David Wyss, chief economist for Standard & Poor’s, recently opened an article, “Good, Gloomy or Grim in 2005?,” with the words: “Growth tops the wish list [for the U.S. economy], but even recession wouldn’t be all that bad, given that recovery always follows. The big fear? Stagnation” (Business Week Online, January 10, 2005).

This assessment is important enough we believe to deserve closer scrutiny. Wyss suggests that a cyclical downturn since it would be automatically followed by a cyclical upturn represents a less serious threat to the accumulation process than a continuation or a deepening of the stagnation that has plagued the U.S. and world economy in recent decades. Stagnation is usually understood as a long period of slow growth, weak employment, and weak investment. It is as evident in business upturns, which tend to be weak and dependent on artificial stimulants, as in business downturns. Stagnation thus represents the underlying economic trend in which the normal business cycle ups and downs occur. It does not lead automatically to its own reversal, and can linger on endlessly—no wonder that it rather than recession constitutes, according to Wyss, “the scariest scenario.”

The U.S. economy is now in the midst of a recovery from the 2001 recession—a downturn that was preceded by the bursting of the New Economy financial bubble. Are there reasons under current conditions to fear that the economic engine might suddenly stall or simply sputter along for years (or even decades) without getting up any real steam? Wyss suggests there are. First—although he doesn’t bother to mention it to his Business Week Online audience—there is the history of the last four years (three of them recovery years), during which real GDP has grown by an anemic 2.5 percent. Second, there are a number of “major risks” including: “rising oil prices, the falling dollar, higher interest rates and the twin deficits”—the federal budget deficit and the current accounts deficit on international transactions—that could destabilize the economy. The biggest worry is the possibility that a further financial crisis brought on by such factors will lead to the kind of deep-seated, unrelenting stagnation that has plagued the Japanese economy since the bursting of its financial bubble in late 1989. “So far,” Stephen Roach, chief economist for Morgan Stanley, declares, “America’s post-bubble experience has been very different—merely one recession and nothing worse than a brief deflation scare. Yet it may be premature to conclude that the U.S. has avoided the dreaded Japanese syndrome” (“Global Post-Bubble Pitfalls—Yet Another Lesson from Japan,” www.morganstanley.com, February 18, 2005).

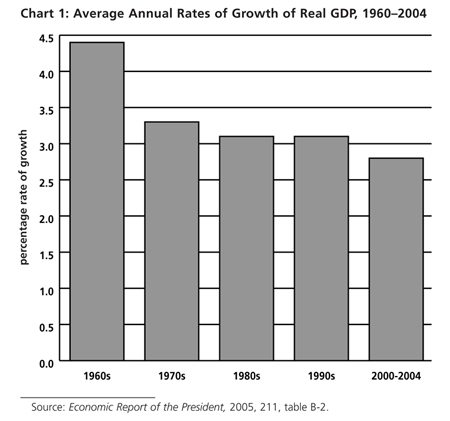

But if the specter of stagnation is haunting the U.S. and world economy this is downplayed in the Bush administration’s own assessment in the 2005 Economic Report of the President. The introduction signed by President Bush proclaims that “the United States is enjoying a robust economic expansion.” Nevertheless, economic growth of 3.3 percent, only a little above the average annual rate for the last thirty–five years, is projected by the administration for the rest of the decade. Indeed, if the 2.8 percent growth rate for the years 2000–04 (see chart 1) is combined with the administration’s own projections for the next five years the annual growth rate for the 2000–09 decade would be 3.1 percent, slightly below the average for the last three decades and far worse than the 1960s. Recent economic history and the administration projections therefore point to the likelihood of continuing slow growth in the years ahead.

Still, the implications of this are deftly avoided in this year’s Economic Report of the President. Released in late February by the president’s Council of Economic Advisors it attributes the weak recovery of the last few years to the shallowness of the preceding recession. In an obvious attempt to side step the question of slow growth the report claims that both “recent recessions and expansions have been especially moderate, suggesting the economy has become more stable in general” (70). What this means of course is that a lackluster expansion has been difficult to distinguish from the relatively shallow contraction that preceded it. In a word, stagnation.

