The development of crisis theory within the Marxian tradition has been central to much of our work in the last several years. The view that the various fragmentary references to crisis theory in the three volumes of Capital constitute a fully developed coherent structure, which only requires diligent exegesis, is a view that has never seemed sensible to us.

Recent research into the evolution of Marx’s manuscripts in connection with the production of the Marx-Engels-Gesamtausgabe (MEGA), the historical-critical edition of the complete writings of Karl Marx and Friedrich Engels, has confirmed our understanding in a very exciting way. It is now clear that Marx never ceased to develop his thinking on the phenomena of crises in capitalism, and never ceased to discard earlier formulations; for example, at the end of his life he was focused on questions of credit and crisis. Monthly Review rarely presents its readers with discussions of economic theory at a relatively high degree of abstraction; this, however, is such an occasion. We trust that the author’s exemplary clarity will permit ready access to readers with any degree of interest in Marx’s theory; for those who wish to become familiar with the conceptual outline of Marx’s work, we cannot do better than to recommend the author’s An Introduction to the Three Volumes of Karl Marx’s Capital (Monthly Review Press, 2012). —The Editors

In Marx’s work, no final presentation of his theory of crisis can be found. Instead, there are various approaches to explain crises. In the twentieth century, the starting point for Marxist debates on crisis theory was the third volume of Capital, the manuscript of which was written in 1864–1865. Later, attention was directed towards the theoretical considerations on crisis in the Theories of Surplus-Value, written in the period between 1861 and 1863. Finally, the Grundrisse of 1857–1858 also came into view, which today plays a central role in the understanding of Marx’s crisis theory for numerous authors. Thus, starting with Capital, the debate gradually shifted its attention to earlier texts. With the Marx Engels Gesamtausgabe (MEGA), all of the economic texts written by Marx between the late 1860s and the late 1870s are now available. Along with his letters, these texts allow for an insight into the development of Marx’s theoretical considerations on crisis after 1865.

Hope, Experience, and the Changing Analytical Framework of Marx’s Theory

In the first half of the nineteenth century, it became clear that periodic economic crises were an inevitable component of modern capitalism. In the Communist Manifesto, they were regarded as a threat to the economic existence of bourgeois society. Crises first took on a special political meaning for Marx in 1850 when he attempted a closer analysis of the failed revolutions of 1848–1849. He now regarded the crisis of 1847–1848 as the decisive process which led to revolution, from which he drew the conclusion: “A new revolution is possible only in consequence of a new crisis. It is, however, just as certain as this crisis.”1

In the following years, Marx eagerly awaited a new deep crisis. It finally came in 1857–1858: all capitalist centers experienced a crisis. Whereas Marx acutely observed the crisis and analyzed it in numerous articles for the New York Tribune, he also attempted to work out his critique of political economy, which he had planned for years.2 The result was the untitled manuscript which is known today as the Grundrisse.

In the Grundrisse, the theory of crisis bears the stamp of the expected “deluge” that Marx wrote about in his letters.3 In an early draft for the structure of the manuscript, crises come at the end of the presentation, after capital, the world market, and the state, where Marx fashions a direct connection to the end of capitalism: “Crises. Dissolution of the mode of production and form of society based upon exchange value.”4

In the so-called “Fragment on Machines,” one finds an outline of a theory of capitalist collapse. With the increasing application of science and technology in the capitalist production process, “the immediate labour performed by man himself” is no longer important, but rather “the appropriation of his own general productive power,” which leads Marx to a sweeping conclusion: “As soon as labour in its immediate form has ceased to be the great source of wealth, labour time ceases and must cease to be its measure, and therefore exchange value [must cease to be the measure] of use value. The surplus labour of the masses has ceased to be the condition for the development of general wealth, just as the non-labour of the few has ceased to be the condition for the development of the general powers of the human head. As a result, production based upon exchange value collapses.”5

These lines have often been quoted, but without regard for how insufficiently secure the categorical foundations of the Grundrisse are. The distinction between concrete and abstract labor, which Marx refers to in Capital as “crucial to an understanding of political economy,” is not at all present in the Grundrisse.6 And in Capital, “labor in the immediate form” is also not the source of wealth. The sources of material wealth are concrete, useful labor and nature. The social substance of wealth or value in capitalism is abstract labor, whereby it does not matter whether this abstract labor can be traced back to labor-power expended in the process of production, or to the transfer of value of used means of production. If abstract labor remains the substance of value, then it is not clear why labor time can no longer be its intrinsic measure, and it’s not clear why “production based on exchange value” should necessarily collapse. When, for example, Hardt and Negri argue that labor is no longer the measure of value, they do not really refer to the value theory of Capital but to the unclear statements of the Grundrisse.7

Marx indirectly addresses this set of problems from the Grundrisse in the first volume of Capital, when dealing with the concept of relative surplus-value: there Marx makes fun of the notion that the determination of value by labor is called into question by the fact that in capitalist production, the point is to reduce the labor time required for the production of an individual commodity—and that was the argument upon which the theory of collapse in the Grundrisse was based.8

The crisis of 1857–1858 was over quickly. It did not lead, economically or politically, to the shaking up of conditions that Marx had hoped for: the capitalist economy emerged strengthened from the crisis, and revolutionary movements did not arise anywhere. This experience was integrated into Marx’s theoretical development: after 1857–1858, Marx no longer argued in terms of a theory of final economic collapse, and he no longer made out a direct connection between crisis and revolution.

