In the way that even an accumulation of debts can appear as an accumulation of capital, we see the distortion involved in the credit system reach its culmination.

In 1997, in his last published article, Paul Sweezy referred to “the financialization of the capital accumulation process” as one of the three main economic tendencies at the turn of the century (the other two were the growth of monopoly power and stagnation).2 Those familiar with economic theory will realize that the phrase was meant to be paradoxical. All traditions of economics, to varying degrees, have sought to separate out analytically the role of finance from the “real economy.” Accumulation is conceived as real capital formation, which increases overall economic output, as opposed to the appreciation of financial assets, which increases wealth claims but not output. In highlighting the financialization of accumulation, Sweezy was therefore pointing to what can be regarded as “the enigma of capital” in our time.3

To be sure, finance has always played a central, even indispensable, role in capital accumulation. Joseph Schumpeter referred to the creation of credit ad hoc as one of the defining traits of capitalism. “The money market,” he added, “is always…the headquarters of the capitalist system.”4 Yet something fundamental has changed in the nature of capitalism in the closing decades of the twentieth century. Accumulation—real capital formation in the realm of goods and services—has become increasingly subordinate to finance. Keynes’s well-known fear that speculation would come to dominate over production seems to have finally materialized.

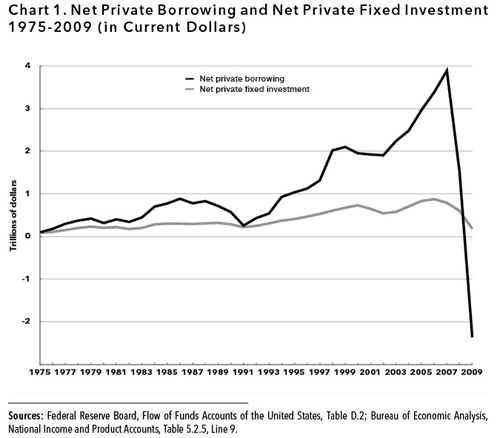

When Sweezy made his observation with respect to the financialization of capital accumulation more than a decade ago, it drew very little attention. But today, following the greatest financial and economic crisis since the Great Depression, we can no longer ignore the question it raises. Now more than ever, as Marx said, “an accumulation of debts” appears as “an accumulation of capital,” with the former increasingly effacing the latter. As shown in Chart 1, net private borrowing has far overshot total net private fixed investment over the last third of a century—in a process culminating in 2007-2009 with the bursting of the massive housing-financial bubble and the plummeting of both borrowing and investment.5

Indeed, since the 1970s we have witnessed what Kari Polanyi Levitt appropriately called “The Great Financialization.”6 Financialization can be defined as the long-run shift in the center of gravity of the capitalist economy from production to finance. This change has been reflected in every aspect of the economy, including: (1) increasing financial profits as a share of total profits; (2) rising debt relative to GDP; (3) the growth of FIRE (finance, insurance, and real estate) as a share of national income; (4) the proliferation of exotic and opaque financial instruments; and (5) the expanding role of financial bubbles.7 In 1957 manufacturing accounted for 27 percent of U.S. GDP, while FIRE accounted for only 13 percent. By 2008 the relationship had reversed, with the share of manufacturing dropping to 12 percent and FIRE rising to 20 percent.8 Even with the setback of the Great Financial Crisis, there is every indication that this general trend to financialization of the economy is continuing, with neoliberal economic policy aiding and abetting it at every turn. The question therefore becomes: How is such an inversion of the roles of production and finance to be explained?

Keynes and Marx

In any attempt to address the role of finance in the modern economy, the work of John Maynard Keynes is indispensable. This is especially true of Keynes’s achievements in the early 1930s when he was working on The General Theory of Employment, Interest and Money (1936). It is here, in fact, that Marx figures centrally in Keynes’s analysis.

In 1933 Keynes published a short piece called “A Monetary Theory of Production,” which was also the title he gave to his lectures at the time. He stressed that the orthodox economic theory of exchange was modeled on the notion of a barter economy. Although it was understood that money was employed in all market transactions under capitalism, money was nonetheless “treated” in orthodox or neoclassical theory “as being in some sense neutral.” It was not supposed to affect “the essential nature of the transaction” as “one between real things.” In stark opposition, Keynes proposed a monetary theory of production in which money was one of the operative aspects of the economy.

The principal advantage of such an approach was that it established how economic crises were possible. In this, Keynes was launching a direct attack on the orthodox economic notion of Say’s Law that supply created its own demand—hence, on the view that economic crisis was, in principle, impossible. Challenging this, he wrote, “booms and depressions are phenomena peculiar to an economy in which…money is not neutral.”9

In order to develop this crucial insight, Keynes distinguished between what he called a “co-operative economy” (essentially a barter system) and an “entrepreneur economy,” where monetary transactions entered into the determination of “real-exchange” relations. This distinction, Keynes went on to explain in his lectures, “bears some relation to a pregnant observation made by Karl Marx….He pointed out that the nature of production in the actual world is not, as economists seem often to suppose, a case of C-M-C′, i.e., of exchanging commodity (or effort) for money in order to obtain another commodity (or effort). That may be the standpoint of the private consumer. But it is not the attitude of business, which is a case of M-C-M′, i.e., of parting with money for commodity (or effort) in order to obtain more money.”10

