The Great Recession in the United States, which lasted eighteen months, the longest downturn since the 1930s Depression, was declared over and done as of July 2009. The economy has been growing, albeit slowly, since then, and the output of goods and services (Gross Domestic Product or GDP) has returned to pre-recession levels. U.S. corporate profits have soared, and most of the big banks, after being bailed out, have been making piles of money. However, rising production and profits have not been accompanied by the return to work of millions of unemployed people, many of whom have been out of work for numerous months and have little prospect of future employment.

This essay will focus on the jobs disaster in the United States, although the problem is global. The United States is where the crisis began, and it is still the world’s richest and most powerful nation. What happens here has serious repercussions for everyone in the world. In addition, the disconnect between economic reality and the propaganda of recovery is greatest in the United States. So a close examination of what is happening in this country is instructive, not just for those of us who live here, but for those in the rest of the world as well.

Overview

If we focus our attention on the conditions of the working class, of ordinary men and women, it is impossible to argue that the Great Recession is over. In the “recovery” year of 2010, approximately one and a half million people declared bankruptcy, banks repossessed one million homes, nearly three million homeowners received foreclosure notices, record numbers of people (some forty-three million) received food stamps, and more than twenty million people remained unemployed and underemployed.

Let us take a closer look at the labor market. Over eight million jobs were lost at the height of the recession, but only about one and a half million jobs have been added since the recession’s trough, enough to keep pace with the increasing number of working age people but not enough to make much of a dent in the rates of unemployment and underemployment. What is more, some six million people—or 45 percent of the approximately 13.5 million officially unemployed—have been without work for more than twenty-seven weeks. In March 2011, two years after the beginning of massive job losses, there were an estimated two million people who had reached the maximum ninety-nine weeks during which they were allowed to receive unemployment benefits, a number that is expected to grow dramatically in the coming months. There has not been such severe long-term unemployment since the 1930s.

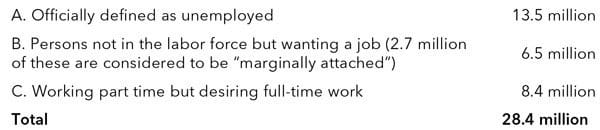

The official U.S. unemployment rate was over 9.0 percent for twenty-one straight months (through January 2011), dropping slightly below this level in February and March only because thousands of people, having become so discouraged that they stopped looking for work, were no longer considered unemployed. This figure still leaves 13.5 million people considered officially unemployed. However, double that number—a total of twenty-eight million people—want to work (or need full-time jobs instead of part-time ones) (see Table 1). The labor force participation rate, which indicates the fraction of the “non-institutional” working-age population in the labor force, shows what is happening. This rate has been declining for some time, meaning that people have been dropping out of the labor force. The rate was 67.3 percent in April 2000, but only 64.2 percent in January 2011.

The Great Recession and its aftermath have particularly affected young people, African-Americans, and those with lower levels of education. Nearly 25 percent of sixteen-to-nineteen-year-olds were unemployed in March 2011. At the same time, the rate of unemployment among blacks was 15.5 percent, approximately double that of whites (7.9 percent). For those with less than a high school diploma, the unemployment rate in March 2011 was 13.7 percent, while for those with a college diploma or graduate schooling, it was 4.4 percent.

Prospects for those seeking employment, although improving from the depths of the recession, are still very difficult. This is especially so for the long-term unemployed because companies are discriminating against these workers. At the start of 2011, there were more than four unemployed persons per job opening. The long-term unemployed suffer both economic hardship and severe psychological problems, and they rightly fear that the longer they are unemployed the harder it will be to get a job. The economic insecurity they and many others face is creating profound negative effects on many people, and there are indications that suicide rates have increased over the last few years.1 Approximately one-third of the unemployed are not receiving any sort of unemployment benefits because they are not eligible for the unemployment insurance program. Even those with higher levels of education are finding it difficult to obtain employment once they have lost a job.

Table 1. Unemployed and Underemployed in March 2011

Source: U.S. Dept. of Labor, Bureau Economic Research, “The Employment Situation—March 2011,” Tables A-1 and A-8, seasonally adjusted.