Marx’s hopes in the crisis were disappointed, but at least he had begun to formulate his critique of political economy. This project would grip him until the end of his life, and the theory of crisis would play an important role within it. Although Marx had in no way finished with the process of research, he made numerous attempts at an adequate presentation. Starting in 1857, three comprehensive economic manuscripts emerged: after the Grundrisse of 1857–1858, the Manuscript of 1861–1863 (which contains the Theories of Surplus-Value) and the Manuscript of 1863–1865 (which among other things contains the manuscript used by Engels as the foundation for his edition of the third volume of Capital). In the MEGA, where these manuscripts have been published in their entirety, they are referred to as “the three drafts of Capital.” This widely used description is problematic: it suggests a seamless continuity and conceals the shifts in the theoretical framework of Marx’s analysis.

One result of the Grundrisse was the six-book plan announced in the preface to A Contribution to the Critique of Political Economy (capital, landed property, wage-labor, the State, foreign trade, the world market).9 Fundamental for the first book is the distinction between “capital in general” and the “competition of many capitals”: everything that merely manifests at the level of appearance in competition was to be developed in the section on “capital in general,” abstracted however from any observation of individual capitals or a particular capital.10

In the Manuscript of 1861–1863, where Marx attempts to implement this concept, the theory of crisis is dealt with under new considerations. Crises are no longer an indication of the dissolution of the capitalist mode of production, but are rather the constant and completely normal accompaniment of this mode of production, which provide a “forcible adjustment of all the contradictions.” Correspondingly, the theory of crisis no longer constitutes the endpoint of the presentation. Rather, individual moments of crisis are to be dealt with at different levels of the presentation. Marx makes the programmatic declaration:

The world trade crises must be regarded as the real concentration and forcible adjustment of all the contradictions of bourgeois economy. The individual factors, which are condensed in these crises, must therefore emerge and must be described in each sphere of the bourgeois economy and the further we advance in our examination of the latter, the more aspects of this conflict must be traced on the one hand, and on the other hand it must be shown that its more abstract forms are recurring and are contained in the more concrete forms.11

However, Marx had a problem determining which moments of crisis are to be developed at which level. He still had not found the proper structure of the presentation. In the course of his work on the Manuscript of 1861–1863, Marx had to accept two dramatic results: (1) the six-book plan was too comprehensive, he would not be able to carry it out completely. Marx announced that he would restrict himself to the book on “Capital,” eventually he intended to get around to writing the book on the state, but all the rest had to be done by others on the basis of the foundation that he would provide.12 (2) It would soon become clear, however, that the strict separation between “capital in general” and “competition” could no longer be maintained.13 For the book on capital that Marx now planned, the concept of “capital in general” no longer played a role. Whereas from 1857 to 1863 in the manuscripts as well as in Marx’s letters, Marx often referred to “capital in general” when discussing the structure of the planned work, this term no longer showed up anywhere after the summer of 1863.

So we are not dealing with three drafts for the final version of Capital, but rather with two different projects: the plan followed between 1857 and 1863 for a six-book Critique of Political Economy, and after 1863, the four-book work on Capital (three “theoretical” volumes and one on the history of theory). The Grundrisse and the Manuscript of 1861–1863 are the two drafts for the book on capital from the original six-book Critique of Political Economy, whereas the Manuscript of 1863–1865 is the first draft for the three theoretical volumes of the four-book Capital. If we consider the Manuscript of 1863–1865, then it becomes clear not only that the concept of “capital in general” is missing, but also that the structure of presentation does not anymore correspond to the opposition between capital in general and competition. Instead, a central role is played by the relationship between individual capital and the total social capital, which is dealt with at the different levels of abstraction of the process of production, the process of circulation, and the process of capitalist production as a whole. The strict separation of the presentation of capital, wage-labor, and landed property could also no longer be maintained: in the newly conceptualized Capital, one finds theoretically fundamental sections of the previously planned books on landed property and wage-labor. All that remains are the special studies mentioned in the text.14 So overall, Capital corresponds to the material of the first three books of the earlier six-book plan, but within an altered theoretical framework. The planned presentation of the history of theory had also been altered: a history of economic theory in its entirety replaces the history of individual categories intended for the old book on capital. Here as well, the originally planned separation cannot be maintained.