“An entrepreneur,” Keynes insisted, in line with Marx, “is interested, not in the amount of product, but in the amount of money which will fall to his share. He will increase his output if by so doing he expects to increase his money profit.” Conversely, the entrepreneur (or capitalist) will decrease the level of output if the expectation is that the money profit will not increase. The monetary aspect of exchange, as depicted by Marx’s M-C-M′, thus suggested, not only that monetary gain was the sole object of capitalist production, but that it was also possible for economic crises to arise due to interruptions in the process. Following his discussion of Marx’s M-C-M′, Keynes went on to declare in terms similar to Marx: “The firm is dealing throughout in terms of sums of money. It has no object in the world except to end up with more money than it started with. That is the essential characteristic of the entrepreneur economy.”11

Keynes, as is well known, was no Marx scholar.12 The immediate inspiration for his references to Marx in his lectures was the work of the American economist Harlan McCracken, who had sent Keynes his book, Value Theory and Business Cycles, upon its publication in 1933. McCracken’s analysis focused on the problem of effective demand and the role of money, in the tradition of Malthus. But he dealt quite broadly with the history of economic thought. In his chapter on Marx, which Keynes cited in his lecture notes, and which is well worth quoting at length in this context, McCracken wrote:

In dealing with exchange or the metamorphosis of commodities, he [Marx] first treated C-M-C (Commodity for Money for Commodity). Such an exchange he considered no different in principle from barter since the object of exchange was to transfer a commodity of little or no utility to its possessor for a different commodity of high utility, and money entered in as a convenient medium to effect the transaction. The double transaction indicated no exploitation, for the assumption was that in each transaction there was an exchange of equivalent values, or quantities of embodied labor, so the final commodity had neither more nor less value than the original commodity, but had a higher utility for the recipient. Thus the metamorphosis C-M-C represented an exchange of equivalent values and no exploitation….

But the metamorphosis M-C-M′ was fundamentally different. And it was in explaining this formula that Marx treated thoroughly the nature and source of surplus value. In this case, the individual starts with money and ends with money. The only possible motive, then, for making the two exchanges was to end with more money than at the beginning. And the extent to which the second M or M′ exceeds the first, is the measure of surplus value. However, surplus value was not created or gained in the circulation of commodities but in production.13

In a letter to McCracken, dated August 31, 1933, Keynes thanked him for his book, adding: “For I have found it of much interest, particularly perhaps the passages relating to Karl Marx, with which I have never been so familiar as I ought to have been.”14

Basing himself on McCracken’s exposition of Marx, Keynes proceeded to explain that a crisis could occur if M exceeded M′, i.e., if capitalists were not able, in Marx’s terms, to “realize” the potential profits generated in production, and ended up losing money. “Marx,” Keynes explained,

was approaching the intermediate truth when he added that the continuous excess of M′ would be inevitably interrupted by a series of crises, gradually increasing in intensity, or entrepreneur bankruptcy and underemployment, during which, presumably, M [as opposed to M′] must be in excess. My own argument, if it is accepted, should at least serve to effect a reconciliation between the followers of Marx and those of Major Douglas [a leading British underconsumptionist], leaving the classical economists still high and dry in the belief that M and M′ are always equal!

Marx’s general formula for capital, or M-C-M′, Keynes suggested, not only offered credence to the views of Major Douglas, but also to the underconsumptionist perspectives of “[John] Hobson, or [William T.] Foster and [Waddill] Catchings…who believe in its [the capitalist system’s] inherent tendency toward deflation and under-employment.”15 Shortly after reading McCracken’s Value Theory and Business Cycles and encountering its treatment of Marx’s M-C-M′ formula, Keynes made direct reference in his lectures to “the realisation problem of Marx” as related to the problem of effective demand.16

Without a great deal of direct knowledge of Marx’s analysis, Keynes thus grasped the implications of Marx’s general formula for capital, its relation to the critique of Say’s Law, and the necessity that it pointed to of integrating within a single system the real and the monetary, production and finance. All of this converged with Keynes’s own attempts to construct a monetary theory of production (i.e., The General Theory). As Sweezy was to observe more than a half-century later when Keynes’s lectures on the monetary theory of production first came to light, these remarks on Marx’s general formula for capital indicated that: (1) Keynes “was in important respects closer to Marx’s way of thinking about money and capital accumulation than he was to the accepted neoclassical orthodoxy,” and (2) “he had an eye for what is important in Marx far keener than any of the other bourgeois economists.”17

Indeed, it is remarkable, in looking back, just how much of Keynes’s thinking here converged with that of Marx. In Theories of Surplus Value, Marx pointed to what he called “the abstract possibility of crisis,” based on the M-C-M′. “If the crisis appears…because purchase and sale become separated, it becomes a money crisis,” associated with money as a “means of payment…[I]n so far as the development of money as means of payment is linked with the development of credit and of excess credit the causes of the latter [too] have to be examined.” For Marx, then, a realization crisis, or crisis of effective demand, was always tied to the monetary character of the system, and necessarily extended not just to the phenomenon of credit but also to excess credit. It thus pointed to potential crises of overindebtedness.18

Hidden within the general formula for capital, M-C-M′, Marx argued, was a tendency of capital to try to transform itself into a pure money (or speculative) economy; i.e., M-M′, in which money begat money without the intermediate link of commodity production. In M-M′, he wrote, “the capital relationship reaches its most superficial and fetishized form.”19 If M-M′ originally referred simply to interest-bearing capital, it metamorphosed in the course of capitalist development into the speculative demand for money more generally. “Credit,” Marx explained, “displaces money and usurps its position.” Capital more and more took on the “duplicate” forms of: (1) “real capital,” i.e., the stock of plant, equipment and goods generated in production, and (2) “fictitious capital,” i.e., the structure of financial claims produced by the paper title to this real capital. Insofar as economic activity was directed to the appreciation of “fictitious capital” in the realm of finance rather than the accumulation of real capital within production, Marx argued, it had metamorphosed into a purely speculative form.20

