With U.S. capitalism mired in an economic crisis of a severity that increasingly brings to mind the Great Depression of the 1930s, it should come as no surprise that there are widespread calls for “a new New Deal.”1 Already the new Obama administration has been pointing to a vast economic stimulus program of up to $850 billion over two years aimed at lifting the nation out of the deep economic slump.2

The possibility of a new New Deal is to be welcomed by all of those on the left, as promising some relief to a hard-pressed working population. Nevertheless, it raises important questions. What are the real prospects for a new New Deal in the United States today? Is this the answer to the current economic crisis? What should be the stance of the left? A full analysis of all the issues would require a large volume. We shall confine ourselves here to a few points that will help to illuminate the challenges ahead.

The New Deal was not initially an attempt to stimulate the economy and generate recovery through government spending, an idea that was scarcely present in the early 1930s. Rather it consisted of ad hoc salvage or bailout measures, principally aimed at helping business, coupled with work relief programs. The lion’s share of New Deal expenditures at the outset were devoted to salvage operations. As Harvard economist Alvin Hansen, Keynes’s leading early follower in the United States, explained in 1941 in his Fiscal Policy and Business Cycles,

For the most part, the federal government [in the New Deal era] engaged in a salvaging program and not in a program of positive expansion. The salvaging program took the form of refinancing urban and rural debt, rebuilding the weakened capital structure of the banks, and supporting railroads at or near bankruptcy… [T]he Reconstruction Finance Corporation, the Home Owners’ Loan Corporation, and the Farm Credit Administration poured $18 billions into these salvaging operations. The federal government stepped into the breach and supported the hard-pressed state and local governments—again a salvage operation…

That a salvaging program of this magnitude was necessary was, of course, due to the unprecedented depth of the depression reached by early 1933….Under such circumstances the economy dries up like a sponge. Vast governmental expenditures, designed to float the “sponge” to a high level of prosperity, are instead absorbed by the sponge itself. The expenditures seemingly run to waste. This is the salvaging operation. Only when the economy has become thoroughly liquid can further funds float it to higher income levels. A deep depression requires vast salvaging expenditures before a vigorous expansionist process can develop.3

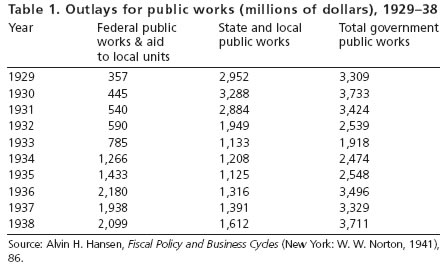

Federal spending on public works, which has become almost synonymous with the New Deal in popular culture, expanded nearly every year from 1929 to 1938 (see table 1). Yet, total government spending on public works did not regain its 1929 level until 1936, due to drops in state and local public works spending that undercut the federal increases. At first, state and local governments had responded to the deep slump by increasing their public works outlays. However, within a couple of years their resources were largely exhausted and their spending on public works dropped below that of 1929. By 1936, state and local public works expenditures were less than half their 1929 level. Hence, for most of the depression decade “the federal government,” as Hansen observed, “only helped to hold back the receding tide.” Despite the fact that federal outlays in this area had increased by almost 500 percent, total government public works expenditures rose only 12 percent over the period, not enough to offer much of a stimulus to the overall economy.

It was only later on in the depression decade, in what historians have called the “second New Deal,” culminating in Roosevelt’s landslide 1936 election victory, that the emphasis shifted decisively from salvage operations to work relief programs, and other measures that directly benefited the working class. This was the era of the Works Progress Administration, headed by Harry Hopkins, along with other progressive programs and measures, such as unemployment insurance, Social Security, and the Wagner Act (giving the de jure right to organize). These advances were made possible by the great “revolt from below” of organized labor in the 1930s.4 The WPA spent $11 billion and employed 8.5 million people. It paid for the building of roads, highways, and bridges. But it did much more than that. The federal school lunch program got its start with WPA dollars. Indeed, what distinguished the WPA from other work programs was that it employed people to do the things that were needed in all areas of society, working at jobs they were already equipped to do. The WPA financed over 225,000 concerts. It paid artists to paint murals and actors to do stage productions.5