The first draft for this new Capital is the Manuscript of 1863–1865. The first printing of the first volume of Capital from 1866–1867, the “Manuscript II” for book II of Capital from 1868–1870,15 as well as the smaller manuscripts for book II and book III created in the same time period16: all of these constitute a second draft (1866–1871) of Capital. The manuscripts written between the end of 1871 and 1881 including the second German edition of the first volume of Capital from 1872–1873 (which exhibits considerable changes from the first edition) and the French edition of 1872–1875 (which contains further changes) constitute a third draft of Capital. So instead of three drafts and the final Capital, we have two different projects with a total of five drafts.17

The Evolution of Marx’s Economic Writings Since 1857

| I. The Critique of Political Economy, in Six Books (1857–1863) | |

| First Draft | Grundrisse 1857–1858 |

| Second Draft | A Contribution to the Critique of Political Economy, 1859 |

| Manuscript of 1861–1863 | |

| II. Capital, in Four Books (1863–1881) | |

| First Draft | Manuscript of 1863–1865 |

| Second Draft | Capital, Vol. I, first edition (1867) |

| Manuscript II for Book II (1868–1870) | |

| Manuscripts for Books II and III (1867–1871) | |

| Third Draft | Capital, Vol. I, second edition (1872–1873) |

| Capital, Vol. I, French translation (1872–1875) | |

| Manuscripts for Book III (1874–1878) | |

| Manuscripts for Book II (1877–1881) | |

“The Law of the Tendency of the Rate of Profit to Fall”—and its Failure (1865)

The most extensive considerations of crisis in the Capital manuscripts can be found in connection with the presentation of the “Law of the tendency of the rate of profit to fall” in the manuscripts for the third book from 1864–1865. Since this “law” plays such an important role in many debates on crisis theory, it will be discussed before coming to the actual theory of crisis.

The idea that the social average rate of profit declines over the long term was considered an empirically confirmed fact since the eighteenth century. Adam Smith and David Ricardo both attempted to demonstrate that the observed fall in the rate of profit was not simply a temporary phenomenon, but rather a result of the inner laws of the development of capitalism. Adam Smith attempted to explain the fall in the rate of profit as a result of competition: in a country with abundant capital, the competition between owners of capital would exert downward pressure on profit.18 This argument is not very plausible. An individual capitalist, in order to improve his competitive position, can lower the price of his commodity and be satisfied with a smaller profit. However, if the majority of capitalists act in this way, then the market price of numerous commodities would decline and therefore also the costs for each enterprise, which in turn would increase profit.

David Ricardo had already criticized Smith’s arguments for the fall in the rate of profit.19 Ricardo proceeded from the assumption that, disregarding a few exceptions, the general rate of profit could only fall if wages increased. Since an increase in the size of the population necessitates more means of subsistence, Ricardo assumed that farmland of increasingly worse quality would have to be cultivated, which would lead to a rise in the price of grain. Since wages must cover the costs of reproduction of the labor force, wages would rise with the rise in the price of means of subsistence, which would cause a decrease in profits. Capitalists would not profit from the rising price of grain: on the worst land, production prices are high; on better land, the costs of production thus saved would flow as ground rent to landowners.20

Marx opposed this with the argument that even in agriculture increases in productivity are possible, so that the price of grain can fall as well as rise. The possibility of agricultural increases in productivity was not so readily apparent to Ricardo as to Marx: the latter was a contemporary of Justus von Liebig, whose discoveries in the field of chemistry revolutionized agricultural production.21 Marx was not the first to assert a long-term fall in the rate of profit as a result of the inner laws of capitalism. However, he did claim to be the first to have discovered a coherent explanation for this law.22

At the end of the manuscript for the third book, Marx characterizes the object of his presentation as “the internal organization of the capitalist mode of production, its ideal average, as it were.”23 With regard to the presentation of this “ideal average,” particular, temporary moments should be disregarded, in favor only of that which is typical of a developed capitalism. In the preface to the first volume of Capital written two years later, Marx also emphasizes that his intent is not the analysis of a single country or a particular epoch of capitalist development, but rather the “laws themselves” that form the basis of this development.24 Accordingly, with regard to his arguments for the law of the rate of profit, Marx does not assume any particular form of market or conditions of competition, but rather solely the form of development of the forces of production typical of capitalism, the increasing deployment of machinery. If the law he derives at this level of abstraction is correct, then it must be valid for all developed capitalist economies.

Marx discusses the law of the rate of profit in two steps: first, he illustrates why there is a tendential fall in the rate of profit at all.25 Subsequently, he discusses a series of factors that counteract this tendency and which even transform it into a temporary rise in the rate of profit, so that the fall in the rate of profit only exists as a “tendency.”26 Since these counteracting factors are more-or-less prominent in individual countries at different times, different trends in the rate of profit arise. However, in the long term, according to Marx’s thesis, the rate of profit must fall.

With this “law,” Marx formulates a very far-reaching existential proposition, which cannot be empirically proven nor refuted. The “law” claims that a fall in the rate of profit results in the long-term from the capitalist mode of development of the forces of production. If the rate of profit has fallen in the past, this does not constitute a proof—since the law purports to apply to future development, and the mere fact of a fall in the rate of profit in the past says nothing about the future. If the rate of profit has risen in the past, then this is also not a refutation, since the law does not require a permanent fall, but rather merely a “tendential” fall, which can still occur in the future. Even if the law cannot be empirically verified, the argumentative conclusiveness of Marx’s reasoning can be discussed.

Here, two points have to be distinguished. The first point concerns the relationship between “the law as such” and the “counteracting factors.” Marx assumes that the fall in the rate of profit, derived as a law, in the long term outweighs all counteracting factors. Yet Marx does not offer a reason for this.