Production and Finance

Marx and Keynes both rejected, as we have seen, the rigid separation of the real and the monetary that characterized orthodox economic theory. A monetary theory of production of the sort advanced, in somewhat different ways, by both Marx and Keynes led naturally to a theory of finance as a realm not removed from the workings of the economy, but integrated fully with it—hence, to a theory of financial crisis. Decisions on whether (or where) to invest today in this conception—as developed by Keynes, in particular—were affected by both expected profits on such new investment and by the speculative demand for money and near money (credit) in relation to the interest rate.

The growing centrality of finance was a product of the historical development of the system. During the classical phase of political economy, in capitalism’s youth, it was natural enough that economic theory would rest on the simple conception of a modified barter economy in which money was a mere means of exchange but did not otherwise materially affect basic economic relations. By the late nineteenth century, however, there were already signs that what Marx called the “concentration and centralization of production,” associated with the emergence of the giant corporation, was giving rise to the modern credit system, based on the market for industrial securities.

This rise of the modern credit system vastly changed the nature of capital accumulation, as the ownership of real capital assets became secondary to the ownership of paper shares or assets—leveraged ever higher by debt. “Speculation about the value of productive assets,” Minsky wrote in his book on Keynes, “is a characteristic of a capitalist…economy. The relevant paradigm for the analysis of a [developed] capitalist economy is not a barter economy,” but “a system with a City [that is, London’s financial center] or a Wall Street where asset holdings as well as current transactions are financed by debt.”21

Rationally, the rigid separation between the real and the monetary in orthodox economics—continuing even up to the present—has no solid basis. Although it is certainly legitimate to distinguish the “real economy” (and “real capital”) from the realm of finance (and what Marx called “fictitious capital”), this distinction should obviously not be taken to imply that monetary or financial claims are not themselves “real” in the normal sense of the word. “There is, in fact, no separation,” Harry Magdoff and Sweezy observed, “between the real and the monetary: in a developed capitalist economy practically all transactions are expressed in monetary terms and require the mediation of actual amounts of (cash or credit) money.” Rather, “the appropriate analytical separation is between the underlying productive base of the economy and the financial superstructure.”22

We can picture this dialectic of production and finance, following Hyman Minsky, in terms of the existence of two different pricing structures in the modern economy: (1) the pricing of current real output, and (2) the pricing of financial (and real estate) assets. More and more, the speculative asset-pricing structure, related to the inflation (or deflation) of paper titles to wealth, has come to hold sway over the “real” pricing structure associated with output (GDP).23 Hence, money capital that could be used for accumulation (assuming the existence of profitable investment outlets) within the economic base is frequently diverted into M-M′, i.e., speculation in asset prices.24 Insofar as this has taken the form of a long-term trend, the result has been a major structural change in the capitalist economy.

Viewed from this general standpoint, financial bubbles can be designated as short periods of extraordinarily rapid asset-price inflation within the financial superstructure of the economy—overshooting growth in the underlying productive base. In contrast, financialization represents a much longer tendency toward the expansion of the size and importance of the financial superstructure in relation to the economic base, occurring over decades. “The final decades of the twentieth century,” Jan Toporowski (professor of economics at the University of London) observed in The End of Finance, “have seen the emergence of an era of finance that is the greatest since the 1890s and 1900s and, in terms of the values turned over in securities markets, the greatest era of finance in history. By ‘era of finance’ is meant a period of history in which finance…takes over from the industrial entrepreneur the leading role in capitalist development.”25

Such an era of finance raises the specter of a pure speculative economy highlighted by Keynes: “Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation.”26 By the 1990s, Sweezy observed, “the occupants of [corporate] boardrooms” were “to an increasing extent constrained and controlled by financial capital as it operates through the global network of financial markets.” Hence, “real power” was to be found “not so much in corporate boardrooms, as in the financial markets.” This “inverted relation between the financial and the real,” he argued, was “the key to understanding the new trends in the world” economy.27

Financial Crises and Financialization

In their attempt to deny any real historical significance to the Great Financial Crisis, most mainstream economists and financial analysts have naturally downplayed its systemic character, presenting it as a “black swan” phenomenon, i.e., as a rare and completely unpredictable but massive event of the kind that might appear, seemingly out of nowhere, once every century or so. (The term “black swan” is taken from the title of Nassim Nicholas Taleb’s book published on the eve of the Great Financial Crisis, where a “black swan event” is defined as a game-changing occurrence that is both exceedingly rare and impossible to predict.)28

However, some of the more critical economists, even within the establishment, such as Nouriel Roubini and Stephen Mihm in their Crisis Economics, have rejected this “black swan” theory, characterizing the Great Financial Crisis instead as a “white swan” phenomenon, i.e., as the product of a perfectly ordinary, recurring, and predictable process, subject to systematic analysis.29 The most impressive attempt to provide a data-based approach to financial crises over the centuries, emphasizing the regularity of such credit disturbances, is to be found in Carmen Reinhart and Kenneth Rogoff’s This Time Is Different: Eight Centuries of Financial Folly.30 (The title of their book is meant to refer to the euphoric phase in any financial bubble, where the notion arises that the business-financial cycle has been transcended and a speculative expansion can go on forever.)

