Five years after the Great Financial Crisis of 2007–09 began there is still no sign of a full recovery of the world economy. Consequently, concern has increasingly shifted from financial crisis and recession to slow growth or stagnation, causing some to dub the current era the Great Stagnation.1 Stagnation and financial crisis are now seen as feeding into one another. Thus IMF Managing Director Christine Lagarde declared in a speech in China on November 9, 2011, in which she called for the rebalancing of the Chinese economy:

The global economy has entered a dangerous and uncertain phase. Adverse feedback loops between the real economy and the financial sector have become prominent. And unemployment in the advanced economies remains unacceptably high. If we do not act, and act together, we could enter a downward spiral of uncertainty, financial instability, and a collapse in global demand. Ultimately, we could face a lost decade of low growth and high unemployment.2

To be sure, a few emerging economies have seemingly bucked the general trend, continuing to grow rapidly—most notably China, now the world’s second largest economy after the United States. Yet, as Lagarde warned her Chinese listeners, “Asia is not immune” to the general economic slowdown, “emerging Asia is also vulnerable to developments in the financial sector.” So sharp were the IMF’s warnings, dovetailing with widespread fears of a sharp Chinese economic slowdown, that Lagarde in late November was forced to reassure world business, declaring that stagnation was probably not imminent in China (the Bloomberg.com headline ran: “IMF Sees Chinese Economy Avoiding Stagnation.”)3

Nevertheless, concerns regarding the future of the Chinese economy are now widespread. Few informed economic observers believe that the current Chinese growth trend is sustainable; indeed, many believe that if China does not sharply alter course, it is headed toward a severe crisis. Stephen Roach, non-executive chairman of Morgan Stanley Asia, argues that China’s export-led economy has recently experienced two warning shots: first the decline beginning in the United States following the Great Financial Crisis, and now the continuing problems in Europe. “China’s two largest export markets are in serious trouble and can no longer be counted on as reliable, sustainable sources of external demand.”4

In order to avoid looming disaster, the current economic consensus suggests that the Chinese economy needs to rebalance its shares of net exports, investment, and consumption in GDP—moving away from an economy that is dangerously over-reliant on investment and exports, characterized by an extreme deficiency in consumer demand, and increasingly showing signs of a real estate/financial bubble. But the very idea of such a fundamental rebalancing—on the gigantic scale required—raises the question of contradictions that lie at the center of the whole low-wage accumulation model that has come to characterize contemporary Chinese capitalism, along with its roots in the current urban-rural divide.

Giving life to these abstract realities is the burgeoning public protest in China, now consisting of literally hundreds of thousands of mass incidents a year—threatening to halt or even overturn the entire extreme “market-reform” model.5 China’s reliance on its “floating population” of low-wage internal migrants for most export manufacture is a source of deep fissures in an increasingly polarized society. And connected to these economic and social contradictions—that include huge amounts of land seized from farmers—is a widening ecological rift in China, underscoring the unsustainability of the current path of development.

Nor are China’s contradictions simply internal. The complex system of global supply chains that has made China the world’s factory has also made China increasingly dependent on foreign capital and foreign markets, while making these markets vulnerable to any disruption in the Chinese economy. If a severe Chinese crisis were to occur it would open up an enormous chasm in the capitalist system as a whole. As the New York Times noted in May 2011, “The timing for when China’s growth model will run out of steam is probably the most critical question facing the world economy.”6 More important than the actual timing, however, are the nature and repercussions of such a slowdown.

Capitalist Contradictions with Chinese Characteristics

For many the idea that the Chinese economy is rife with contradictions may come as something as a surprise since the hype on Chinese growth has expanded more rapidly than the Chinese economy itself. As the Wall Street Journal sardonically queried in July 2011, “When exactly will China take over the world? The moment of truth seems to be coming closer by the minute. China will become the largest economy by 2050, according to HSBC. No, its 2040, say analysts at Deutsche Bank. Try 2030, the World Bank tells us. Goldman Sachs points to 2020 as the year of reckoning, and the IMF declared several weeks ago that China’s economy will push past America’s in 2016.” Not to be outdone, Harvard historian Niall Ferguson declared in his 2011 book, Civilization: The West and the Rest,that “if present rates persist China’s economy could surpass America’s in 2014 in terms of domestic purchasing power.”7

This prospect is generally viewed with unease in the old centers of world power. But at the same time the new China trade is an enormous source of profitability for the Triad of the United States, Europe, and Japan. The latest round of rapid growth that has enhanced China’s global role was an essential component of the recovery of global financialized capitalism from the severe crisis of 2007–09, and is counted on in the future.

There are clearly some who fantasize, in today’s desperate conditions, that China can carry the world economy on its back and keep the developed nations from what appears to be a generation of stagnation and intense political struggles over austerity politics.8 The hope here undoubtedly is that China could provide capitalism with a few decades of adequate growth and buy time for the system, similar to what the U.S.-led debt and financial expansion did over the past thirty years. But such an “alignment of the stars” for today’s world capitalist economy, based on the continuation of China’s meteoric growth, is highly unlikely.

