For a long time now, the U.S. economy and the economies of the advanced capitalist world as a whole have been experiencing a slowdown in economic growth relative to the quarter-century following the Second World War. It is true that there have been cyclical upswings and long expansions that have been touted as full-fledged “economic booms” in this period, but the slowdown in the rate of growth of the economy has continued over the decades. Grasping this fact is crucial if one is to understand the continual economic restructuring over the last three decades, the rapidly worsening conditions in much of the underdeveloped world to which the crisis has been exported, and the larger significance of the present cyclical downturn of world capitalism.

The Slowdown of Growth

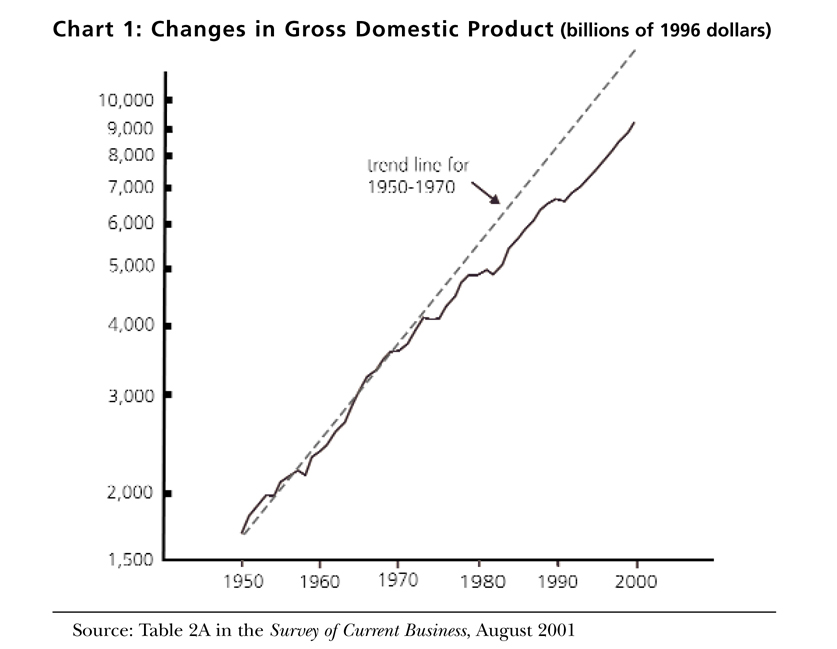

In order to illustrate what is happening to growth in advanced capitalism, the changes in the growth of Gross Domestic Product in the United States over the entire post-Second World War period are shown in chart 1 below. The vertical axis of the chart is designed to bring out rates of change. Termed a semilog chart, the vertical scale differs from the usual arithmetic scale. Thus, the difference between 2,000 and 3,000 represents an increase of 50 percent, whereas the distance between 3,000 and 4,000 is scaled to show an increase of 33.3 percent. In this sort of chart, the straight line portrays an equal rate of change for the period 1950 to 1970, smoothing out the minor fluctuations. Individual years are thus slightly above and below the trend line, but there is a fair consistency in the average rate of growth of the total goods and services produced in the first two decades. Now look at the ever-widening gap between the trend for 1950–1970 and the actual growth rates between 1980 and 2000. The implication of the slowdown is indicated by the fact that if the 1950–1970 growth rate had continued unabated, the economy would have been approximately 20 percent larger than it actually was in 2000.

These changes have occurred during years of class war imposed from above. Commenting on establishment plans to tighten the economic screws on the general population under the cover of the present patriotic fervor, public affairs journalist Bill Moyers has written: “Our business and political class owes us better than this. After all, it was they who declared class war 20 years ago, and it was they who won. They’re on top” (The Nation, November 19, 2001).

This notable slowdown has also taken place alongside a major leap in technology (the so-called New Economy) and the widening globalization that increased exploitation in the third world. Advances in information technology such as computers and the Internet—for all their impacts on office work, inventory management, etc.—have not yet provided the major stimulus that capitalism requires to maintain high growth rates. The contributions of information technology to the growth of the economy have not come close to the long term stimulatory effects of the development of the automobile-centered surface transportation system that dominated the economic history of much of the twentieth century.