The greatest white swan theorist in this sense was, of course, Minksy, who gave us the financial instability hypothesis, building on Keynes’s fundamental insight of “the fragility introduced into the capitalist accumulation process by some inescapable properties of capitalist financial structures.”31

Nevertheless, what thinkers like Minsky, Roubini and Mihm, and Reinhart and Rogoff tend to miss, in their exclusive focus on the financial cycle, is the long-run structural changes in the accumulation process of the capitalist system. Minsky went so far as to chastise Keynes himself for letting “stagnationist and exhaustion-of-investment-opportunity ideas take over from a cyclical perspective.” Thus, Minsky explicitly sought to correct Keynes’s theory, especially his analysis of financial instability, by placing it entirely in short-run business cycle terms, ignoring the long-run tendencies in which Keynes had largely couched his financial-crisis analysis.32

Keynes’s own argument was therefore quite different from the theory that we have become accustomed to via Minsky. He stressed that the stagnation tendency—or the decline in expected profit on new investment in a capital-rich economy—served to increase the power of money and finance. Thus, for Keynes, Minsky noted, “Money rules the roost as the expected yield of real assets declines.”33 As Keynes put it: “Owing to its accumulation of capital already being larger” in a mature, capital-rich economy, “the opportunities for further investment are less attractive unless the rate of interest falls at a sufficiently rapid rate.” The uncertainty associated with the tendency of expected profit on new investment to decline gave an enormous boost to “liquidity preference” (or as Keynes also called it “the propensity to hoard” money) and to financial speculation as an alternative to capital formation, compounding the overall difficulties of the economy.

Underlying all of this was a tendency of the economy to sink into a condition of slow growth and underemployment: “It is an outstanding characteristic of the economic system in which we live,” Keynes wrote, “that…it seems capable of remaining in a chronic condition of sub-normal activity for a considerable period without any marked tendency either towards recovery or towards complete collapse. Moreover, the evidence indicates that full, or even approximately full, employment is of rare and short-lived occurrence.” These conditions led Keynes to his longer-run policy proposals for a “euthanasia of the rentier” and a “somewhat comprehensive socialisation of investment.”34

Keynes did not develop his long-run theory of stagnation and financial speculation. Yet subsequent elaborations of stagnation theory that built on his insights were to arise in the work of his leading early U.S. follower, Alvin Hansen, and in the neo-Marxian tradition associated with Michal Kalecki, Josef Steindl, Paul Baran, and Paul Sweezy. There were essentially two strands to the stagnation theory that developed based on Keynes (and Marx). The first, emphasized by Hansen, and by the later Sweezy—but characterizing all these thinkers in one way or another—examined the question of the maturation of capitalism, i.e., the development of capital-rich economies with massive, unused productive capacity that could be expanded relatively quickly.35 This enormous potential to build up productive capacity came up against the reality of vanishing outlets for investment, since current investment was hindered (under conditions of industrial maturity) by investment that had occurred in the past. “The tragedy of investment,” Kalecki remarked, “is that it causes crisis because it is useful.”36

The second strand, in which Baran and Sweezy’s Monopoly Capital is undoubtedly the best known example, centered on the growing monopolization in the modern economy, that is, “the tendency of surplus to rise” in an economy dominated by the giant firm, and the negative effects this had on accumulation.

In both cases, the potential savings or surplus generated by the economy normally outweighed the opportunities for profitable investment of that surplus, leading to a tendency to stagnation (slow growth and rising unemployment/underemployment and idle capacity). “The normal state of the monopoly capitalist economy,” Baran and Sweezy wrote, “is stagnation.”37 Rapid growth could thus not simply be assumed, in the manner of mainstream economics, as a natural outgrowth of the system in the mature/monopoly stage, but became dependent, as Kalecki stated, on “specific ‘development’ factors” to boost output. For example, military spending, the sales effort, the expansion of financial services, and epoch-making innovations such as the automobile all served as props to lift the economy, outside the internal logic of accumulation.38

None of these thinkers, it should be noted, focused initially on the macroeconomic relation between production and finance, or on finance as an outlet for surplus.39 Although Monopoly Capital argued that FIRE could help absorb the economic surplus, this was consigned to the last part of a chapter on the sales effort, and not given strong emphasis.40 However, the 1970s and ’80s saw a deceleration of the growth rate of the capitalist economy at the center of the system, resulting in ballooning finance, acting as a compensatory factor. Lacking an outlet in production, capital took refuge in speculation in debt-leveraged finance (a bewildering array of options, futures, derivatives, swaps, etc.). In the 1970s total outstanding debt in the United States was about one and one-half the size of GDP. By 2005 it was almost three and a half times GDP and not far from the $44 trillion world GDP.41

Speculative finance increasingly took on a life of its own. Although in the prior history of the system financial bubbles had come at the end of a cyclical boom, and were short-term events, financialization now seemed, paradoxically, to feed not on prosperity but on stagnation, and to be long lasting.42 Crucial in keeping this process going were the central banks of the leading capitalist states, which were assigned the role of “lenders of last resort,” with the task of bolstering and ultimately bailing out the major financial institutions whenever necessary (based on the “too big to fail” principle).