If persistent and prolonged stagnation is the “big fear” of those running today’s economy how is it to be explained? And how is this connected to the current attack on Social Security and other social programs, representing what is clearly a new stage in the class war from above?

According to a theoretical perspective that we have presented many times in these pages, stagnation not rapid growth is the normal state of the capitalist economy. This is particularly true of the monopoly stage of capitalism (including today’s more globalized corporate world) in which the giant firms attempt to maximize the economic surplus at their disposal by seeking to control and carefully regulate the expansion of production capacity. Overaccumulation, reflected in the buildup of undesired excess capacity, due ultimately to the restricted consumption of the masses, has the effect of shutting off investment as corporations seek to avoid adding to their idle plant and equipment. The result is a tendency toward a general slowdown in growth.

At the root of this problem is the effective banning of price competition in the more mature, consolidated industries. Prices as a whole tend to go only one way—up. This means that competition is not eliminated but channeled into areas such as cost-saving innovations and marketing. Corporations respond to shortfalls in demand not by reducing prices for the most part but by reducing capacity utilization along with employment in order to defend their profit margins. Increases in productivity do not generally lead to lower prices or increased real wages (which rise decisively only when the economy approaches full employment peaks), instead they end up feeding the surplus in the hands of corporations and the wealthy. The result of all of this, however, is to create overaccumulation and a shortage of effective demand in the economy as a whole. A growing investment-seeking surplus increasingly controlled by a relatively small number of giant corporations and wealthy individuals is unable to find profitable investment outlets, reducing the rate of economic expansion. Those investment booms that do occur under these circumstances tend to be extremely short-lived and self-limiting.

These problems of accumulation typical to monopoly capitalism need to be understood in a larger and wider historical context in which it is recognized that all periods of rapid growth under capitalism have been periods in which external historical factors not understandable in terms of the internal accumulation (savings-and-investment) process have come into play. In the initial period of industrialization there was a seemingly insatiable demand for new plant and equipment since industry had to be built up virtually from scratch. But in a mature, capital-rich economy, in which ample productive capacity exists both to meet current needs and to expand the level of production, with investment only needed to replace worn-out, depreciated plant and equipment, strong stimuli to new investment on the scale represented by an industrial revolution is lacking. As Joseph Schumpeter observed near the end of his two volume work on Business Cycles (1939): “The atmosphere of industrial revolutions—of ‘progress’—is the only one in which capitalism can survive.” Without this capitalism tends to descend into stagnation. The Great Depression of the 1930s represented a long period of vanishing investment opportunities in which economists of all stripes were eventually compelled to grapple with the question of stagnation.

The depression finally ended not through any internal process associated with accumulation, but as a result of the boom resulting from the huge increase in military spending with the outbreak of the Second World War in Europe. When the war ended stagnation seemed to have vanished. Rapid growth took place, lasting for more than two decades. The strength and duration of this “golden age” as it has been called was clearly the product of special historical factors. These included: (1) the build-up of consumer savings during the war; (2) the reconstruction of the European and Japanese economies following the war-time devastation; (3) the extraordinary expansion of the role of the automobile in American life in a wave of growth in this sector that also included the construction of the interstate highway system and the suburbanization of the country; (4) the rise of the United States and the dollar to hegemonic status in the world economy; (5) the creation of a permanent war economy justified by the Cold War (which included hot wars in Asia); (6) the commercialization of nearly all aspects of American life with the attendant sales effort and consumer debt structure; and (7) the beginnings of a boom/bubble in the financial superstructure of the economy.

The trouble is that all of these forces were either temporary or simply couldn’t do the job sufficiently. An economy with a tendency to stagnation is like a leaky tire; it is always in the process of going flat. It therefore has to be pumped up constantly. Since what we are talking about is a growing system, moreover, we can say that both the tire and the leak are expanding in size so that only a bigger and more active pump will serve to keep it inflated (see Harry Magdoff and Paul Sweezy, The End of Prosperity, 1977, 22).