It must be noted, too, that a high level of unemployment means those with jobs suffer as well; they are always fearful they will lose their jobs or see their wages and benefits shrink. Those returning to work after being unemployed are finding lower salaries. As a Wall Street Journal headline put it, “Downturn’s Ugly Trademark: Steep, Lasting Drop in Wages.”2 Of those able to find work, over half are earning less than they did at their previous job. Remarkably, real average weekly earnings of production and nonsupervisory workers have been falling, even as the economy is recovering.

A New Normal?

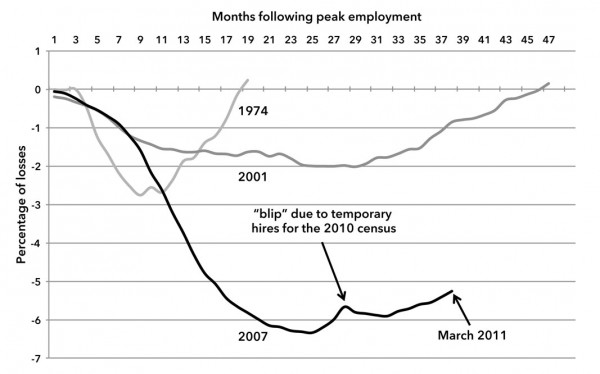

Some economists and reporters are talking of a “new normal” labor market situation, in which high rates of unemployment will persist for many years to come. There have been twelve recessions since the end of the Second World War and five over the last three decades. Following most post-Second World War recessions, the economy recovered rapidly, with lost jobs returning fairly quickly. For example, in the relatively typical recession that began in 1974, it took nineteen months to get back to pre-recession numbers of jobs (Chart 1). However, in the 2001 recession—although not a very severe one—it took a post-Great Depression record of forty-seven months to return to pre-recession employment. In the wake of the 2007-2009 recession—deeper than other post-Second World War recessions—there appears, as of March 2011, a very long way to go to get back all the lost jobs (Chart 1).

Chart 1. Percent of Job Losses in Recessions

Source: Calculated from All Employees: Total nonfarm employees (PAYEMS), downloaded from St. Louis Federal Reserve FRED database, http://research.stlouisfed.org.

So why do conditions this time appear especially tough—with little evidence of jobs rapidly returning, even though the output of goods and services has returned to pre-recession levels? How did all this come about? Is it due to long-term changes and trends, or just some recent mischief and misbehavior by banks, Wall Street, and other parts of the financial sector? Before discussing the current situation in more detail, let us take a look back to the “golden” era of the 1950s and ’60s and what has occurred since, including the two most recent recessions, those of 1990-91 and 2001.

The “Golden” Years

In the mid-1960s, Harry Magdoff described the prevailing beliefs regarding the U.S. economy as follows: “Wave upon wave of prosperity, accompanied by ever higher levels of production and consumption, nourish the belief that the U.S. economy has found new sources of strength and that remaining weaknesses can be fairly easily overcome.”3 These “golden” years of the 1950s and ’60s were special, with relatively high rates of economic and job growth, but they were not as successful as believed, nor did they portend a coming era of perpetual high growth rates.

A number of forces propelled the economy during the years following the Second World War, increasing the number of jobs and pushing wages higher. These included the pent-up civilian demand (and savings) built up during the War; the stimulus from helping to rebuild Europe; both the direct stimulus and side-effects arising from the increasing dominance of the automobile in transportation (including the growth of suburbs and the building of the huge interstate highway system, development of motels, fast-food restaurants, and the like); the needs for new housing with the forming of many new families after the delay occasioned by the war; and the baby boom itself. For twenty-seven years, starting in 1947, the population grew at an average of almost 1.7 percent a year, with a maximum of a 2 percent increase from 1949 to 1950. Procurement for the Korean War also provided a significant stimulus to the economy during this period. By the mid-1960s, spending for President Johnson’s “Great Society” programs and, by the end of the decade, for the war against Vietnam, provided additional economic stimulation. A strong union movement—numerically, in terms of union members, and in support from the public—helped workers in their struggle to increase wages and benefits. And this had real positive “trickle down” effects on lower-wage, nonunion workers.

