Also in this issue

- Harmony and Ecological Civilization: Beyond the Capitalist Alienation of Nature

- The Denialism of Progressive Environmentalists

- Passage to More Than India: Greenpeace International Meets the Movement for Justice in Bhopal

- Joan Acker's Feminist Historical-Materialist Theory of Class

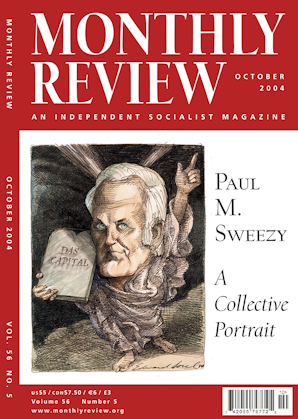

- An Important Time Recalled

Books by Paul M. Sweezy

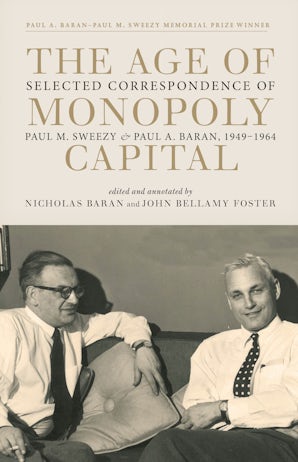

The Age of Monopoly Capital

Edited by John Bellamy Foster and Nicholas Baran

by Paul M. Sweezy and Paul A. Baran

Stagnation and the Financial Explosion

by Harry Magdoff and Paul M. Sweezy

Four Lectures on Marxism

by Paul M. Sweezy

Modern Capitalism

by Paul M. Sweezy

Dynamics of U.S. Capitalism

by Paul M. Sweezy

Article by Paul M. Sweezy

- Freedom and Economics

- Listen to the Ecologists!

- The Ecological Crisis of Capitalism and Human Survival

- The Political Tragedy of Capitalist Rule

- The Puzzle of Financialization

- End of Cold War Illusions

- Monthly Review in Historical Perspective

- Oliver Cromwell Cox's Marxism

- The Quality of Monopoly Capitalist Society: Mental Health

- 'The Deadly Implications of Capital for the Human Habitat': A Letter to István Mészáros from Paul M. Sweezy, October 16, 1992