The second point concerns the “law as such”: does Marx actually manage conclusively to prove the “law as such”? This section will be concerned solely with this point: it can be shown that Marx does not succeed in providing such a proof. The “law of the tendency of the rate of profit to fall” does not first fall apart in the face of the “counteracting factors”; it already falls apart because the “law as such” cannot be substantiated.27

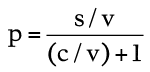

In order to argue for the fall in the rate of profit, Marx initially presupposes a constant rate of surplus-value and considers in a numerical example a rising value composition of capital, which then necessarily leads to a fall in the rate of profit. Not explicitly, but in principal Marx uses in this observation an expression of the rate of profit that he obtains from the first equation:

by dividing the numerator and denominator by v:

If, as Marx initially assumes, the numerator s/v remains constant while the denominator (c/v) + 1 grows, because c/v grows, then it is clear that the value of the entire fraction falls. However, the numerator does not remain constant. The value composition of capital increases because of the production of relative surplus-value, that is to say in the case of an increase in the rate of surplus-value. Contrary to a widespread notion, the increase in the rate of surplus-value as a result of an increase in productivity is not one of the “counteracting factors,” but is rather one of the conditions under which the law as such is supposed to be derived, the increase in c occurring precisely in the course of the production of relative surplus-value, which leads to an increasing rate of surplus-value.28 For that reason, shortly after the introductory example Marx emphasizes that the rate of profit also falls in the case of a rising rate of surplus-value. The question, however, is whether this can be conclusively argued.

If not only the value-composition of capital grows, but also the rate of surplus-value, then in the above fraction, both the numerator and denominator increase. When Marx claims a fall in the rate of profit, then he must demonstrate that in the long term the denominator grows faster than the numerator. Yet there is no evidence whatsoever for such a comparison in the speed of growth. Marx circles around this problem in the text more than he actually delivers any substantiation. His uncertainty becomes clear every time he asserts that the law has been proven, only to once again begin with an argument for it. These attempts at substantiation rest upon the notion that not only does the rate of surplus-value increase, but also that the number of workers employed by a capital of a given size decreases.

In the notes from which Engels constructed the fifteenth chapter of the third volume, Marx appears finally to be able to prove a fall in the rate of profit even in the case of an increasing rate of surplus-value with the following argument: if the number of workers continues to decrease, then at some point the surplus-value they create will also decline—regardless of how much the rate of surplus-value may rise. This can be easily seen using a numerical example: twenty-four workers, each of whom yield two hours of surplus-labor, yield a total of forty-eight hours of surplus-labor. However, if as a result of a strong increase in productivity, only two workers are necessary for production, then these two workers can only yield forty-eight hours of surplus-labor, if each works for twenty-four hours and does not receive a wage. Marx thus concludes that “the compensation of the reduced number of workers by a rise in the level of exploitation of labour has certain limits, that cannot be overstepped; this can certainly check the fall in the profit rate, but it cannot cancel it out.”29

However, this conclusion is only correct if the capital (c + v) necessary to employ the two workers is of an amount at least as great as that required to employ twenty-four workers before. Marx had merely demonstrated that in equation (1), the value of the numerator decreases. If a decline in the value of the entire fraction is to result from the decrease in the value of the numerator, then the denominator must at least remain constant. If the value of the denominator also decreases, then we would have the problem that numerator and denominator decrease, and it then becomes a question as to which decreases faster. However, we cannot exclude the possibility that the capital used to employ the two workers is smaller than that required to employ twenty-four. Why? Only wages for two workers have to be paid, instead of for twenty-four. Since an enormous increase in productivity has occurred (instead of twenty-four, only two workers are necessary), we can assume a considerable increase in productivity in the consumer goods industry, so that the value of labor-power also decreases. So the sum of wages for the two workers is not only one-twelfth that of the twenty-four workers, it is in fact much smaller. However, on the other hand the constant capital used up also increases. But for the denominator c + v to at least remain the same, it is not enough that c increases; c must also increase at least by the same amount that v decreases. Yet we do not know how much c increases, and for that reason, we do not know whether the denominator increases, and we therefore also do not know whether the rate of profit (the value of our fraction) decreases. So nothing has been proven.

Here, a fundamental problem is made abundantly clear: regardless of how we express the rate of profit, it is always a relation between two quantities. The direction of movement for these two quantities (or parts of these two quantities) is known. That, however, is not sufficient; the point is, which of the two quantities changes more rapidly—and we do not know that. For that reason, at the general level at which Marx argues, nothing can be said concerning long-term tendencies of the rate of profit.30 There is an additional problem, which cannot however be discussed here in any detail. The growth of c, from which the decline in the rate of profit supposedly results, is not completely unlimited. In the second part of the fifteenth chapter of the first volume of Capital, Marx argues that the additional application of constant capital encounters its own limits in the reduction of variable capital. If this is consistently taken into consideration, this presents a further argument against the “law as such.”31