Although government spending stimulated both the private economy and job creation, direct government employment provided a significant number of jobs. During this period, local (especially) and state governments created many jobs to staff new and expanding schools, police and fire departments, and other public services. The growth of public employment was substantial—providing nearly one-quarter of all jobs that were added to the economy during the 1960s.

During the 1950s and ’60s, unemployment rates were relatively low. For close to 40 percent of the period, unemployment was less than 4 percent. And for a short period during the Korean War, unemployment was below 3 percent, probably as close to full employment as we can get in the United States.

But Harry Magdoff went on to explain that, in the midst of the “golden” era, what actually existed was “(1) an economy that has not been able to achieve reasonably full employment in any year since 1953 [during the Korean War]; (2) an economy that but for the military effort might have from 20 to 24 million unemployed; (3) an economy which in addition to the reliance on military spending is growing increasingly dependent on injections of credit; and (4) an economy in which after twenty years of prosperity, fully a third of the young men of military age do not meet required standards of health and education.”4

The Great Moderation?

Despite reduced economic growth following the “golden” decades and a litany of significant financial crises and recessions, people came to believe in the late 1980s and ’90s that the economy “had found new sources of strength and that remaining weaknesses” could be easily overcome. A permanent “Great Moderation” had taken hold. They believed that the new computer technologies and a variety of business techniques were making deep crises a thing of the past and business cycle crises easy to deal with by using federal monetary and fiscal policies.

Reflecting a radically different view, Harry Magdoff and Paul Sweezy, from the 1970s to the late 1990s, wrote a series of articles in Monthly Review in which they discussed the tendency of mature capitalist economies to stagnation, the return to lower economic growth rates after the large post-Second World War growth spurt, the growth of the financial system as a response to the difficulty of making profits in the “real economy,” and the resulting increase in debt in all sectors of society. After the stock market crash of 1987, which followed the severe recession in the early 1980s, they observed:

But, you may ask, won’t the powers that be step into the breach again and abort the crisis before it gets a chance to run its course? Yes, certainly. That, by now, is standard operating procedure, and it cannot be excluded that it will succeed in the same ambiguous sense that it did after the 1987 stock market crash. If so, we will have the whole process to go through again on a more elevated and more precarious level. But sooner or later, next time or further down the road, it will not succeed….We will then be in a new situation as unprecedented as the conditions from which it will have emerged.5

It has taken awhile for a day of major reckoning to appear. Measures that government and business took to fight each crisis helped the working population to some extent (though real wages stagnated and household debt rose), but they also helped create conditions that led to the next crisis. The basic structural problems remained. Slow economic growth engendered financialization of the economy because finance is where “real” money could be made. In making money only with money, no product or service is provided. “Something for nothing. It never loses its charm,” as Michael Lewis put it.

However, financialization went hand in hand with, and was partly responsible for, the return to the large inequality of income and wealth last seen in the late 1920s. This, in turn, reinforced the slow growth tendencies, once the piles of new debt accumulated by those whose incomes were falling began to default and the massive speculation spurring all the debt along could no longer be sustained. The trend over the past three decades seems to be bubble-crisis-bubble: the 1987 stock market crash; followed by the savings and loan banking crisis (late 1980s to mid-1990s, contributing to the recession of 1990-91); the Mexican economic crisis (1994); the Asian financial crisis (1997); the collapse of the Long-Term Capital Management hedge fund (1998); the 2000 bursting of the dot-com bubble (leading to the 2001 recession); and, finally, the housing bubble bursting (pointing to the Great Recession that began at the end of 2007). All the while, powerful financial interests were able to push through their deregulation agenda, giving them increasing freedom to create a vast array of financial products and to speculate without adult supervision—increasing the likelihood of more bubbles and crises.

As stated above, there were props that kept crises at bay for a while. One was “defense” spending. Government hiring, almost exclusively by local and state governments, added approximately ten million jobs. However, trouble was always brewing. Real GDP grew at an average annual rate of 5.9 percent in the 1940s, 4.2 percent in the 1950s and ’60s, 3.4 percent in the 1970s, 3.2 percent in the 1980s and ’90s, and 1.9 percent during the first decade of the twenty-first century.