None of this conformed to the later precepts of Keynesian economics. As late as 1937, Roosevelt’s New Deal administration had still not given up the goal of balancing the federal budget—a core aim of Secretary of the Treasury Henry Morgenthau Jr.—even in the midst of the Great Depression. It thus clamped down on federal spending, with expenditures being reduced in the budgets for fiscal years 1937 and 1938. Meanwhile the new Social Security program, passed in 1935, began taxing workers in fiscal year 1936 based on regressive payroll taxes, with no payouts for old age insurance supposed to occur until 1941, thereby generating a massive deflationary effect.6

These and other contradictions came to a head in the recession of 1937–38, during which the recovery that had been taking place since 1933 suddenly came to a halt prior to a full recovery, with unemployment jumping from 14 to 19 percent. It was only in response to deepening economic stagnation that the Roosevelt administration was at last induced to move decisively away from its attempt to balance the federal budget, turning to the strategy promoted by Federal Reserve Board Chairman Marriner Eccles of utilizing strong government spending and deficit financing to lift the economy. These actions corresponded to the publication of An Economic Program for American Democracy, signed by Richard V. Gilbert, George H. Hildebrand Jr., Arthur W. Stuart, Maxine Y. Sweezy, Paul M. Sweezy, Lorie Tarshis, and John D. Wilson—a group of young Harvard and Tufts economists representing the Keynesian revolution. This work was a Washington D.C. bestseller and immediately became the intellectual defense after the fact for the New Deal expansionary policies of 1938–39.7 Nevertheless, the stimulus measures adopted at this stage were too meager to counter the conditions of depression that prevailed at the time. What rescued the capitalist economy was the Second World War. “The Great Depression of the thirties,” John Kenneth Galbraith wrote, “never came to an end. It merely disappeared in the great mobilization of the forties.”8

But this raises further questions. As Paul Baran and Paul Sweezy asked in Monopoly Capital in 1966: “Why was such an increase [in government spending] not forthcoming during the whole depressed decade? Why did the New Deal fail to attain what the war proved to be within easy reach? The answer to these questions,” they contended, “is that, given the power structure of United States monopoly capitalism, the increase of civilian [government] spending had about reached its outer limits by 1939. The forces opposing further expansion were too strong to be overcome.”

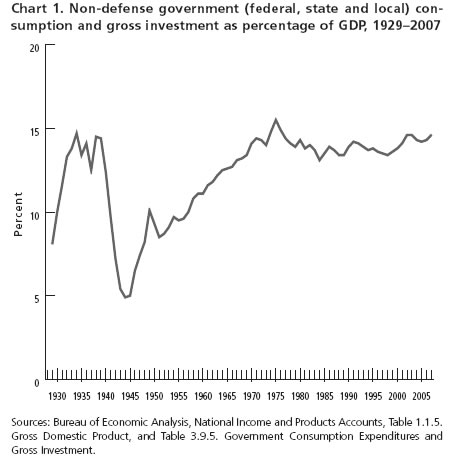

Baran and Sweezy’s thesis that civilian government spending had “about reached its outer limits” by the end of the New Deal was directed primarily at total non-defense government purchases as a percentage of GDP. This constitutes almost the entire direct contribution of government to the welfare of the population, encompassing public education, roads and highways, health, sanitation, water and electric services, commerce, conservation, recreation, police and fire protection, courts, prisons, legislators, the executive branch, etc. By 1939, Baran and Sweezy contended, these critical elements of government taken together had reached their maximum share of GDP, given the power structure of U.S. monopoly capitalism.9

Remarkably, Baran and Sweezy’s civilian government ceiling thesis has been borne out in the more than forty years since it was formulated (see chart 1). Civilian government consumption and investment purchases as a percentage of GDP rose to 14.5 percent of GDP in 1938 (14.4 percent in 1939), fell during the 1940s due to the great expansion of military spending during the Second World War, and then regained their lost ground in the 1950s, 1960s, and early ’70s. Civilian government spending on consumption and investment reached its highest point of 15.5 percent of national income in 1975 (dropping in 1976 to its second highest level of 14.9 percent), and then stabilized at around 14 percent from the late 1970s to the present. In 2007 non-defense government consumption and investment purchases constituted 14.6 percent of GDP, almost exactly the same level as in 1938–39!