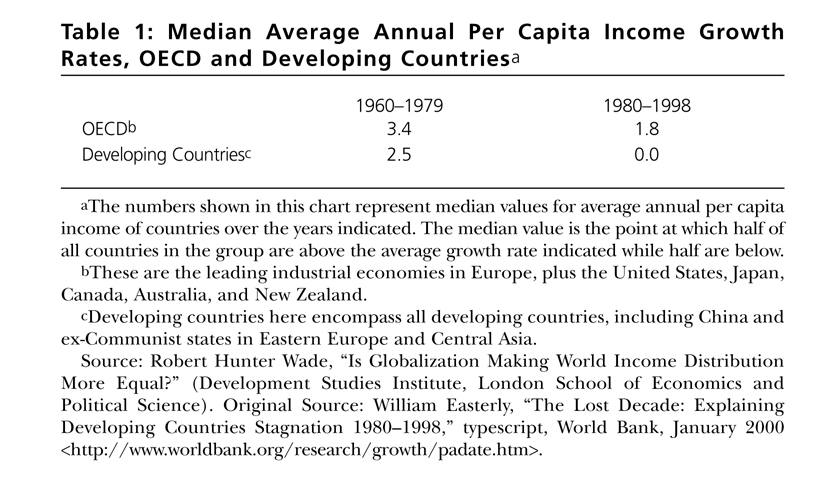

Capital in the core countries certainly profited heavily from the globalization trend of recent decades, despite the stagnation tendency. But this was hardly the case in the third world, as can be seen in the table 1.

This table highlights three important points: (1) The decline in growth rates since the 1980s is typical of industrialized countries in general. (2) The demand for primary products by the rapidly growing wealthy nations contributed to the significant growth of the poor countries fresh from the experience of decolonization. In addition, the flow of loans and investment early on spurred initial growth. (3) However, conditions of unequal exchange and the development of underdevelopment ultimately caught up with the poor countries. Many of them had adopted the strategy urged by the North: a growth of manufacturing exports facilitated by multinational corporations seeking a low-wage labor force and financed by foreign banks looking for new markets for loans. This meant that more and more of the economic surplus was skimmed off for profits and debt service payments destined for the rich countries. Unfavorable terms of trade, growing competition for the same markets, and a slowdown in the core economies all led to third world debt crises and a decisive decline in growth rates, with many poor countries experiencing negative rates of growth.

Third world countries have thus been suffering, with few exceptions, from two decades of severe declines in growth rates, with many falling below zero growth. Now, with a new period of global slowdown, their conditions have gone from serious to critical, as witnessed by the deep economic crisis and largest-ever foreign-debt default in Argentina. In 2000, in The Return of Depression Economics, liberal economist Paul Krugman wrote that the underlying problem destabilizing finance and threatening underdeveloped countries in particular had not gone away, and that the financial/foreign-debt crises in Mexico in 1995 and Asia in 1997–1998 were in all likelihood just the first two acts in a three-act play. The disaster surrounding the Argentine peso in 2001–2002 clearly represents the beginning of this third act—but how the remainder of the play will unfold we still do not know.

The Tendency Toward Excess Capital

During the last half of the 1990s, a number of economists indicated that the business cycle might be a thing of the past. The “New Economy” of the “Information Age” was so efficient that capitalists would make more rational decisions with more certain knowledge of current and future conditions. Nevertheless, Karl Marx’s insight that “the real barrier to capitalist production is capital itself” still holds true. One of the most common causes of economic slowdown is that the rate of investment tends to exceed the growth of final demand. The rapid growth of output needed to satisfy the brisk growth in demand and to increase market share during an economic upturn leads to the creation of excess productive capacity (idle plant and equipment). At some point the growth of demand fails to meet projections, leaving corporations with massive amounts of unused capacity and unsold inventory. Further investment is then impeded because corporations are reluctant to invest in the face of substantial excess capacity—sometimes referred to as a “capital overhang.” As stated in The Economic Report of the President, 2002, authored by the president’s Council of Economic Advisers: “A capital overhang develops when the amount of capital in the economy exceeds the amount that businesses desire for the production of goods and services. The emergence of such an overhang complicates both business planning and policymaking. Businesses often have to alter their capital spending plans and curtail their investment spending—sometimes quite abruptly” (p. 39).

