Also in this issue

Books by Edward S. Herman

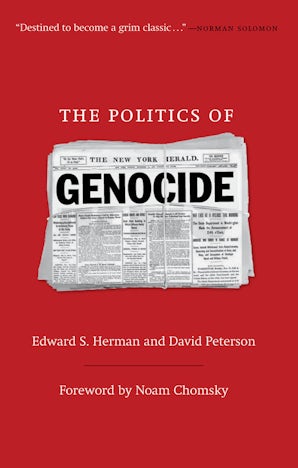

The Politics of Genocide

by Edward S. Herman and David Peterson

Foreword by Noam Chomsky

Article by Edward S. Herman

- The Necessity of a Universal Project

- The Present in History, 2021

- The Propaganda Model Revisited

- Fake News on Russia and Other Official Enemies: The New York Times, 1917Ð2017

- The Criminality of Wall Street

- The Crisis: A View from Occupied America

- A History of the Great BustÑStill With Us

- Rwanda and the Democratic Republic of Congo in the Propaganda System

- Four Crises of the Contemporary World Capitalist System

- Jeremiah Wright in the Propaganda System