The reasons for this are straightforward. Beyond some minimal level, real estate interests oppose public housing; private health care interests and medical professionals oppose public health care; insurance companies oppose public insurance programs; private education interests oppose public education; and so on. The big exceptions to this are highways and prisons within civilian government spending, together with military spending. “The point can be elucidated,” Baran and Sweezy wrote,

by considering two budget items simultaneously, say housing and health. Very few people nowadays are opposed to a modest public housing program, and of course everyone is in favor of at least enough spending on health to control epidemic diseases. But beyond a certain point, opposition begins to build up in each case, at first from real estate interests to housing and from the medical profession to public programs of medical care. But real estate interests presumably have no special reasons to oppose medical care, and doctors no special reasons to oppose housing. Still, once they have each gone into opposition to further increases in their own spheres, they may soon find it to their joint interest to combine forces in opposing both more housing and more public health. The opposition to each individual item thus builds up faster when two items are under consideration, and fastest of all for across-the-board increases in the whole budget. We might say figuratively that if one item is being considered, opposition grows in proportion to the amount of the increase; while if all items are being considered, opposition grows in proportion to the square of the increase.10

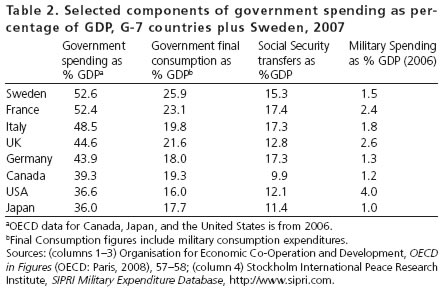

The fact that the ceiling to government expenditures in the U.S. system is a political rather than an economic barrier is demonstrated by the very different levels of government spending as a share of GDP in advanced capitalist countries. Table 2 provides comparative data for the G-7 countries plus Sweden for 2007. Total government spending (column 1) includes both (a) direct government purchases, which add directly to total aggregate demand, and (b) expenditures which reallocate income and capital within the economy, such as interest payments, social insurance transfer payments, farm subsidies, and investment subsidies.11 Final consumption expenditures of government (column 2) make up the largest component of the government purchases portion of column 1, and include consumption for military purposes. Social security transfers (column 3) encompass the totality of social insurance schemes covering the community as a whole, the major component of social welfare spending. Military expenditure data (column 4) are taken from the Military Expenditure Database of the Stockholm International Peace Research Institute (data are for 2006). (Note: columns 2, 3, and 4 do not add up to column 1, but rather show selected components of the latter. Some of the other components of total government spending not included are capital formation, interest payments, and other transfer payments.)

Examining these figures, it is clear that the United States has the lowest government final consumption (which includes military consumption) as a percentage of GDP, and is near the bottom in government spending and social security transfer payments as a percentage of GDP. The United States also expends a greater share of its national income on the military. U.S. government consumption expenditures, minus military consumption, came to only 11.8 percent of GDP in 2007. It is obvious then that there is ample room for the United States to expand its civilian government spending and social insurance transfers. The ceiling on such expenditures as a share of national income is rather a reflection of the power structure of U.S. society, including the relative weak organization of labor and the relative strength of big capital. The United States, despite its formally democratic character, is firmly in the hands of a moneyed oligarchy, probably the most powerful ruling class in history.

All of this is inseparable from the U.S. role as an imperial power and the effects that this has on its domestic power structure. Acknowledged (Office of Management and Budget) U.S. military expenditures in 2007 were $553 billion (4 percent of GDP), while actual U.S. military expenditures were $1 trillion (7.3 percent of GDP). Federal non-defense consumption and investment purchases in 2007 were, according to the Bureau of Economic Analysis, less than half federal defense consumption and investment purchases.12

Our argument therefore is simple. Given that a political ceiling on U.S. civilian government purchases as a percentage of GDP has persisted for more than seven decades, it is unlikely that this will change without a massive, indeed social-transformative, struggle, despite a relatively progressive administration and the worst economic crisis since the Great Depression. Even the greatest environmental crisis in the history of civilization, threatening life throughout the planet, is unlikely to result in a sufficiently massive response by government without the U.S. system first being turned upside down. The forces holding down civilian government spending are too strong to be affected by anything but a major upsurge in society.

Of course, the history of U.S. capitalism since the Second World War might suggest that the most likely recourse of those in charge in these dire circumstances would be to attempt to stimulate the economy through an extraordinary increase in military spending. That the incoming Obama administration has already announced plans to maintain the current war budget and expand the war in Afghanistan only fuels this concern.13 For this reason it is imperative for the left to redouble its efforts to oppose militarism and demand that resources be put to civilian use.