What should be clear is that there is no real answer to this problem of overexpansion of productive capacity under monopoly capitalism, since capital is continually confronted with the fact that the main barrier to investment is investment itself. Useful as investment can be, it is circumscribed by the eventual saturation of the market for its end product. The ongoing propulsion of competition and the struggle of each of the giant corporations for a greater share of the market thus turns the useful contribution of investment into its opposite. Given these circumstances, excess capacity plays an especially prominent role in any economic slowdown under monopoly capitalism. Large firms seeking to protect their profit margins tend to respond to a downturn by cutting back on their capacity utilization rather than reducing prices (as orthodox economic theory would lead one to expect).*

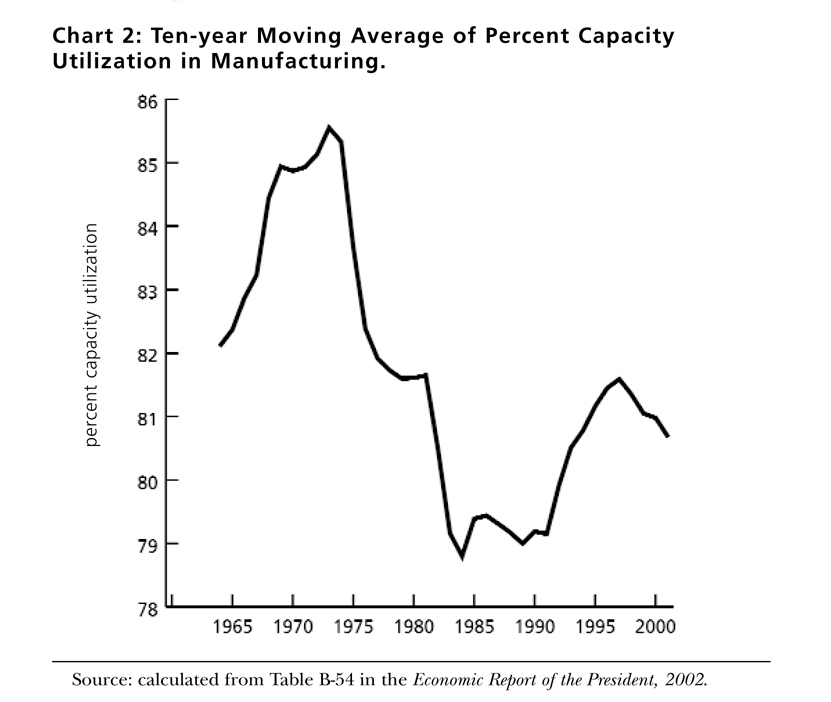

The long-term decline in capacity utilization in manufacturing can be seen in chart 2, which presents this in terms of ten-year moving averages. During the period shown on the chart, the high point was the ten-year period 1964–1975, while the low point was 1975-1984. Preliminary data indicate that 2001 saw the lowest annual level of capacity utilization (the highest level of excess capacity) since 1983.

As mentioned above, slowdowns become self-reinforcing because corporations are extremely reluctant to invest when faced with substantial amounts of excess capacity and inventories. This situation is particularly evident today in high-technology, most notably telecommunications. “Some businesses, especially in the information and communications technology sector,” The Economic Report of the President, 2002 declares, “may have overestimated the potential of the ‘New Economy’ and therefore overinvested in productive capacity. In addition, businesses throughout the economy were surprised by the extent of the slowdown in aggregate demand in 2000 and 2001, and they therefore had to revise downward the path of their desired capital stock” (p. 40).

