Also in this issue

Books by Michael D. Yates

The Political Writings of Bhagat Singh

Edited by Chaman Lal and Michael D. Yates

Work Work Work

by Michael D. Yates

Why Unions Matter

by Michael D. Yates

Can the Working Class Change the World?

by Michael D. Yates

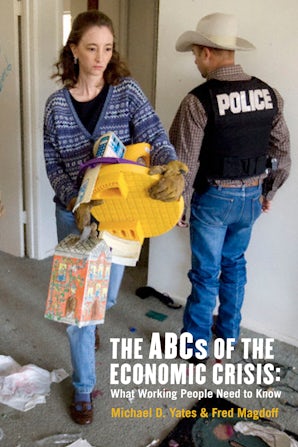

The ABCs of the Economic Crisis

by Fred Magdoff and Michael D. Yates

Article by Michael D. Yates

- 'Ballad of an American': The Illustrious Life of Paul Robeson, Newly Illustrated

- Panopticon

- These Brothers Chose Well

- COVID-19, Economic Depression, and the Black Lives Matter Protests: Will the Triple Crisis Bring a Working-Class Revolt in the United States?

- It's Still Slavery by Another Name

- Nothing to Lose but Their Chains

- Thinking Clearly about the White Working Class

- 'Mourning and Militancy'

- On Henry Giroux: Foreword to 'America's Addiction to Terrorism'