A key contradiction was that the financial explosion, while spurring growth in the economy in the short run, generated greater instability and uncertainty in the long run. Thus, Magdoff and Sweezy, who engaged in a running commentary on these developments from the 1970s to the late 1990s, argued that sooner or later—given the globalization of finance and the impossibility of managing it at that level—the ballooning of the financial superstructure atop a stagnant productive base was likely to lead to a major crash on the level of the 1930s. But whether even such a massive financial collapse, if it were to occur, would bring financialization to a halt remained, in their view, an open question.43

“In an era of finance,” Toporowski writes, “finance mostly finances finance.”44 Hence, production in recent decades has become increasingly “incidental to the much more lucrative business of balance-sheet restructuring.” With the big motor of capital accumulation within production no longer firing on all cylinders, the emergency backup engine of financial expansion took over. Growing employment and profit in the FIRE sector helped stimulate the economy, while the speculative growth of financial assets led to a “wealth effect” by means of which a certain portion of the capital gains from asset appreciation accruing to the well-to-do were funneled into increased luxury consumption, thereby stimulating investment. Even for the broad middle strata (professionals, civil servants, lower management, skilled workers), rapid asset price inflation enabled a large portion of employed homeowners to consume through new debt the apparent “capital gains” on their homes.45 In this manner, the expansion of debt raised asset prices, which in turn led to a further expansion of debt that raised asset prices, and so on: a bubble.

Debt can be seen as a drug that serves, under conditions of endemic stagnation, to lift the economy. Yet the use of it in ever larger doses, which such a process necessitates, does nothing to overcome the underlying disease, and serves to generate its own disastrous long-run side effects. The result is a stagnation-financialization trap. The seriousness of this trap today is evident in the fact that capital and its state have no answer to the present Great Financial Crisis/Great Recession but to bail out financial institutions and investors (both corporate and individual) to the tune of trillions of dollars with the object of debt-leveraging up the system all over again. This dynamic of financialization in relation to an underlying stagnant economy is the enigma of monopoly-finance capital. As Toporowski has observed, “The apparent paradox of capitalism” at the beginning of the twenty-first century is that “financial innovation and growth” are associated with “speculative industrial expansion,” while adding “systematically to economic stagnation and decline.”46

The Logical End-Point of Capitalism

Hence, financialization, while boosting capital accumulation through a process of speculative expansion, ultimately contributes to the corrosion of the entire economic and social order, hastening its decline. What we are witnessing today in society as a whole is what might be called the “financialization of class.” “The credit system,” David Harvey observes, “has now become…the major modern lever for the extraction of wealth by finance capital from the rest of the population.”47 In recent years, workers’ wages have stagnated along with employment, while both income and wealth inequality have increased sharply. In 1976 the top 1 percent of households in the United States accounted for 9 percent of income generated in the country; by 2007 this share had risen to 24 percent. According to Raghuram Rajan (former chief economist for the IMF), for “every dollar of real income growth that was generated [in the United States] between 1976 and 2007, 58 cents went to the top 1 percent of households.” In 2007 a single hedge fund manager, John Paulson, “earned” $3.7 billion, around 74,000 times the median household income in the country. Between 1989 and 2007, the share of total wealth held by the top 5 percent of wealth-holders in the United States rose from 59 percent to 62 percent, far outweighing the wealth of the bottom 95 percent of the population. Middle-class homeowners benefitted for a while in the housing boom, but are now losing ground with the housing bust. This increasing inequality in the distribution of income and wealth in an age of financialization has taken the form of “a growing distinction between the ‘balance sheet’ rich and the ‘balance sheet’ poor.” It is the “enforced savings” of the latter that help augment the exorbitant gains of the former.48

The rapid increase in income and wealth polarization in recent decades is mirrored in the growing concentration and centralization of capital. In 2000, at the peak of the merger and acquisition frenzy associated with the New Economy bubble, the value of global mergers and acquisitions rose to $3.4 trillion—declining sharply after the New Economy bubble burst. This record was only surpassed (in real terms) in 2007, during the peak of the housing bubble, when the value of global mergers and acquisitions rose to over $4 trillion—dropping off when the housing bubble popped. The result of all this merger activity has been a decline in the number of firms controlling major industries. This increasing monopolization (or oligopolization) has been particularly evident in recent years within finance itself. Thus, the share of U.S. financial-industry assets held by the top ten financial conglomerates increased by six times between 1990 and 2008, from 10 percent to 60 percent.49

This analysis of how financialization has heightened the disparities in income, wealth, and power helps us to put into perspective the view, now common on the left, that neoliberalism, or the advent of extreme free-market ideology, is the chief source of today’s economic problems. Instead, neoliberalism is best seen as the political expression of capital’s response to the stagnation-financialization trap. So extreme has the dominant pro-market or neoliberal orientation of monopoly-finance capital now become that, even in the context of the greatest economic crisis since the 1930s, the state is unable to respond effectively. Hence, the total government-spending stimulus in the United States in the last couple of years has been almost nil, with the meager federal stimulus under Obama negated by deep cuts in state and local spending.50 The state at every level seems to be stopped in its tracks by pro-market ideology, attacks on government deficits, and irrational fears of inflation. None of this makes any sense in the context of “what,” to quote Paul Krugman, “looks increasingly like a permanent state of stagnation and high unemployment.”51 The same basic problem is evident in the other advanced capitalist countries.