The Productivity Panacea

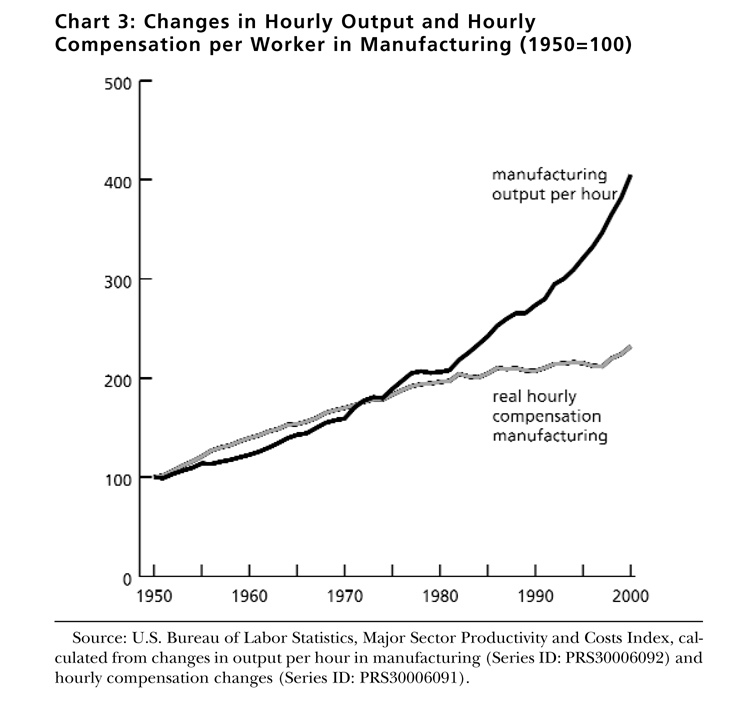

Faced with a growth slowdown, economists often point to increasing productivity as the panacea. Manufacturing is generally conceived as the engine for a capitalist economy, because it is expected to operate as the inner mechanism for the self-expansion of the system. This is how it is supposed to work: (1) Improvements in technology and/or increased intensity of labor produce ever-growing labor productivity. (2) The resulting surplus accruing to capital is used to reduce prices and/or increase wages. (3) Either measure leads to increased demand. (4) The increased demand is a stimulus for profit-seeking capital to expand production.

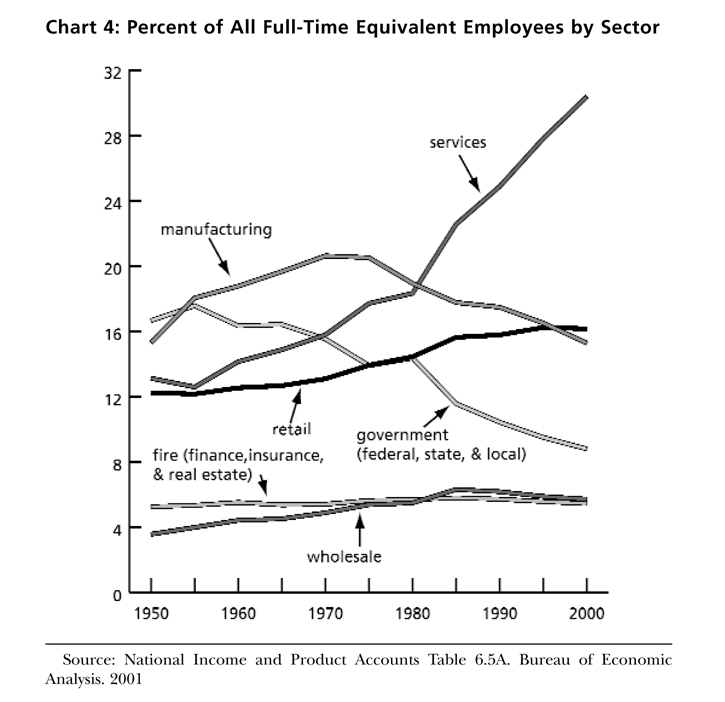

So much for the standard doctrine. What actually happened between 1980 and 2000 fits none of this. Chart 3 is an index of manufacturing productivity (output per hour) compared to an index of hourly compensation of manufacturing workers (adjusted for prices). Now consider the surprising spread between the two lines since 1980. Prices did not decrease nor was there a rise in wages that would support a significant rise in demand. This widening gap between output per hour and real hourly compensation, rooted in the stagnation of real wages, means that almost the entire gain from increasing productivity since 1980 has been appropriated as surplus by capital. The manufacturing sector neither lowered prices nor increased wages in keeping with the growing output per worker. This (together with the lack of new factory jobs) did not help to provide the effective demand for the growth in output. Instead, as shown in chart 4, employment kept on expanding in the service sector, where a significant portion of the jobs are notoriously low-paid or part-time.

Mounting Debt

Debt is a normal, indeed often a necessary, ingredient of a capitalist economy. It plays a role in facilitating foreign trade, providing working capital for seasonal industries, supplementing investments in private enterprises, and, of course, by means of a national debt helping to regulate imbalances between revenue and expenditure. Debt can also stimulate the economy. For example, most people do not have sufficient savings to purchases a new house, car, or new furniture for an apartment. When these purchases are made on credit, economic activity occurs that would not have happened without the home mortgage, car, or credit card loans. When capitalists borrow money and build a new factory or retail store or a hospital borrows to build a new wing, the economy is stimulated at first by job creation during construction and later by staffing and supplying the new facility.