Crisis Theory Without the Tendency of the Rate of Profit to Fall

Since many Marxists regarded the “law of the tendency of the rate of profit to fall” as the foundation of Marx’s theory of crisis, they vehemently defended it against every critique. The assumption that Marx intended to base his theory of crisis upon this law, however, is primarily a consequence of Engels’s editorship of the third volume of Capital. Marx’s manuscript of 1865, which was the foundation of Engels’s edition, is barely divided into subsections. It only has seven chapters, from which Engels made seven parts. In Marx’s manuscript, the third chapter on the fall in the rate of profit is not divided into any subsections. Its division into three separate chapters was done by Engels. The first two chapters on the “law as such” and the “counteracting factors” closely follow Marx’s argumentation, but the manuscript then flows out into a sea of notes and constantly interrupted thoughts. Engels heavily revised this material to construct the third chapter on the “law”: he condensed it with abridgments, he made rearrangements, and divided it into four subsections. This created the impression of an already largely completed theory of crisis. And since Engels gave the whole thing the chapter title “Development of the Law’s Internal Contradictions,” he created—on the part of readers who did not know that this chapter title did not at all originate with Marx—the expectation that this theory of crisis was a consequence of the “law.”32

If we turn to Marx’s text without any such preconceived notions, then it quickly becomes clear that Marx’s considerations do not yield any unified theory of crisis, but contain rather disparate thoughts on crisis theory.33 The most general formulation of capitalism’s tendency to crisis is completely independent of the “law of the tendential fall in the rate of profit”; rather, its starting point is the immediate purpose of capitalist production, surplus-value or rather profit. Here, a fundamental problem becomes apparent:

The conditions for immediate exploitation and for the realization of that exploitation are not identical. Not only are they separate in time and space, they are also separate in theory. The former is restricted only by the society’s productive forces, the latter by the proportionality between the different branches of production and by the society’s power of consumption. And this is determined neither by the absolute power of production nor by the absolute power of consumption but rather by the power of consumption within a given framework of antagonistic conditions of distribution, which reduce the consumption of the vast majority of society to a minimum level, only capable of varying within more or less narrow limits. It is further restricted by the drive for accumulation, the drive to expand capital and produce surplus-value on a larger scale…. The market, therefore, must be continually extended […] the more productivity develops, the more it comes into conflict with the narrow basis on which the relations of consumption rest. It is in no way a contradiction, on this contradictory basis, that excess capital coexists with a growing surplus population.34 [italics added]

Here, Marx points out a fundamental contradiction between the tendency towards an unlimited production of surplus-value, and the tendency toward a limited realization of it, based upon the “antagonistic conditions of distribution.” Marx is not advocating an underconsumptionist theory here, which only takes up capitalism’s limitations upon the possibility for consumption by wage-laborers, since he also includes the “drive to expand capital” in society’s power of consumption.35 It is not only the consumer demand of the working class, but also the investments of businesses that determine the relationship between production and consumption. However, the limitations upon the drive for accumulation are here not further substantiated by Marx. To do that, it would have been necessary to include the credit system in these observations. On the one hand, the credit system plays a role here, which Marx worked out in the manuscripts for book II. The realization of surplus-value in an amount of money beyond the capital advanced as c + v is ultimately made possible by the credit system.36 On the other hand, that which was already clear to Marx in the Grundrisse must also be systematically assimilated: “in a general crisis of overproduction the contradiction is not between the different kinds of productive capital, but between industrial and loan capital; between capital as it is directly involved in the production process and capital as it appears as money independently (relativement) outside that process.”37

So a systematic treatment of crisis theory cannot therefore follow immediately from the “law of the tendency of the rate of profit to fall,” but only after the categories of interest-bearing capital and credit have been developed. The theoretical position for crisis theory suggested by Engels’s editorship is definitely wrong, but this suggestion has been extremely influential: many Marxist approaches to crisis theory completely disregard credit relationships and consider the root causes of crisis to be phenomena that have nothing to do with money and credit.

Since Marx’s theory of credit remained fragmentary in the manuscript of 1865, and Marx no longer explicitly took up the question of the relationship between production and credit in his approach to crisis theory, his theory of crisis is not just incomplete in a quantitative sense (to the extent that a part is missing); rather, it is incomplete in a systematic sense. As the following section demonstrates, this was abundantly clear to Marx—in contrast to many later Marxists.

Marx’s Research Program in the 1870s

The debates on the tendential fall in the rate of profit and crisis theory conducted in connection with volume III of Capital are based upon a text that Marx wrote in 1864–1865. In accordance with the classification introduced in the first part of this article, this text belongs to the first draft of Capital. However, Marx did not stop there. The second draft (1866–1871) brought progress in the development of book II; on the themes of book III, only shorter manuscripts emerged. However, already an expansion of the treatment of the credit system can be observed. In the Manuscript of 1863–1865, credit was to be merely a subsidiary point within the section on interest-bearing capital. However, in a letter to Engels from April 30, 1868, in which Marx explains the structure of book III, the treatment of credit is already on an equal footing with interest-bearing capital. On November 14, 1868, Marx writes to Engels that he will “use the chapter on credit for an actual denunciation of this swindle and of commercial morals.”38 This initially means a comprehensive illustration, however, it is foreseeable that this illustration requires a more far-reaching theoretical advance. Marx already seems to have adjusted to the need for such a deepening: in 1868 and 1869, comprehensive excerpts on credit, the money market, and crises emerge.39