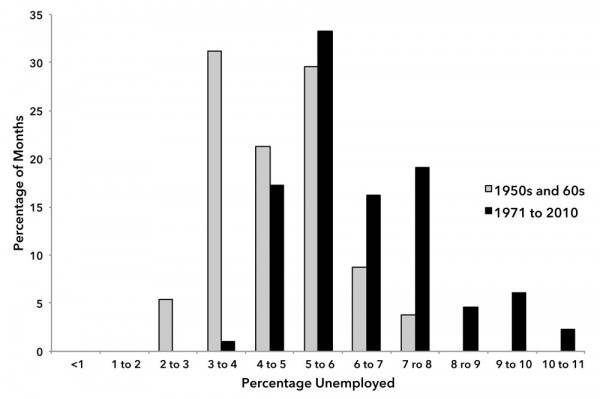

If we look at the differences in the job situation between the 1950s and ’60s and the last four decades, we see a striking disparity in the length of time that unemployment was in certain ranges (Chart 2). During the former period, there were recessions, but they were usually of short duration, and employment tended to bounce back quickly. And, as mentioned above, for about 40 percent of the time, the unemployment rate was below 4 percent, reaching less than 3 percent for a short period in the early 1950s. Contrast this with the situation of the 1970s through 2010, when unemployment was very low (less than 4 percent) for less than 1 percent of the time, and 6 percent or higher for over half of the time. Add to this the related stagnation in real wages and, to put it mildly, this was not a favorable forty-year period for labor. Families were able to maintain or increase their living standards by having more two-earner households, working longer hours, and taking on increased levels of debt.

Chart 2. Percent of Time (Months) in Unemployment Range

Source: Calculated from Civilian Unemployment Rate (UNRATE), downloaded from St. Louis Federal Reserve FRED database, http://research.stlouisfed.org.

A new phenomenon appeared in the 1990s. The recession in the early decade, from July 1990 through March 1991, produced a “jobless recovery”; it took thirty-one months for jobs to return to pre-recession levels. And the short period of rapid growth of jobs that did occur in the mid-1990s through 2000 was fueled by an enormous jump in debt and the spending associated with the dot-com-induced stock bubble. The amount of debt driving the system is hard to imagine. From 1996 to 2000, all debt (personal, business, and government) increased by an average of over $1,600 billion ($1.6 trillion) per year—with increasing household debt alone averaging over $400 billion per year—at a time when the GDP was growing at an average rate of about $500 billion per year.

The recession of 2001 lasted for eight months, but, as indicated in Chart 1, its effects lingered for many years and produced a second “jobless recovery.” The economy grew so slowly after the 2001 recession ended (real GDP growth averaged 2.7 percent for 2002 through 2006) that it took nearly four years to gain back the jobs that had been lost—the most time to recoup jobs lost by an economic downturn since the Great Depression. The recovery of private sector jobs to pre-recession levels took even longer—fifty-four months. Some of the growth that did occur in this period resulted from the large expansion of the defense budget when military spending skyrocketed as the “War on Terror”—mainly the Afghanistan and Iraq wars—was pursued, following the events of September 11, 2001. But the “recovery” from the 2001 recession was stimulated mainly by increasing levels of debt and speculation, this time primarily taking the form of a housing bubble and building boom. The significance of the debt explosion to the stimulation of growth and speculation cannot be stressed too strongly. From 2001 through 2007 the average annual increase in debt in all sectors of the economy was a staggering $3,000 billion ($3 trillion) per year—with household debt alone increasing by over $900 billion annually—while the GDP increase averaged less than $600 billion per year.

An inherently unstable situation develops when, over a period of years, total societal debt greatly outpaces economic output. Only one and a half years after the level of employment reached pre-2001 recession levels, the bottom seemed to fall out of the economy, as the financial crisis began.