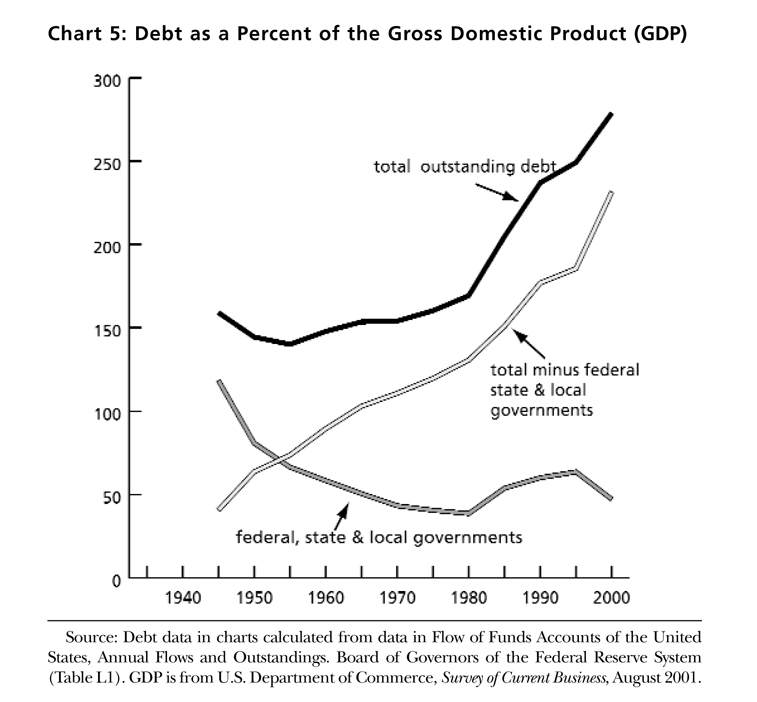

As shown in chart 5, a marked change in the role of debt occurred between 1980 and 2000—the very period, when, as shown in chart 1, there was a decided slowdown in the growth of Gross Domestic Product. From 1945 up to 1980, total outstanding debt as a percent of Gross Domestic Product remained rather flat. The decline in the governmental debt, mostly associated with Second World War expenses, was offset with a corresponding increase in all other debt: corporate, consumer, financial institutions. Even before 1980, the relatively rapid growth of the economy was therefore increasingly dependent on the use of private (as opposed to public) debt. Such debt acted as a stimulus to consumer buying, as a spur to building additional productive capacity, and as an impetus to speculative activity. But after 1980, the growth in outstanding private debt swings upward at a much faster rate. In other words, it becomes an ever more important element in keeping the economy going. By 2000, outstanding private debt is two and one quarter times GDP, while total outstanding debt—private plus government—approaches three times the GDP. The productive economy is now completely dependent upon and overshadowed by a mountain of debt, which has assumed a life of its own as reliance on debt has increased the demand for more debt.