At the world level, what can be called a “new phase of financial imperialism,” in the context of sluggish growth at the center of the system, constitutes the dominant reality of today’s globalization. Extremely high rates of exploitation, rooted in low wages in the export-oriented periphery, including “emerging economies,” have given rise to global surpluses that can nowhere be profitably absorbed within production. The exports of such economies are dependent on the consumption of wealthy economies, particularly the United States, with its massive current account deficit. At the same time, the vast export surpluses generated in these “emerging” export economies are attracted to the highly leveraged capital markets of the global North, where such global surpluses serve to reinforce the financialization of the accumulation process centered in the rich economies. Hence, “bubble-led growth,” associated with financialization, as Prabhat Patnaik has argued in “The Structural Crisis of Capitalism,” “camouflages” the root problem of accumulation at the world level: “a rise in income inequalities across the globe” and a global “tendency of surplus to rise.”52

Despite “flat world” notions propagated by establishment figures like Thomas Friedman, imperialist divisions are becoming, in many ways, more severe, exacerbating inequalities within countries, as well as sharpening the contradictions between the richest and poorest regions/countries. If, in the “golden age” of monopoly capitalism from 1950-1973, the disparity in per capita GDP between the richest and poorest regions of the world decreased from 15:1 to 13:1, in the era of monopoly-finance capital this trend was reversed, with the gap growing again to 19:1 by century’s close.53

More and more, the financialization of accumulation in the center of the system, backed by neoliberal policy, has generated a global regime of “shock therapy.” Rather than Keynes’s “euthanasia of the rentier,” we are seeing the threatened euthanasia of almost everything else in society and nature. The consequences of this, as Naomi Klein suggested in her book, The Shock Doctrine, extend far beyond the underlying financialized accumulation associated with the neoliberal era, to a much broader set of consequences that can be described as “disaster capitalism”—evident in widening social and economic inequality, deepening instability, expanding militarism and war, and seemingly unstoppable planetary environmental destruction.54

Never before has the conflict between private appropriation and the social needs (even survival) of humanity been so stark. Consequently, never before has the need for revolution been so great. In place of a global system given over entirely to monetary gain, we need to create a new society directed at substantive equality and sustainable human development: a socialism for the twenty-first century.

Notes

- ↩ Karl Marx, Capital, vol. 3 (London: Penguin, 1981), 607-08.

- ↩ Paul M. Sweezy, “More (or Less) on Globalization,” Monthly Review 49, no. 4 (September 1997): 3. Globalization was, in Sweezy’s view, a much longer and wider phenomenon, characteristic of all stages of capitalism’s historical development, and hence not an outgrowth of changing modes of accumulation.

- ↩ The term “the enigma of capital” is taken from David Harvey, The Enigma of Capital (London: Profile Books, 2010). Although Harvey does not use the term in precisely this way, the approach outlined here is generally in accord with the outlook in his latest book.

- ↩ Joseph A. Schumpeter, The Theory of Economic Development (New York: Oxford University Press, 1961), 107, 126, and Essays (Cambridge, Mass.: Addison-Wesley, 1951), 170.

- ↩ The drop in investment in the crisis is reflected in the fact that in 2009 the total capital stock of business equipment in the United States dropped by 0.9 percent from 2008, its first decline since the 1940s; meaning that firms did not even spend enough on new equipment to offset the wear and tear on their existing equipment. “Firms Spend More—Carefully,” Wall Street Journal, August 11, 2010.

- ↩ Kari Polanyi Levitt, “The Great Financialization,” John Kenneth Galbraith Prize Lecture, June 8, 2008, http://karipolanyilevitt.com/documents/The-Great-Financialization.pdf.

- ↩ For evidence of these trends, see John Bellamy Foster and Fred Magdoff, The Great Financial Crisis (New York: Monthly Review Press, 2009). It should be noted that this usage of the term “financialization,” as related to a secular trend in today’s economy, is quite different from its usage in the work of world-system theorists such as Giovanni Arrighi and Beverly Silver, who basically refer to it as a phase in the hegemonic cycles of the capitalist world-system. See Giovanni Arrighi and Beverly J. Silver, Chaos and Governance in the Modern World System (Minneapolis: University of Minnesota Press, 1999), 213.

- ↩ Robert E. Yuskavage and Mahnaz Fahim-Nader, “Gross Domestic Product by Industry for 1947-86,” Bureau of Economic Analysis, Survey of Current Business, December 2005, 71; U.S. Census Bureau, The 2010 Statistical Abstract, Table 656, “Gross Domestic Product by Industry and State: 2008”; Kevin Phillips, Bad Money (New York: Viking, 2008), 31.

- ↩ John Maynard Keynes, “A Monetary Theory of Production,” in Keynes, Collected Writings, vol. 13 (London: Macmillan, 1973), 408-11. As Kenneth Arrow put it: “The view that only real magnitudes matter can be defended only if it is assumed that the labor market (and all other markets) always clear, that is, that all unemployment is essentially voluntarily.” Kenneth, J. Arrow, “Real and Nominal Magnitudes in Economics,” Journal of Financial and Quantitative Analysis 15, no. 4 (November 1980): 773-74.

- ↩ John Maynard Keynes, Collected Writings, vol. 29 (London: Macmillan, 1979), 81-82. See also Dudley Dillard, “Keynes and Marx: A Centennial Appraisal,” Journal of Post Keynesian Economics 6, no. 3 (Spring 1984), 421-24.

- ↩ Keynes, Collected Writings, vol. 13, 89.

- ↩ When Sweezy wrote to Keynes’s younger colleague Joan Robinson in 1982 about the publication of Keynes’s 1930s lecture notes in which he discussed Marx, asking if she had any additional knowledge of this, she replied: “I was also surprised at the note about Keynes and Marx. Keynes said to me that he used to try to get Sraffa to explain to him the meaning of labor value, etc., and recommend passages to read, but that he could never make out what it was about.” Quoted in Paul M. Sweezy, “The Regime of Capital,” Monthly Review 37, no. 8 (January 1986): 2.