The most important changes occurred as Marx was working on the third draft (1871–1881). Presumably, Marx was plagued by considerable doubts concerning the law of the rate of profit. Already in the Manuscript of 1863–1865, Marx was not completely convinced with his explanation, as is made clear by the repeated attempts at formulating a justification. These doubts were probably amplified in the course of the 1870s. In 1875, a comprehensive manuscript emerges which was first published under the title Mathematical Treatment of the Rate of Surplus-Value and Profit Rate.40 Here, under various boundary conditions and with many numerical examples, Marx attempts mathematically to grasp the relationship between the rate of surplus-value and the rate of profit. The intent is to demonstrate the “laws” of the “movement of the rate of profit,” whereby it quickly becomes apparent that in principle all sorts of movement are possible.41 Several times, Marx makes note of possibilities for the rate of profit to increase, although the value-composition of capital was increasing. In the case of a renewed composition of book III, all of these considerations would have had to find their way into a revision of the chapter on the “Law of the Tendency of the Rate of Profit to Fall.” A consistent regard for them should have led to the abandonment of the “law.” Marx also hints at this in a handwritten note he made in his copy of the second edition of volume I, which no longer fits the tendential fall and which Engels incorporated as a footnote in the third and fourth editions: “Note here for working out later: if the extension is only quantitative, then for a greater and a smaller capital in the same branch of business the profits are as the magnitudes of the capitals advanced. If the quantitative extension induces a qualitative change, then the rate of profit on the larger capital rises at the same time.”42

Understood in context, the “qualitative extension” refers to a rising value-composition of capital. Marx proceeds here from the assumption of a rising rate of profit accompanying a rising value-composition of capital, which is diametrically opposed to the argument of the law of the rate of profit in the Manuscript of 1863–1865.43

Changes were also planned in other areas. It is widely known that since 1870, Marx engaged in an intense study of landed-property relations in Russia, and even learned Russian in order to read the corresponding literature.44 Marx also had a great interest in the United States, which was developing at an immensely rapid pace. An interview with John Swinton from 1878 indicates that Marx was planning on presenting the credit system by means of the conditions in the United States, which would have led to a complete revision of the section on interest and credit.45 At the same time, England would therefore have no longer been the “locus classicus” of the capitalist mode of production, as Marx refers to it in the preface to the first volume of Capital.

With regard to crisis theory, Marx is increasingly convinced that inquiry basically has not come far enough for him to proceed to an “appropriate” presentation of the “real movement” that he speaks of in the postface of the second edition of volume I.46 In a letter to Engels from May 31, 1873, Marx wonders whether it would be possible “to determine mathematically the principal laws governing crises.”47 Such a possibility would assume that crises proceed with enormous regularity. The fact that Marx raises the question of mathematical determination shows that he is not yet clear about the extent of this regularity. In a letter to Danielson from April 10, 1879, Marx finally writes that he cannot complete the second volume (which was to encompass Books II and III): “before the present English industrial crisis had reached its climax. The phenomena are this time singular, in many respects different from what they were in the past…. It is therefore necessary to watch the present course of things until their maturity before you can ‘consume’ them ‘productively,’ I mean ‘theoretically.’48

So Marx is still in the middle of the process of research and theory-building that must come before the presentation. In fact, at the end of the 1870s, Marx was confronted with a new type of crisis: a stagnation lasting for years, which is distinguished sharply from the rapid, conjunctural up and down movement which he had hitherto known. In this context, Marx’s attention is drawn to the now internationally important role of the national banks, which have a considerable influence upon the course of the crisis.49 The observations reported by Marx make clear that a systematic treatment of crisis theory is not possible on the immediate basis of the law of the tendential fall in the rate of profit (as suggested by Engels’s edition of the third volume of Capital), but rather only after a presentation of interest-bearing capital and credit. However, if the national banks play such an important role, then it is very doubtful whether the credit system can be categorically presented while excluding an analysis of the state. The same holds for the world market. It was already clear to Marx in the Manuscript of 1863–1865 that the world market was “the very basis and living atmosphere of the capitalist mode of production,” but he still was of the opinion that he had to initially abstract from relations on the world market.50 It is questionable, however, whether or to what extent the presentation of the “shapings of the total process” (Gestaltungen des Gesamtprozesses) envisioned by Marx for book III is at all possible in abstraction from the state and the world market.51 If, however, this is in fact not possible, then the construction of Capital as a whole is called into question.

In light of these considerations and extensions, a mere revision of the previously existing manuscripts was no longer a realistic possibility for Marx. The variety of new results, the geographical expansion of perspective (United States and Russia), the new fields of research that have to be integrated—all of this necessitates a fundamental revision of the hitherto existing manuscripts, a fact that is clearly recognized by Marx.52 In a letter to Ferdinand Domela Nieuwenhuis from June 27, 1880, Marx wrote that “certain economic phenomena are, at this precise moment, entering upon a new phase of development and hence call for fresh appraisal.”53 A year-and-a-half later, Marx was thinking about a complete revision of the first volume of Capital. On December 13, 1881, he wrote to Danielson that the publisher had announced to him that soon a third German edition of the first volume would be necessary. Marx would agree to a small print run with a few minor changes, but then for a fourth edition he would “change the book in the way I should have done at present under different circumstances.”54 Alas, a version of Capital integrating the insights and questions gained in the 1870s remained unwritten.