While the 2007-2009 recession has been declared finis, the crisis is still unfolding. In Europe, people are suffering under austerity programs so that the interests of private capital can be protected. Even after the three bailouts—Greece, Ireland, and Portugal (in process as this is written)—the default of one of the weaker members of the European Union is still a real possibility. And in the United States, where corporate (financial and nonfinancial) interests have been protected, home foreclosures and massive un- and underemployment still haunt the country. At the end of 2010, close to 25 percent of homeowners were “underwater,” owing more on their mortgages than their homes were worth.6

Today, there is the renewed mantra, accepted by almost all politicians, that we must reduce the federal deficit as soon as possible. The result will be a more precarious existence for the most vulnerable—the unemployed or employed in low-wage jobs already living in difficult conditions—as well as for workers higher up the wage scale. The huge deficits in many state and local governments were papered over for two years by the infusion of funds from the federal government “stimulus” program that runs out in the spring of 2011. Thus, the wave of public job losses will continue to grow. And the movement to reduce or eliminate the bargaining power of public sector workers means that the battle of Wisconsin, although in the short run lost by workers, may lead to a prolonged struggle. Regardless of whether or not labor is able to win some of the battles, the conservative political resistance to obtain sufficient funds from “where the money is” (corporations and the wealthy) indicates that the numbers employed by the public sector will continue to decrease or, at best, stagnate.

One might think that the past decade would have been a disaster for U.S. business—economically and politically. After all that has been revealed regarding the shenanigans and criminal activities of banks and corporations, one would think that the credibility of the business sector would have decreased. However, with the national government bailing out the financial system and saving key industries from failure, most wealthy business owners and top managers—although scared to death by what seemed to be a real possibility of the Great Recession turning into a depression—still have their wealth and businesses intact. The great inequality of income and wealth was preserved, as was the power of capital to direct rules, regulations, and propaganda in its favor. Companies learned to go lean and mean during the recession, restructuring operations, firing employees, and requiring those remaining to do more with less. And in the process, many profited, especially during the so-called recovery that began in July 2009. At the end of September 2010, corporations had done so well they were sitting on some two trillion dollars of cash.7 Without profitable outlets for their investments when faced by a weak economy (even if no longer in an actual recession), companies either sit on cash, buy other companies, give out dividends, or buy back stock to help enhance share value.

Although capital as a whole, with some notable exceptions, seems to have weathered the Great Recession storm quite well, the first decade of the twenty-first century has been a lost decade as far as working people are concerned. The average annual growth of real GDP during the last ten years was only 1.9 percent—closer in growth rates to the decade of the 1930s (1.3 percent) than any decade since. This growth rate is not sufficient to provide enough new jobs to decrease the unemployment rate. As an article in The Washington Post explained, “a growth rate in the mid-2 percent range signifies an economy merely treading water.…[Faster] growth …is needed to bring down joblessness and put idle factories to use.”8

The economy was in recession during one-fifth of the past decade—some twenty-six months—and the period ended with approximately 131 million people employed, fewer than the number employed in January 2001. The consequences of a decade of zero growth of jobs have been, as we have seen, catastrophic for many people.

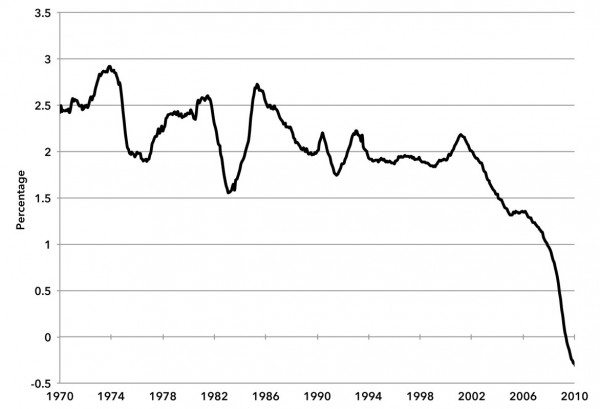

At the time of this writing, in early 2011, it is apparent that the government sector will not be a source of many new jobs for years to come. The disastrous financial conditions of many state and local governments mean that the only issue is how many jobs will continue to be shed from this sector. So that leaves the private sector, and the recent record of private employment generation has been abysmal. The ten-year moving average growth in private sector jobs was around 2 percent a year during the late 1980s and for the 1990s, but started to decrease in 2002, following the 2001 recession, and continued to plunge, reaching zero in 2009 (Chart 3).