At the same time, the notion that military spending can provide an effective economic stimulus under present circumstances is dubious, even to sectors of the ruling class. For starters, U.S. military spending is already at active-war levels and accounts for half (or more) of global military spending. One would arguably have to return to ancient Rome to find a comparable situation of military dominance. This is not 1939–41 where U.S. military spending had to be built up virtually from scratch. To double or triple military spending at this point would mean that the United States would be spending two or three times as much as the rest of the world on war and war preparation (assuming that other nations maintained their current levels of military spending). This would be politically difficult, both globally, with the other major powers that the United States needs to work with already alarmed by U.S. unilateralism, and domestically, where even the lapdog U.S. news media would have difficulty explaining the rationale for diverting more of the economy to militarism as the quality of life crumbles.

Perhaps most important, the notion that increased military spending would effectively stimulate the balance of the economy has been repudiated by economists, even within the mainstream, who note that marginal increases in “defense” expenditures have far less of a positive employment impact than most civilian government spending, given the technology-intensive nature of modern military spending and the fact that a very large share of the purchases take place abroad.

Hence, the main impact of a doubling of U.S. military spending would be to increase greatly the likelihood of bigger and wider wars, and the destruction of human civilization. As C. Wright Mills wrote, “the immediate cause of World War III is the military preparation of it.”14 Even members of the ruling class may balk in the face of the threat of a rising recourse to war and war preparation in an age of nuclear proliferation.

If we are right on this, and we hope we are, then government spending increases in response to this crisis will be mainly a question of expanding civilian expenditures. Such spending will, initially, be dedicated primarily to salvage or bailout operations. These salvage efforts, so crucial to capital, will be legitimated by smaller public works programs directed at the underlying population. Government spending increases as a whole will in the main be conceived as temporary, pump-priming measures rather than permanent increases in the level of government. Although federal spending increases are likely to loom large in budgetary terms, they are unlikely to come anywhere near compensating for the declines in consumption, investment, and state and local government spending. With the economy as a whole drying up like a sponge, a great deal of government spending designed to float the sponge to higher levels of income will likely be absorbed, as in the 1930s, by the sponge itself, leaving little visible effect. Consequently, recovery will be held down, and the economy, already deeply mired in problems of stagnation and financial de-leverage, will continue to be weak.15

A return to the kind of social programs associated with the real or second New Deal can be expected to come, if at all, only later, after the initial salvage effort. Moreover, this is unlikely to materialize to any considerable extent apart from a revolt from below on the scale at least of the mid-1930s. Labor must rise again from its ashes. Only a very radical shift in U.S. politics resulting from a major groundswell from below will be able significantly to budge the ceiling on civilian government spending.

Under these circumstances, it is the specific responsibility of the left to urge not only the militant organization of the underlying population, but also the kinds of change, going against the logic of the system and relying on an expansion of government, that will contribute substantially to bettering the conditions of those at the bottom. In terms of demands this should include, for starters, that: (1) government assume the responsibility for providing useful work at a livable wage to all who need it, utilizing existing skills; (2) unemployment compensation be extended beyond its present inadequate limits; (3) those in danger of losing their homes be granted government assistance; (4) a crash housing program be initiated on behalf of those who are homeless or wretchedly housed (including mortgage relief and support to renters); (5) a truly progressive tax system, incorporating a wealth tax, be established; (6) food stamps and food programs for the poor be expanded along with other welfare provisions and easier access; (7) national health insurance (a single-payer system) be provided for the entire population; (8) pension funds be guaranteed by government; (9) Social Security be augmented and regressive payroll taxes eliminated; (10) restrictive laws on unionization be removed; (11) the federal minimum wage be raised; (12) a thirty-hour working week be introduced; (13) a nationwide program of mass transit be promoted; (14) publicly owned and controlled communications systems be greatly enlarged and extended throughout the nation; (15) public education funding be enormously elevated; and (16) environmental protection be vastly increased, in line with the ecological revolution now necessary to save the planet.16

Of course, given the existing power structure of U.S. society and the seven-decades-long ceiling on civilian government purchases as a percentage of GDP, all of this may appear to be pie in the sky. And our message is that it is, unless the power structure of U.S. society can be altered. Only a reform movement so radical that it would appear revolutionary within the context of the existing U.S. economic and social order, fundamentally reducing the field of operation of the capitalist market, holds any chance of substantially improving the conditions of most people in society. Needless to say, for such a struggle to succeed people will have to have a sense of real things to struggle for that will materially affect their lives.

