerard Dumenil and Dominick Levy, Capital Resurgent (Cambridge: Harvard University Press, 2004) argued that the Volcker stabilization plan signaled the reinstatement of the “power of finance that had been eclipsed in the aftermath of the World War and was in this sense a ‘coup.’”

14. This process involved the defeat of working-class aspirations and the smashing of unions for instance with the squashing of the Air Traffic Controllers strike in 1980. Panitch and Gindin, “Finance and the American Empire.”

15. Arloc Sherman and Aviva Aron-Dine “New CBO data show Income inequality continues to widen,” Center on Budget and Policy Priorities, January 23, 2007, http://www.cbpp.org.

16. Tamara Draut and Javier Silva, Borrowing to make ends meet (New York: Demos Institute, 2003), http://www.demos.org/pub1.cfm.

17. Internation Monetary Fund, “Global Financial Stability Report: Financial Market Turbulence,” October 2007, Table 3, 139.

18. Global Development Finance online, http://publications.worldbank.org/GDF/.

19. International Monetary Fund, World Economic Outlook (2007), chap. 3. From $38 billion in 1990 net private inflows to emerging markets rose steadily to peak at about $284 billion in 1997 (GDF online database). In the same period the dollar share in the currency composition of emerging market debt grew from 42 to 64 percent.

20. International Monetary Fund, World Economic Outlook (2007), chap. 3.

21. James Crotty and Kang-Kok Lee, “Neoliberal Restructuring in Post Crisis Korea,” in G. Epstein, ed., Financialization and the World Economy (Northampton, MA: Edward Elgar, 2005).

22. Marcelo de Cecco, Money and Empire (New York: St Martins Press, 1984).

23. Peter H Lindert, Key Currencies and Gold, 1900–13, Princeton Studies in International Finance 24, (1969): 18.

24. Anthony Bloomfield, Short Term Capital Movements under the Pre 1914 Gold Standard. (Princeton, N.J: International Finance Section, Department of Economics, Princeton University, 1969).

25. Mckinsey Global Institute, “The New Power Brokers” (2007).

26. The next major crisis to hit the City of London, the Barings crisis, was different both in the organization of a private bailout through the offices of a consortium of Bankers and Discount houses and the displacement of the deflationary impact of the crisis to Argentina.

27. “In times of general crises the balance of payments is against every country, at least against every commercially developed country, but always against each of these in succession—like volley firing—as soon as the sequence of payments reaches it…in every case the same collapse follows” Karl Marx, Capital, vol. 3 (London: Penguin, 1981), 624.

28. Mckinsey Global Institute, “The New Power Brokers.”

Comments are closed.