In the 1970s the economy slowed down representing a return of stagnation. Full employment production was not approached again for any extended period and the average annual rate of growth of the economy sank by more than a quarter during the last three decades of the century, as compared with the 1960s (chart 1). Moreover, the growth rate appears to be slowly slipping even further. The leak from the income stream required a bigger and more active pump. And while this was found to some extent through an enormous financial explosion the resulting financial bubble (or bubbles) has generated fears of sudden bubble-bursting events, leading to cascading defaults of the kind that have preceded deep stagnations.

Capital’s response to these exigencies has been threefold: (1) a stepped-up class war; (2) an attempt to increase the size and activity of the pump (but, consistent with the class war from above in terms that primarily serve capital); and (3) a growth of imperialism (including economic globalization) and war.

All three methods of confronting the crisis have been used by the Bush White House, which has gone further than any other administration in promoting the class war; has pumped up the economy in every way it can that it is consistent with direct adherence to ruling-class interests; and has launched a global war to back up an imperialist strategy of world domination.

Domestically, the Bush White House has followed a policy first initiated by the Reagan administration of continual pressure on labor and the poor while stimulating the economy by generating massive deficits. These are made more acceptable to the system since associated with military spending and with tax cuts mainly for corporations and the wealthy. Budget deficits as part of a “starve the beast” strategy are then used to justify sharp reductions for social programs that help the poor as well as the working and middle class (Paul Krugman, “Spearing the Beast,” New York Times, Op-Ed, February 8, 2005). The ultimate reactionary goal of this class war is to eliminate or eviscerate the major social programs—not only Medicare, Medicaid, and Social Security, but also housing assistance, nutrition assistance, etc.—that help people cope with the many harsh realities of capitalism.

It is a sign of capital’s strength in the class struggle that Social Security, the most popular of all U.S. government programs, has been chosen as the first target of a renewed offensive in the battle to eliminate all New Deal and 1960s era social programs. Despite decades of conservative propaganda meant to soften it up for assault, Social Security has thus far been largely impregnable (though some benefit cuts were initiated in the Reagan period) since supported by its own regressive payroll taxes giving workers the sense that their Social Security benefits are owed to them. The plan for partial privatization of Social Security through the creation of private accounts, which would be based on carve-outs from the Social Security payroll taxes and would require benefits cuts in turn, is a Trojan horse introduced by the Bush White House as a device for destroying Social Security from within. But in order to frighten the public into supporting such a major overhaul of an immensely popular government program it was necessary to claim that Social Security was facing a severe crisis, making it untenable in the long-run.

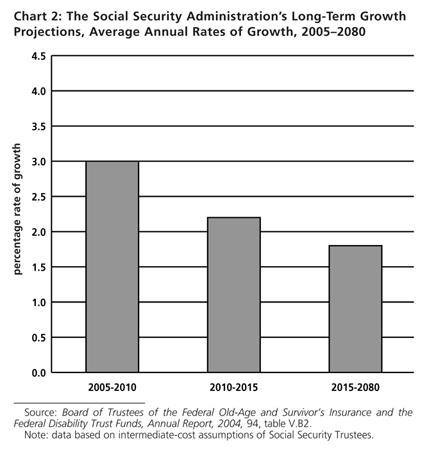

It is now considered common knowledge that the Social Security trust fund will no longer be able to meet its total obligations by 2042 (with its funds predicted to fall some 25 percent below what it will owe to its beneficiaries at that point). However, this “fact” is based on long-run forecasting by the Social Security Administration claiming (in the intermediate-cost projections) that the average annual rate growth of the economy will drop precipitously from 3 percent in 2005–10 to 2.2 percent in 2010–15 to an abysmal 1.8 percent in 2015–80 (see chart 2). The 1.8 percent growth forecasted here is lower than the growth rate in any two decades of U.S. history, including 1920–39, which includes the Great Depression and is viewed as the classic period of stagnation under monopoly capitalism.* With economic growth rates only a little above this, Social Security would not be in any peril and would have the funds to cover its beneficiaries indefinitely. Indeed, the date at which Social Security is supposed to run short of the full funds it needs has been continually pushed back as real growth rates have proven greater than those projected.