These gains will only be made through an enormous class struggle from below. If won, they will not, we underscore, eliminate the evils of capitalism, or the dangers it poses for the world and its people. In the end, there is no real answer but to remove brick by brick the capitalist system itself, rebuilding the entire society on socialist principles. This is something that the great majority of the population will undoubtedly learn in the course of their struggles for a more equal, more humane, more collective, and more sustainable world. In the meantime, it is time to begin to organize a revolt against the ruling class–imposed ceiling on civilian government spending and social welfare in U.S. society.

—December 21, 2008

Notes:

- ↩ The question of a “new New Deal” in the face of the deepening stagnation of U.S. capitalism is not a new one. See Harry Magdoff and Paul M. Sweezy, “A New New Deal?,” Monthly Review 33, no. 9 (February 1982), 1–10. On the present economic crisis see John Bellamy Foster and Fred Magdoff, The Great Financial Crisis (New York: Monthly Review Press, 2008).

- ↩ Associated Press, “Obama Team Weighs Up to $850 billion Economic Jolt,” December 18, 2008.

- ↩ Alvin H. Hansen, Fiscal Policy and Business Cycles (New York: W.W. Norton, 1941), 85–87.

- ↩ David Milton, The Politics of Labor: From the Great Depression to the New Deal (New York: Monthly Review Press, 1982).

- ↩ Harry Magdoff and Paul M. Sweezy, “The Responsibility of the Left,” Monthly Review 34, no. 7 (December 1982), 6–9;Nick Taylor, American-Made (New York: Bantam, 2008); “FDR’s New Deal Blueprint for Obama,” CBS News, December 14, 2008, http://www.cbsnews.com.

- ↩ Allan H. Meltzer, A History of the Federal Reserve, vol. 1(Chicago: University of Chicago Press, 2003), 521; Dean L. May, From New Deal to New Economics (New York: Garland, 1981), 91–113, 122; Hansen, Fiscal Policy and Business Cycles, 88. Partly in response to the recession of 1937, Social Security was put on a “pay as you go” basis.

- ↩ May, From New Deal to New Economics, 147–48; John Kenneth Galbraith, Money: Whence It Came, Where it Went (Boston: Houghton Mifflin, 1995), 232–36; Richard V. Gilbert, George H. Hildebrand, Jr., Arthur W. Stuart, Maxine Y. Sweezy, Paul M. Sweezy, Lorrie Tarshis, and John D. Wilson, An Economic Program for American Democracy (New York: Vanguard Press, 1938). There were other authors of An Economic Program for American Democracy, who were not able to sign it for various reasons, such as government jobs, including Alan Sweezy and Emile Despres. “Interview of Paul M. Sweezy,” The Coming of Keynesianism to America, ed., David C Collander and Harry Landreth (Brookfield, Vermont: Edward Elgar, 1996), 81.

- ↩ John Kenneth Galbraith, American Capitalism (Boston: Houghton Mifflin, 1952), 69.

- ↩ Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966), 151–61.

- ↩ Baran and Sweezy, Monopoly Capital, 164.

- ↩ These two categories of government spending are referred to as exhaustive and nonexhaustive expenditures. On this see Francis M. Bator, A Question of Government Spending (New York: Collier Books, 1960), 17–46. On the construction of OECD accounts see François Lequiller and Derek Blades, Understanding National Accounts (Paris: Organisation of Economic Co-operation and Development, 2006).

- ↩ See John Bellamy Foster, Hannah Holleman, and Robert W. McChesney, “The U.S. Imperial Triangle and Military Spending,” Monthly Review 60, no. 5 (October 2008): 9–13; Bureau of Economic Analysis, National Income and Product Accounts, Table 3.9.5.

- ↩ “A Fighter Jet’s Fate Poses a Quandary for Obama,” New York Times, December 10, 2008.

- ↩ C. Wright Mills, The Causes of World War Three (New York: Simon and Schuster, 1958), 85.

- ↩ It should be pointed out that the other G-7 countries (and Sweden) referred to here face analogous problems, starting out at higher levels of government spending as a percentage of GDP. They too are caught in the stagnation trap and could use increases in government spending to lift their economies, but face powerful class forces at the top of the society that limit the magnitude and direction of such spending.

- ↩ See Harry Magdoff and Paul M. Sweezy, “The Coming Crisis and the Responsibility of the Left,” Monthly Review 39, no. 2 (June 1987): 5.

Comments are closed.