Notes

- ↩ Karl Marx and Frederick Engels, Collected Works (London: Lawrence and Wishart, 1975), vol. 10, 135 (henceforth MECW).

- ↩ These observations can be found in his Book on Crisis, a collection of materials about the crisis ordered according to countries. The Book on Crisis will be published in Karl Marx and Friedrich Engels, Gesamtausgabe (MEGA) (Berlin: Dietz-Verlag, later Akademie-Verlag, 1975), II/14 (henceforth MEGA; the MEGA is divided in four sections: the Roman number stands for the section, and the Arabic number for the volume in this section.)

- ↩ See Marx to Engels, Dec 8, 1857, MECW, vol. 40, 217.

- ↩ MECW, vol. 28, 195.

- ↩ MECW, vol. 29, 91.

- ↩ Karl Marx, Capital, vol. 1 (London: Penguin, 1976), 132.

- ↩ Michael Hardt and Antonio Negri, Empire (Cambridge, MA: Harvard University Press, 2000).

- ↩ Marx, Capital, vol. 1, 437. A more detailed critique of Marx’s arguments in the machine fragment can be found in Michael Heinrich, “The Fragment on Machines: A Marxian Misconception in the Grundrisse and its Overcoming in Capital,” in Riccardo Bellofiore, Guido Starosta, and Peter D. Thomas, eds., In Marx’s Laboratory: Critical Interpretations of the Grundrisse (Leiden: Brill Academic Press, 2013).

- ↩ MECW, vol. 29, 261.

- ↩ Cf. MECW, vol. 28, 236, 341; MECW, vol. 29, 114–15.

- ↩ MECW, vol. 32, 140.

- ↩ See his letter to Kugelmann, December 28, 1862, MECW, vol. 41, 435.

- ↩ The double requirement posed by Marx with regard to “capital in general,” of presenting a specific content (everything that appears in competition) at a certain level of abstraction (abstracted from individual capitals and the particularities of capital) proved to be unfeasible. The presentation of the process of capitalist reproduction as a whole and the constitution of the social average rate of profit is not possible at this level of abstraction; the distinction between particular sectors of social production and the competition of individual capitals are required. However the process of capitalist reproduction as a whole and the average rate of profit have to be developed before interest-bearing capital can be presented, and the latter has to be presented before the real movement of competition can be dealt with (for a more extensive discussion of this point, see Michael Heinrich, Die Wissenschaft vom Wert. Die Marxsche Kritik der politischen Ökonomie zwischen wissenschaftlicher Revolution und klassischer Tradition [The Science of Value: Marx’s Critique of Political Economy Between Scientific Revolution and Classical Tradition], 5th edition (Münster: Westfälisches Dampfboot, 2011); an English translation will be published by Brill in 2014.

- ↩ cf. Marx, Capital, vol. 1, 683; Karl Marx, Capital , vol. 3 (London: Penguin, 1981), 751.

- ↩ Included in MEGA, II/11.

- ↩ MEGA, II/4,3.

- ↩ For a more detailed account on this point, see Michael Heinrich, “Reconstruction or Deconstruction? Methodological Controversies about Value and Capital, and New Insights from the Critical Edition,” in Riccardo Bellofiore and Roberto Fineschi, eds., Re-reading Marx: New Perspectives After the Critical Edition (Houndmills: Palgrave Macmillan, 2009), 71–98.

- ↩ Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, in The Glasgow Edition of the Works and the Correspondence of Adam Smith (Oxford: Oxford University Press 1976),111. Originally published 1776.

- ↩ David Ricardo, On the Principles of Political Economy and Taxation, in Piero Sraffa, ed., The Works and Correspondence of David Ricardo, vol.1 (Cambridge: Cambridge University Press, 1951), 289–300. Originally published 1823.

- ↩ Ibid, 110–127.

- ↩ Marx subjected Ricardo’s theory of ground rent to an extensive critique in numerous passages of the Theories of Surplus-Value, see MECW, vol. 31, 457-551. A critique of Ricardo’s explanation of the falling profit rate can be found in MECW, vol. 32, 72-103.

- ↩ Marx, Capital, vol. 3, 319–20.

- ↩ Ibid, 970.

- ↩ Marx,Capital, vol. 1, 91.

- ↩ Marx,Capital, vol. 3, Chapter 13.

- ↩ Ibid, Chapter 14.

- ↩ Simon Clarke, like many others, accentuates that Marx’s profit law has to be seen not in isolation but in a “wider theoretical context” as part of the “complex analysis of secular tendencies of capitalist accumulation.” See Marx’s Theory of Crisis (London: Macmillan, 1994), 208. Nevertheless in Chapter 13 of Capital, vol. 3, Marx begins with a discussion of the profit law in such isolation. Marx knows very well that before putting an issue in a wider context, first we have to provide arguments for it. However when the basic arguments already prove to be wrong, they will not become correct by putting them in a wider context. Therefore the profit law will be discussed in the same abstract context in which it was introduced by Marx in Chapter 13.