- ↩ Harlan Linneus McCracken, Value Theory and Business Cycles (Binghampton, New York: Falcon Press, 1933), 46-47.

- ↩ Keynes to McCracken, August 31, 1933, in Steven Kates, “A Letter from Keynes to Harlan McCracken dated 31st August 1933: Why the Standard Story on the Origins of the General Theory Needs to Be Rewritten,” October 25, 2007, Social Science Research Network, Working Paper Series, http://ssrn.com/abstract=1024388.

- ↩ Keynes, Collected Writings, vol. 29, 81-82. Some will recognize this as the basis for Keynes’s later allusion in The General Theory to “the underworlds of economics” in which “the great puzzle of effective demand” has its “furtive“ existence—and where mention is made of Marx, Hobson, and Douglas. On this, see Keynes, The General Theory of Employment, Interest and Money in Keynes, Collected Writings, vol. 7 (London: Macmillan, 1973), 32, 355, 364-71. In referring favorably in his lectures to the American underconsumptionists William T. Foster and Waddill Catchings, Keynes was clearly influenced by McCracken’s chapter on these thinkers. See McCracken, Value Theory and Business Cycles, 157-68.

- ↩ Keynes, Collected Writings, vol. 13, 420. See also Donald Moggridge, “From the Treatise to the General Theory: An Exercise in Chronology,” History of Political Economy 5, no. 1 (Spring 1973), 82.

- ↩ Sweezy, “The Regime of Capital,” 2.

- ↩ Karl Marx, Theories of Surplus Value, Part 2 (Moscow: Progress Publishers, 1968), 509-15. For a good rendition of the overlap of the analysis of Marx and Keynes in this area, see Peter Kenway, “Marx, Keynes, and the Possibility of Crisis,” Cambridge Journal of Economics 4 (1980): 23-36.

- ↩ Marx, Capital, vol. 3, 515.

- ↩ Marx, Capital, vol. 3, 607-610, 707; Karl Marx and Frederick Engels, Selected Correspondence (Moscow: Progress Publishers), 396-402; Jan Toporowski, Theories of Financial Disturbance (Northampton, Mass.: Edward Elgar, 2005), 54. For a detailed description of Marx’s theory of “fictitious capital” see Michael Perelman, Marx’s Crises Theory (New York: Praeger, 1987), 170-217.

- ↩ Hyman P. Minsky, John Maynard Keynes (New York: Columbia University Press, 1975), 72-73.

- ↩ Harry Magdoff and Paul M. Sweezy, Stagnation and the Financial Explosion (New York: Monthly Review Press, 1987), 94-95. The distinction between production and finance, as representing base and superstructure, should not, of course, be confused—Magdoff and Sweezy argued—with the wider, all-encompassing base-superstructure metaphor of historical materialism. Both sets of relations and processes, to which the base-superstructure metaphors refer, must alike be understood as dialectical. The historical emergence of finance from production gives no warrant for reductive explanations of how the structured process functions (or malfunctions) today. This is an error exactly parallel to a frequent, crude misunderstanding of the base-superstructure metaphor of historical materialism by the critics of Marxism. See István Mészáros, Social Structure and Forms of Consciousness, vol. 2 (New York: Monthly Review Press, forthcoming), chapter 1.

Thus, it is a mistake to argue reductionistically, as even some Marxists theorists have, that “the financial cycle is only a reflection of the economic cycle, monetary and financial movements reflect non-monetary and non-financial internal and international disturbances.” Suzanne de Brunhoff, Marx on Money (New York: Urizen Books, 1973), 100-01.

It should be added that Keynes, too, distinguished between separate realms of industry and finance—as a complex relation where the latter did not simply “reflect” the former—in his chapter on “The Industrial Circulation and the Financial Circulation” of The Treatise on Money. John Maynard Keynes, Collected Writings, vol. 5 (London: Macmillan, 1971), 217-30. - ↩ Hyman P. Minsky, “Hyman P. Minsky” (autobiographical entry), in Philip Arestis and Malcolm Sawyer, A Biographical Dictionary of Dissenting Economists (Northampton, Mass.: Edward Elgar, 2000), 414-15; Minsky, “Money and Crisis in Schumpeter and Keynes,” 115. Compare Marx, Capital, vol. 3, 608-09.

- ↩ See Magdoff and Sweezy, Stagnation and the Financial Explosion, 93-94.

- ↩ Jan Toporowski, The End of Finance (London: Routledge, 2000), 1.

- ↩ Keynes, The General Theory, 159.

- ↩ Paul M. Sweezy, “The Triumph of Financial Capital,” Monthly Review 46, no. 2 (June 1994): 8-10. For a discussion of the growing political-economic role of finance in U.S. society, see John Bellamy Foster and Hannah Holleman, “The Financial Power Elite,” Monthly Review 62, no. 1 (May 2010): 1-19.

- ↩ Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable (New York: Random House, 2007).

- ↩ Nouriel Roubini and Stephen Mihm, Crisis Economics: A Crash Course in the Future of Finance (New York: Penguin, 2010), 13-37.

- ↩ Carmen M. Reinhart and Kenneth S. Rogoff, This Time is Different: Eight Centuries of Financial Folly (Princeton: Princeton University Press, 2009).

- ↩ Minsky, “Money and Crisis in Schumpeter and Keynes,” 121; also see Minsky, John Maynard Keynes.

- ↩ Minsky, John Maynard Keynes, 79-80.

- ↩ Minsky, John Maynard Keynes, 78.