Chart 3. Private Sector Job Growth (10-year moving average annual percent growth)

Source: Calculated from All Employees: Total Private Industries (USPRIV), downloaded from St. Louis Federal Reserve FRED database, http://research.stlouisfed.org.

Thus, the private sector produced fewer and fewer jobs as the decade proceeded, and the implications for working people are serious. Although public sector employment, as one would expect, showed more stability at the beginning of the crisis, it too has weakened, as state and local governments have found themselves facing deep fiscal crises, and as the right-wing attacks on public sector employees have accelerated.

The Rough Road Ahead

For large numbers of jobs to be added by the private sector, the growth of GDP needs to be in the range of 3 to 4 percent or above. It is not at all clear that the economy can sustain this rate for sufficient time to dig out of the job hole that has been created. As indicated in Table 1, there are some twenty-eight million people who do not have jobs and want to work (or work part-time and want full-time work), with 13.5 million of those officially considered to be unemployed. To put this in perspective, employment by private companies in March 2010 was less than 110 million. It is almost unimaginable that the private sector can create 13.5 million jobs in the foreseeable future, let alone the twenty-eight million needed to provide jobs to all who want work.

The difficult economic situation and its implication for workers did not happen overnight—or even over a few years, or because of the subprime mortgage fiasco. We have reached this point because of decades of capital (and the government) trying to overcome stagnation’s limits to finding profitable investment outlets. In the process, the financial sector became ever larger, creating an increasingly fragile economy, dependent on new infusions of debt, made more precarious because debt was growing so much faster than the economy and because so much of it was being used for speculative purposes.

For the last half-century, as noted above, the financial explosion was behind much of the economic growth. The total debt in the U.S. economy went from around 150 percent of the GDP in the mid-1980s to well over 300 percent by the beginning of the Great Recession in December 2007. Although some debts are being erased, either through paying them off, home foreclosures, or bankruptcy (“deleveraging,” in the parlance of economists), it is questionable that things have reached the stage in which increased financialization can get things going once again. It is unlikely that a large expansion in household debt can occur until personal debt loads are reduced further than they have been already (from close to 100 to about 91 percent of the GDP). And since consumer purchases account for about two-thirds of the economy, lack of growth of wages as well as difficulty increasing consumer debt does not bode well for this sector’s contribution to stimulating sufficient new growth. If it cannot, then what is there in the real economy that might provide the rapid sustained growth needed to produce sufficient jobs to reach something close to full employment?

Although the federal government is likely to spend more than it takes in for a long time to come, largely because of decreased revenues, political considerations make it unlikely that there will be an expansion of national government debt for the purpose of stimulating the economy. In addition, state and local governments will most likely be areas of job losses for some years.

The goods-producing industries—manufacturing, mining, forestry, and agriculture—have generally lost jobs over the last half-century and so it has been in the service sector that employment growth has occurred. Although manufacturing will add jobs as the economy slowly recovers, job growth in new manufacturing ventures to produce goods for the U.S. market is occurring mainly abroad. The hoped-for effects of the Federal Reserve’s 2010 to mid-2011 program of “quantitative easing”—essentially printing money to ease the financial crisis—are to prop up the stock market and to lower the value of the dollar in order to make U.S. exports more attractive. It is extremely doubtful, however, that this kind of monetary strategy can, by itself, create the kind of growth needed in order significantly to alleviate the pitiful job situation.