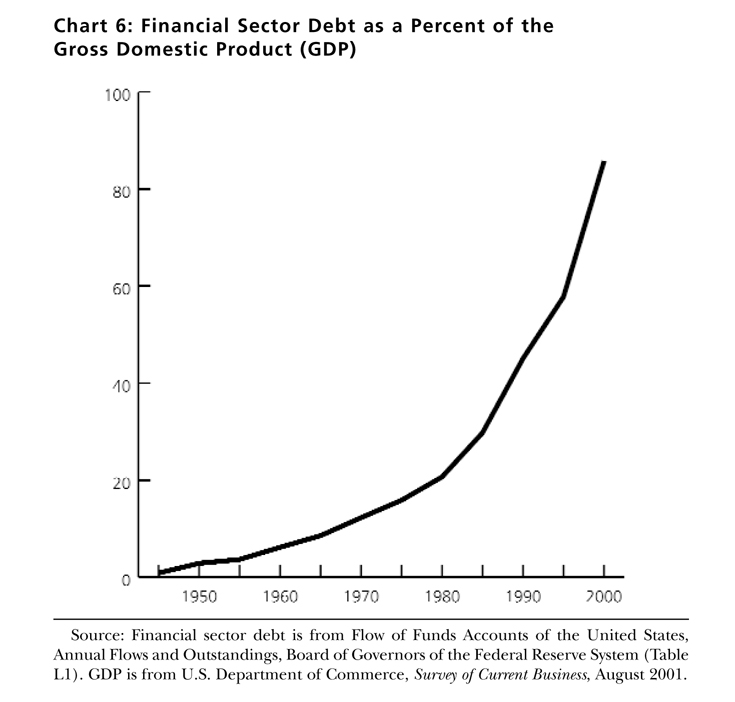

A particularly ominous aspect of this growing dependence on debt is that the financial sector is responsible for an ever-increasing portion of the total debt. Here again we can see 1980 as a critical point for changes in the economy. As can be seen in chart 6, from 1945 to 1980, financial debt as a percentage of GDP rose by 20 points. Then, in the following two decades, it rose by almost 70 points. The total outstanding debt of the financial sector alone is now almost 90 percent of GDP and represents over 35 percent of the total outstanding non-governmental debt.

Corporate (including financial) debt is not the only problem. The growing debt in the consumer sector even well into the recession has been one of the main reasons that the recession so far has been a relatively mild one. Workers have sought to maintain their spending despite little in the way of real wage gains for decades and despite rising unemployment. It is unlikely though that this will continue much longer without a sudden interruption. In the 1990s, household debt rose for the first time above 100 percent of personal disposable income in the United States and is even higher in some other advanced capitalist countries, including Japan, Germany, and Britain (Economist, January 26, 2002, pp. 22–23).

Casino Capitalism

As discussed above, the service sector of the economy has been one of the great areas for investment and employment. The other outlet has been speculation—in reality, just another word for gambling. The financial sector of the capitalist economy is no longer confined to the needs of production, employment, and investment. Beginning in the 1980s, it has become an increasingly autonomous form of money-making, particularly evident in the growth of derivatives markets. A derivative is a financial instrument that “derives” its value from another financial instrument. A financial future, for example, is an agreement to purchase some other financial instrument, say a stock or a bond, at some given point in the future. Derivatives tend to magnify gains and losses. If an interest rate or a stock price on which a derivative is based goes up, the gains obtained through a derivative can skyrocket. On the other hand, if the underlying financial asset declines, the value of a derivative can plummet. The speed of the rise and fall of financial values adds to the risk of the individual betters. As in a horse race, some betters lose, others gain. The risk here is to the financial sector as a whole or an important part, and hence a risk to the economy as a whole. The reason: these speculations are highly leveraged. For example, the buyer of a derivative may put up 5 percent while a bank loan provides the rest.

Recently, the Enron fiasco has highlighted how large the derivatives market has become. In testimony before the United States Senate Committee on Governmental Affairs on January 24, 2002, Frank Partnoy, Professor of Law at the University of San Diego School of Law, explained, “Enron was at its core, a derivatives trading firm. Nothing made this more clear than the layout of Enron’s extravagant new building—still not completed today, but mostly occupied—where the top executives’ offices on the seventh floor were designed to overlook the crown jewel of Enron’s empire: a cavernous derivatives trading pit on the sixth floor.”

Partnoy’s explanation of the nature and extent of the derivatives market in the context of his testimony on Enron’s collapse provides a detailed glimpse into the growth of the derivatives market, which now permeates U.S. business:

Derivatives are complex financial instruments whose value is based on one or more underlying variables, such as the price of a stock or the cost of natural gas. Derivatives can be traded in two ways: on regulated exchanges or in unregulated over-the-counter (OTC) markets.…

The size of derivatives markets typically is measured in terms of the notional value of contracts. Recent estimates of the size of the exchange-traded derivatives market, which includes all contracts traded on the major options and futures exchanges, are in the range of $13 to $14 trillion in notional amount. By contrast, the estimated notional amount of outstanding OTC derivatives as of year-end 2000 was $95.2 trillion. And that estimate is most likely an understatement.

In other words, OTC derivatives markets, which for the most part did not exist twenty (or, in some cases, even ten) years ago, now comprise about 90 percent of the aggregate derivative market, with trillions of dollars at risk every day.…Enron may have been just an energy company when it was created in 1985, but by the end it had become a full-blown OTC derivatives trading firm. Its OTC derivatives-related assets and liabilities increased more than five-fold during 2000 alone.

The vast expansion of the debt of U.S. corporations, including financial institutions, is clearly bound up with this widespread and growing speculative activity. Enron was simply an exaggerated example of this. The result is a financial structure that is more and more shaky, more prone to disaster if the underlying economy weakens and if new forms of financial instruments, designed to put off the day of reckoning, are not constantly introduced.