- ↩ In the case of the “counteracting factors,” the first point dealt with by Marx is the increase in the rate of exploitation—but not as a result of the deployment of machinery, but rather as a result of the prolongation of the working day and the intensification of labor. So in the case of the “counteracting factors,” we are dealing with an additional increase of the rate of surplus-value.

- ↩ Marx, Capital, vol. 3, 356.

- ↩ The many “proofs” of the law that can be found in the literature, either rest upon logical errors, similar to those just demonstrated in the case of Marx, or upon absurd assumptions, such as the precondition that v = 0, as in the work of Andrew Kliman, Reclaiming Marx’s ‘Capital’: A Refutation of the Myth of Inconsistency (Lanham: Lexington, 2007).

- ↩ This problem is discussed, as well as the various attempts at rescuing Marx’s law, in Heinrich, Die Wissenschaft vom Wert.

- ↩ Of course Engels’s intention was not to deceive the reader. He wanted, as he emphasized, to create a “readable” edition. In doing so, he made certain editorial decisions which were not recognizable as editorial decisions to the reader, but which considerably influenced the reader’s understanding of the text. For more on this, see Michael Heinrich, “Engels’ Edition and Marx’s Original Manuscript,” Science & Society 60, no. 4, (Winter 1996/97): 452–66; and Jürgen Jungnickel and Carl-Erich Vollgraf, “Marx in Marx’s Words?,” International Journal of Political Economy 32, no. 1 (Spring 2002): 35–78.

- ↩ The various approaches are dealt with more extensively in Heinrich, Die Wissenschaft vom Wert.; see also An Introduction to the Three Volumes of Karl Marx’s Capital (New York: Monthly Review Press, 2012)

- ↩ Marx, Capital, vol. 3, 352–53.

- ↩ Although sometimes formulations can be found that could be understood as underconsumptionist; see Marx, Capital, vol. 3, 615.

- ↩ At the level of abstraction of book II, where the category of interest-bearing capital has not yet been developed, Marx can only explain this additional amount of money with the anachronistic assumption of additional money reserves of the capitalists.

- ↩ MECW, vol. 28, 340.

- ↩ MECW, vol. 43, 160.

- ↩ They will be published in MEGA IV/19.

- ↩ MEGA II/14.

- ↩ MEGA II/14, 128.

- ↩ Marx,Capital, vol. 1, 781.

- ↩ On the basis of this note, Shalom Groll and Ze’ev Orzech already supposed that Marx doubted his own law of the rate of profit. In light of the manuscripts from the 1870s that have been published in the meantime, this supposition has gained considerable plausibility. See their “Technical Progress and Value in Marx’s Theory of the Decline in the Rate of Profit: an Exegetical Approach,” History of Political Economy 19, no. 4 (1987): 604.

- ↩ See, among other things, his letter to Kugelmann from June 27, 1870, MECW, vol. 43, 528. In connection with his study of Russian landed-property relations, as well as further ethnological studies, Marx also finally transcends the Eurocentrism that one finds in his writings on India from the 1850s. See Kevin B. Anderson, Marx at the Margins: On Nationalism, Ethnicity, and Non-Western Societies (Chicago: University of Chicago Press, 2010), and Kolja Lindner, “Marx Eurocentrism: Postcolonial Studies and Marx Scholarship,” Radical Philosophy 161 (2010): 27–41.

- ↩ See MECW, vol. 24, 583–85. It is noteworthy, however, that Marx apparently was not familiar with the book Lombard Street: A Description of the Money Market (1873) by Walter Bagehot—the publisher of The Economist, which Marx read regularly. This book is regarded today as the first formulation of the principles of a money market managed by a central bank.

- ↩ Marx, Capital, vol, 1, 102.

- ↩ MECW, vol. 44, 504.

- ↩ MECW, vol. 45, 354, accentuation by Marx.

- ↩ See ibid, as well as the letter to Danielson from September 12, 1880, MECW, vol. 46, 31.

- ↩ Marx, Capital, vol. 3, 205.

- ↩ Marx used this title for book III after 1864–65. He also used it in the preface to the first edition of volume I when announcing the future volumes. Engels changed this to “The total process of capitalist production.” This difference between the announcement of book III in the preface of book I (stressing “shapings”) and the title of book III in the edition of Engels (stressing “production”) is not very clear in the English translation.

- ↩ These were not just limited to the already mentioned landed property, credit, and crisis. The excerpts from the 1870s also dealt with physiology, geology, and the history of technology. They not only show the broad areas of interest to Marx, they are also of direct relevance to Capital: Marx’s earlier engagement with technological questions, which were at the foundation of the first volume published in 1867, were no longer sufficient in light of the state of technical progress that in the meantime had considerably changed not just production, but also communication.

- ↩ MECW, vol. 46, 16.

- ↩ MECW, vol. 46,161. The unfortunate circumstances mentioned here refer to Marx’s poor health and the death of his wife Jenny on December 2, 1881.

Comments are closed.