With the public sector and goods-producing industries no longer in any shape to constitute major job-growth areas, can the service sector—the major source of employment expansion for decades—provide sufficient job growth to reach anything like meaningful full employment? The fastest growing broad job categories from the 1960s through the present have been retail trade, hospitality and leisure, education and health, and business services. But job growth in each of these areas was sliding, even before the Great Recession. The growth in employment in retail trade began a steady drop in the mid-1980s. Job growth in the leisure and hospitality industries also began to decrease in the 1980s, while, in education and health, the decline began in the mid-1990s. All of these areas were adding jobs except during recessions, but their rates of annual growth were declining long before the Great Recession. And job growth in the financial services industry began to falter following the 2001 recession. Even if the service sector somehow is able to provide a lot of jobs, many of these are at relatively low wages. For example, the average wage for recreation workers in the accommodation industry is $22,280 a year.9

In order to create a lot of new jobs annually over a period of decades, the United States needs a truly epoch-making new technology like the railroad or the automobile-highway-suburbanization complex, which can shake the economy out of its tendency to stagnation. Computers, the Internet, smart phones, iPads, etc. have certainly changed the way we live and work, but they have not resulted in a major self-sustaining and society-wide stimulation of job growth. Partly this is due to production abroad and to labor-saving effects of computerization in some economic sectors. While it is impossible to know what lies ahead, there is no technology or grouping of technologies—and that includes “green” energy—that appear capable of supplying the impetus to begin and maintain a long wave of rapid growth.

Given the lack of another government “stimulus,” the shedding of jobs from state and local governments, and the inability of the private sector to produce an adequate number of jobs, slow economic (GDP) growth will probably continue to provide a low quantity of relatively low-paying new jobs. A prolonged sluggish economy with high rates of unemployment may well be the “new normal.” With the private sector seemingly unable to provide sufficient new jobs to employ those who want and need employment, a new Depression era WPA-like government jobs program is desperately needed, as is increased funding for programs to help the poor. Any such jobs program must aim to provide essential public services, including high-quality housing, schooling, health care, protection for the environment, public spaces, and income security. It must be aimed primarily at those most harmed by our jobs crisis. It also needs to include an unconditional amnesty for undocumented workers, who have been disproportionately hurt by the Great Recession and who have been viciously scapegoated and hunted down, imprisoned, and deported. Finally, it must also be accompanied by significant constraints on the finance capital that has been moving its money around the world and creating in its wake immense amounts of human misery.

The current political climate makes all of this unlikely to happen. A mass movement, capable of forcing action will be necessary for such truly radical change to occur. The recent struggles by public workers in Wisconsin and a few other states might rekindle such a movement. What has been interesting and hopeful about these struggles is how they took inspiration from the revolt in Egypt—where workers actually sent solidarity messages (and pizza) to Madison, Wisconsin. We live in a world in which working-class misery and working-class responses to it are increasingly interconnected. Even though we must, for the most part, confine our battles to our home terrain, we can take heart in the fact that workers around the world are beginning to fight back.

Notes

- ↩ Jacob S. Hacker, Philipp Rehm, and Mark Schlesinger, “Standing on Shaky Ground: American’s Experiences with Economic Insecurity,” The Economic Security Index and the Rockefeller Foundation, December 2010. Annual suicide rates were approximately 11.0 per 100,000 in the early part of the decade, 11.5 in 2007, and 11.8 (preliminary figure) for 2008.

- ↩ Sudeep Reddy, “Downturn’s Ugly Trademark: Steep, Lasting Drop in Wages,” The Wall Street Journal, January 11, 2011.

- ↩ Harry Magdoff, “Problems of United States Capitalism,” Socialist Register (1965), 62-79.

- ↩ Ibid.

- ↩ Harry Magdoff and Paul M. Sweezy, The Irreversible Crisis (New York: Monthly Review Press, 1988), 76.

- ↩ Carl Bialik, “Housing Statistics Hit Rough Waters,” The Wall Street Journal, January 8, 2011.

- ↩ Justin Lahart, “Companies Cling to Cash,” The Wall Street Journal, December 10, 2010.

- ↩ Neil Irwin and Sonja Ryst, “GDP Report: Economic Growth Slows with 2 Percent Rate in Second Quarter,” The Washington Post, July 31, 2010.

- ↩ United States Bureau of Labor Statistics, Occupational Outlook Quarterly, U.S. Department of Labor, Winter 2010-11. This can be downloaded at http://bls.gov.

Comments are closed.