Where this will lead no one knows. At best, the pile-up of debt and the increasingly shaky nature of the debt structure place limitations on economies struggling to emerge from a cyclical downturn. At worst, a serious financial meltdown could further destabilize the capitalist world economy. In this respect it is crucial to understand that not only is the U.S. economy characterized by production shortfalls and an unsustainable explosion of debt, but so is the world economy in general, where a synchronized world recession has appeared. Excess capacity and financial volatility have become almost universal phenomena in an increasingly globalized economic environment. “The current global slowdown,” the London-based Economist magazine noted on August 25, 2001 is distinguished from others over the previous half-century in that,

economic weakness is more widespread than in previous downturns. In the 1991 ‘world recession,’ for instance, the American economy sank, but Japan, Germany and emerging East Asia continued to boom, helping to cushion world demand. So far this downturn is not deep, but it could be the most synchronized since the 1930s. Therein lies the biggest risk. Economies have become increasingly integrated through trade and investment in recent years….The downside to this globalisation is that the economic slowdown around the world is now proving self-reinforcing, magnifying the initial fall in demand. As investment has collapsed in America and Japan, those countries have slashed their imports from East Asian producers. But weaker demand in Asian countries is causing them in turn to trim their imports, not just from America and Japan, but also from Europe. The chances of a prolonged American (and global) downturn have therefore increased considerably (pp. 11–12).

As always, it is the poorer countries in the periphery of the system that are hurt most in a general crisis of the world economy. As previously indicated, per capita economic growth rates have stagnated over the last twenty years in underdeveloped countries (with only a very few notable exceptions), creating worse and worse economic problems.

The Field of Vision

Neoliberalism insists that the creation of a free market, which means the elimination of all attempts by states to restrain the market, will ultimately benefit all countries. A fundamental axiom of conventional economics is that the market acts as a regulator. Whether and how it does so applies mainly to the prices, production, and sale of commodities. The use of the surplus, however, has no such clear relation to the market’s regulatory mechanism. This has become increasingly evident as the stagnation tendency has persisted. As opportunities for investment in production of goods and services slowed down, despite the opportunities offered by the new technology, more and more of the surplus was devoted to a vast expansion of finance. Aided by information technology, financial markets became increasingly international. Globalization became the order of the day as capital searched every recess of the globe for profit opportunities. The ruling ideology celebrated the speed-up of globalization claiming that a rising tide raises all ships—even more so for the underdeveloped countries if the latter would adopt the free market ideology of the core countries. The result—hardly what was promised—has been plummeting growth rates in most cases.

For those whose vision of the future is confined within those boundaries acceptable to capitalism, all of this will no doubt be viewed as an utterly gloomy picture. Globalization under neoliberal regimes has meant in many ways the globalization of stagnation tendencies and financial crisis. The capitalist world economy is confronted everywhere with unused productive capacity and mountains of debt. Nor is there any obvious solution to these problems within the context of the system. To top it all off, the social fallout of this latest phase of crisis has yet to emerge.

Yet it is upon such social fallout that all those whose vision of the future is not confined to capitalism pin their hopes—the opening up of alternative paths through struggle. We do not know what the future will bring, nor how many struggles will be needed to reach the aim of a society ruled by the people and designed to meet the needs of populations throughout the world. We can, however, be assured of two things: that this aim will never be achieved without militant class struggle, and that an equitable, sustainable capitalist world economy is not part of the future of humanity.

*Under monopoly capitalism excess capacity cannot be considered to be simply a temporary phenomenon associated with business cycle downturns. As Josef Steindl argued in Maturity and Stagnation in American Capitalism (New York: Monthly Review Press, 1976), pp. 10-12, “undesired” or “disequilibrium” excess capacity may be “for practical purposes…permanent,” tied to the underlying tendency toward stagnation. By cutting back on output and decreasing capacity utilization during an economic slowdown monopolistic firms are able to adjust to demand shortfalls while maintaining profit margins—thus avoiding the dangers of full-fledged price competition. During an expansion, these same firms may adopt a certain degree of “planned excess capacity,” building ahead of demand in order to capture a larger market (and market share). However, the overinvestment that this inevitably turns into only makes the “undesired excess capacity” that corporations end up holding during the subsequent downturn that much greater.

Comments are closed.