More telling, however, is the fact that if stagnation as deep as the 1920s and 1930s were actually to extend out for decades (with the rate of growth falling to less than 2 percent for most of the century), in conformity with what is considered the best-guess forecast of the Social Security Administration, U.S. capitalism as a whole would be in serious jeopardy and the class struggle enormously intensified. Social Security, which could still cover three-quarters of its benefits in that situation, would be the least of the problems of the system and would even be considered a saving grace. Indeed, given the economic Armageddon that such an abysmally low long-run growth rate would portend for a capitalist society it is hard to imagine getting very far down the road that the Social Security Administration projects without major social upheavals of the kind that defy all future assumptions.

The truth is that with a long-run growth rate of this kind what would be called into question would not be Social Security so much as capitalism itself. Is this within the range of possibility? Yes, we think it is. But to project such a future, in which U.S. capitalism as a whole would sink into deep, perpetual stagnation and unending crisis and class war, and then, without addressing this larger crisis, present this as simply a crisis of Social Security resulting from mere demographic trends is dishonest to an extreme.

The extent of the deception is revealed by the fact that then Chairman of the Council of Economic Advisors in the Bush Administration, N. Gregory Mankiw, baldly declared: “The Social Security trust fund will be empty in 2042, at which point the system will be insolvent” (“The Economic Agenda,” The Economists’ Voice, vol. 1, no. 3 [2004], 4). Yet this is clearly meant to mislead since at this date Social Security will have sufficient funds to meet three-quarters of its obligations according to the conservative assumptions of the Social Security Administration—even if absolutely no changes are made to the system. Indeed, it is appropriate to wonder how Social Security could become insolvent at all, since it is part of the U.S. government budget. If Social Security is ever short of funds these could be taken from the general tax revenue as in other advanced industrial countries. There is no reason that Social Security has to be internally self-supporting any more than the Pentagon.

Social Security was a product of the great revolt from below by workers during the Great Depression of the 1930s. It was designed to keep the elderly and disabled from falling into a deep and unending pit of poverty. Now, ironically, economic downturns approaching those of the depression are being projected for this century as a means of justifying the effective elimination of Social Security. There can hardly be a more dramatic sign of the great reversal in the class struggle and in the political economy of capitalism that has occurred over the last few decades.

Given the foregoing it follows that those who, in conformity with the present White House proposal, claim that Social Security can be partially privatized through the creation of individual private accounts and that those accounts will then earn high rates of return are shuffling two different sets of books. High rates of return on the stock market are extremely unlikely in a severely stagnating economy. “If economic growth is slow enough that we’ve got a problem with Social Security, then we are also going to have problems with the stock market. It’s as simple as that,” according to Douglas Fore, director of investment analytics for TIAA-CREF Investment Management Group (Washington Post, February 9, 2005). As Congressman Peter DeFazio (D-OR) puts it, “Proponents have not been able to show how the stock market would be able to yield 7 percent returns in the future [as claimed in Bush administration sales-pitches regarding private accounts] when economic growth is projected to be only about half of what it has been in the past.” (Peter DeFazio Reports, January 2005). As we observed in these pages more than four years ago (“Social Security, the Stock Market and the Elections,” November 2000), it is “like predicting the Great Depression without a stock market crash.”

Since there is no scientific basis on which growth trends of the economy can be accurately predicted even a few years (or months) ahead the current predictions of the Social Security Administration could just as easily be replaced with slightly more optimistic ones that would leave the system entirely in the black. Yet there is a certain degree of realism embodied in these projections to the extent that they do recognize that stagnation is ingrained in the U.S. economy. Not only is a full employment level of production no longer considered likely, but the system seems to be getting further and further from that goal. Stagnation, though this is barely acknowledged, is almost a built-in assumption in most mainstream economic analysis today, since it accepts with equanimity the notion that full capacity production will almost never be reached.