- ↩ Keynes, The General Theory, 31, 228, 242, 249-50, 376-78; John Maynard Keynes, “The General Theory of Employment,” Quarterly Journal of Economics 51 (February 1937): 216; Dudley Dillard, The Economics of John Maynard Keynes (New York: Prentice-Hall, 1948), 146-54.

- ↩ The maturity argument was evident in Sweezy as early as the 1940s in The Theory of Capitalist Development (New York: Monthly Review Press, 1972), 220-21. But it took on far greater prominence in his later work beginning in the early 1980s. See Four Lectures on Marxism (New York: Monthly Review Press, 1981), 26-45.

- ↩ Michal Kalecki, Essays in the Theory of Economic Fluctuations (New York: Russell and Russell, 1939), 149; Alvin H. Hansen, Full Recovery or Stagnation? (New York: W.W. Norton, 1938).

- ↩ Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966), 108.

- ↩ Michal Kalecki, Theory of Economic Dynamics (New York: Augustus M. Kelley, 1969), 161. See also Josef Steindl, Maturity and Stagnation in American Capitalism (New York: Monthly Review Press, 1976), 130-37.

- ↩ Toporowski argues that Kalecki and Steindl, beginning with Kalecki’s 1937 article on “The Principle of Increasing Risk,” dealt extensively with the contradictions at the level of the firm of reliance on external financing and rentier savings (as opposed to the internal funds of corporations) in funding investment. This was never developed, however, into a theory of “credit inflation” or integrated with a notion of finance as a means of boosting aggregate demand. See Toporowski, Theories of Financial Disturbance, 109-30; Michal Kalecki, “The Principle of Increasing Risk,” Economica 4, no. 16 (1937): 440-46.

- ↩ Baran and Sweezy, Monopoly Capital, 139-41.

- ↩ Total outstanding debt here includes household, business, and government (national, state, and local); Federal Reserve, Flow of Funds Accounts of the United States, Tables L.1 and L.2; Economic Report of the President, 2006, Table B-78; also see Foster and Magdoff, The Great Financial Crisis, 45-46.

- ↩ Sweezy, “The Triumph of Financial Capital,” 8.

- ↩ Harry Magdoff and Paul M. Sweezy, “Financial Instability: Where Will It All End?” Monthly Review 34, no. 6 (November 1982): 18-23, and Stagnation and the Financial Explosion, 103-05.

- ↩ Jan Toporowski, “The Wisdom of Property and the Politics of the Middle Classes,” Monthly Review 62, no. 4 (September 2010): 12.

- ↩ Toporowski, “The Wisdom of Property,” 11. Keynes himself pointed to a negative wealth effect whereby stagnation tendencies (the decline in the marginal efficiency of capital) negatively affected stock equities thereby, resulting in declines in consumption by rentiers, which then intensified stagnation. See Keynes, The General Theory, 319. Asset-price inflation, together with the subsequent collapse of the financialization era, have extended both the “wealth effect” and the “negative wealth effect” far beyond the relatively few rentiers to the broad intermediate strata (“middle classes”).

- ↩ Toporowski, End of Finance, 8-9.

- ↩ Harvey, The Enigma of Capital, 245.

- ↩ Raghuram G. Rajan, Fault Lines (Princeton: Princeton University Press, 2010), 8; Edward N. Wolff, “Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze—An Update to 2007,” Levy Economics Institute, Working Paper no. 589 (March 2010), 11, http://levy.org; Arthur B. Kennickell, “Ponds and Streams: Wealth and Income in the U.S., 1989 to 2007,” Federal Reserve Board Working Paper, 2009-23 (2009), 55, 63; Toporowski, “The Wisdom of Property.” 12, 14.

- ↩ Bloomberg, 2010 M&A Outlook, bloomberg.com, 8, accessed 8/28/2010; “M&A in 2007,” Wall Street Journal, January 3, 2008; “A Record Year for M&A,” New York Times, December 18, 2006; Floyd Norris, “To Rein in Pay, Rein in Wall Street,” New York Times, October 30, 2009; Henry Kaufman, The Road to Financial Reformation (Hoboken, New Jersey: John Wiley and Sons, 2009), 97-106, 234. Traditionally, economic textbooks have treated new stock issues as raising capital for investment. The proliferation of merger activity highlights the fact that this is, in fact, hardly ever the case, and that most stock activity is directed at increasing financial gains.

- ↩ Paul Krugman, “America Goes Dark,” New York Times, August 8, 2010. The overwhelming of federal spending by the cuts in state and local spending replicates the experience of the 1930s. See John Bellamy Foster and Robert W. McChesney, “A New Deal Under Obama?” Monthly Review 60, no. 9 (February 2009), 2-3.

- ↩ Krugman, “This Is Not a Recovery,” New York Times, August 6, 2010.

- ↩ Prabhat Patnaik, “The Structural Crisis of Capitalism,” MRzine, August 3, 2010; Rajan, Fault Lines, 6.

- ↩ The gap between the richest and poorest country in 1992 was 72:1. Angus Maddison, The World Economy: A Millennial Perspective (Paris: Development Centre, OECD, 2001), 125; Branko Milanovic, World’s Apart: Measuring International and Global Inequality (Princeton: Princeton University Press, 2005), 40-50, 61-81; Thomas L. Friedman, The World is Flat (New York: Farrar, Straus and Giroux, 2005).

- ↩ Naomi Klein, The Shock Doctrine: The Rise of Disaster Capitalism (New York: Henry Holt, 2007).

Comments are closed.