The answer to economic slowdown offered again and again by economic and political decision-makers is to remove the restraints on capital imposed or strengthened by the New Deal in one area after another—in banking, industry, welfare, food and drugs, and media regulations. Yet the inevitable result is only to deepen the economic and social crisis of capitalist society. Wyss’s “major risks” point to how fragile the accumulation process has become. High oil prices (not unrelated to U.S. attempts to gain control of world oil through the invasion of Iraq), rising interest rates (threatening a bursting of the housing bubble supporting U.S. consumption), the falling dollar (associated with the growing current account deficit arising from a deteriorating trade balance and the outflow of dollars for empire), and the federal budget deficit (a combined result of weak growth, tax cuts for the wealthy, and a boom in the armament-imperialism complex)—all point to the enormous perils of a stagnating economy.

Federal deficit spending, though a necessary tool in keeping the economy going, has itself become a major potential source of instability, threatening financial markets. Testifying before the House Budget Committee on March 2, 2005, Federal Reserve Chairman Alan Greenspan declared: “When you begin to do the arithmetic of what the rising debt level implied by the deficits tells you, and you add interest costs to that ever-rising debt, at ever-higher interest rates, the system becomes fiscally destabilizing. Unless we do something to ameliorate it in a very significant manner we will be in a state of stagnation.”

As Greenspan well knows the federal deficit could be eased by reversing the tax cuts aimed at the wealthy that the Bush administration has introduced (or by not allowing them to become permanent). Moreover, a small portion of the revenue lost through these tax cuts would be sufficient to put Social Security on a solid basis indefinitely even with abysmally slow growth in the future. The share of GDP now spent on the war in Iraq would also be more than enough to accomplish the same end (Paul Krugman, “Inventing a Crisis,” New York Times, December 7, 2004). Yet, the U.S. ruling class, wallowing in its wealth, is not about to offer the miniscule amount of the surplus at its disposal that would be necessary to strengthen Social Security—or to go one step further and make Social Security benefits more adequate for its recipients who increasingly depend on it as their main source of income. Instead, the goal is to use the phony Social Security crisis (concocted partly to hide the real fiscal crisis) as an excuse to squeeze workers even further. Thus Greenspan, loath to reimpose taxes on the rich, has nonetheless made a strong plea to Congress for the introduction of a consumption tax that would hit workers particularly hard. This policy has a name: class war.

It is in the nature of this game that working people will come under sharper attack while deficits will keep on mounting with all the attendant problems. As Harry Magdoff and Paul Sweezy observed in Stagnation and the Financial Explosion (1987), “the stimulation generated by unending and ever more red ink is self-limiting. Deficits piled on top of deficits provide fuel for new inflationary spirals and help sustain high interest rates; and at the same time they set in motion forces that eventually arrest growth and lead to a new business decline. In short, capitalism finds itself on the horns of a dilemma: it can’t live without deficits, and it can’t live with them” (106). The fiscal crisis of the state, or, as Schumpeter called it, “the crisis of the tax state,” is therefore a part of the logic of stagnation under monopoly capitalist society.

Indeed, at this point any of the economy’s major risks has the potential to shake the entire system, bursting financial bubbles and bringing growth to a standstill or worse. Nor are these problems confined to the United States. The rest of the capitalist world economy is caught up in various ways in this enduring crisis. Class war from above, growing competition between major capitalist states, imperialism, global military conflict, and the proliferation of waste are all natural outgrowths of the present economic malaise.

What is the answer? There are no ready-made solutions to the problems raised here. The economic burdens of the system are likely to become more not less crushing for the ordinary populace, nationally and globally. In the search for a rational, sustainable society there is no alternative but socialism—i.e., the struggle for a democratic, egalitarian order. It is of an old idea, but one that refuses to die and that is now taking on new revolutionary forms. Understanding the limitations of capitalism is only the first step; the second has to take us beyond it.

Notes

* The average annual rate of growth of real GDP was 2.1 percent from 1920-39 (1.8 percent from 1920-38) (Historical Statistics of the United States, 1970, 226, series F 31).

Comments are closed.