“Let’s not get carried away,” the Wall Street Journal cautions us. “There’s a good deal of turmoil simmering beneath the surface of China’s miracle.” The contradictions it points to include mass protests (rising to as many as 280,000 in 2010), overinvestment, idle capacity, weak consumption, financial bubbles, higher prices for raw materials, rising food prices, increasing wages, long-term decline in labor surpluses, and massive environmental destruction. It concludes, “If nothing else, the colossal challenges that lie ahead for China provide an abundance of good reasons to doubt long-term projections of the country’s economic supremacy and global dominance.” The immediate future of China is therefore uncertain, throwing added uncertainty on the entire global economy. As we shall see, not only might China not bail out global capitalism at present, an argument can be made that it constitutes the single weakest link for the global capitalist chain.9

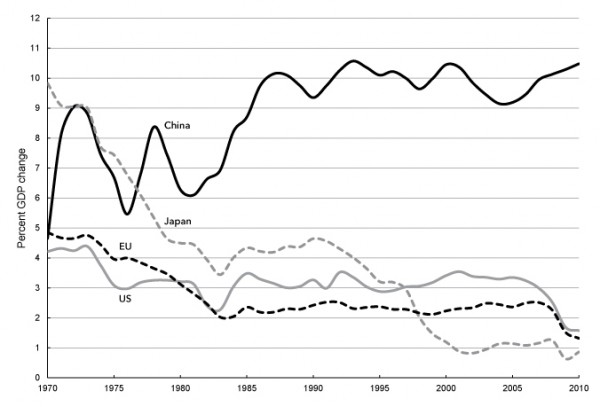

At question is the extraordinary rate of Chinese expansion, especially when compared with the economies of the Triad. The great divergence in growth rates between China and the Triad can be seen in Chart 1 (below), showing ten-year moving averages of annual real GDP growth for the United States, the European Union, and Japan, from 1970 to 2010. While the rich economies of the United States, Western Europe, and Japan have been increasingly prone to stagnation—overcoming this in 1980–2006 only by means of a series of financial bubbles—China’s economy over the same period (beginning in the Mao era) has continually soared. China managed to come out of the Great Financial Crisis period largely unaffected with a double-digit rate of growth, at the same time that what The Economist has dubbed “the moribund rich world” was laboring to achieve any positive growth at all.10

Chart 1. Change in Real GDP, 1970–2010 (Ten-Year Moving Average of Percent Change From Previous Year)

Sources: WDI database for China, Japan, and the European Union (http://databank.worldbank.org) and St. Louis Federal Reserve Database (FRED) for the United States (http://research.stlouisfed.org/fred2/).

To give a sense of the difference that the divergence in growth rates shown in Chart 1 makes with respect to exponential growth, an economy growing at a rate of 10 percent will double in size every seven years or so, while an economy growing at 2 percent will take thirty-six years to double in size, and an economy growing at 1 percent will take seventy-two years.11

The economic slowdown in the developed, capital-rich economies is long-standing, associated with deepening problems of surplus capital absorption or overaccumulation. As the New York Times states, “Mature countries like the United States and Germany are lucky to grow about 3 percent annually”—indeed, today we might say lucky to grow at 2 percent. Japan’s growth rate has averaged less than 1 percent over the period 1992 to 2010. As Lagarde noted in a speech in September 2011, according to the latest IMF projections, “the advanced economies will only manage an anemic 1 1/2-2 percent” growth rate over the years 2011–12. China, in contrast, has been growing at 10 percent.12

The problems of the mature economies are complicated today by two further features: (1) the heavy reliance on financialization to lift the economy out of stagnation, but with the consequence that the financial bubbles eventually burst, and (2) the shift towards the corporate outsourcing of production to the global South. World economic growth in recent decades has gravitated to a handful of emerging economies of the periphery; even as the lion’s share of the profits derived from global production are concentrated within the capitalist core, where they worsen problems of maturity and stagnation in the capital-rich economies.13

As the structural crisis within the center of the capitalist world economy has deepened, the hope has been raised by some that China will serve to counterbalance the tendency toward stagnation at the global level. However, even as this hope has been raised it has been quickly dashed—as it has become increasingly apparent that cumulative contradictions are closing in on China’s current model, producing growing panic within world business.

Ironically, today’s fears regarding the Chinese economy stem in part from the way China engineered its way out of the global slump brought on by the Great Financial Crisis—a feat that was regarded initially by some as conclusive proof that China had “decoupled” itself from the West’s fate and represented an unstoppable growth machine. Faced with the world crisis and declining foreign trade, the Chinese government introduced a massive $585 billion stimulus plan in November 2008, and urged state banks aggressively to make new loans. Local governments in particular ran up huge debts associated with urban expansion and real estate speculation. As a result, the Chinese economy rebounded almost instantly from the crisis (in a V-shaped turnaround). The growth rate was 7.1 percent in the first half of 2009 with state-directed investments estimated as accounting for 6.2 percentage points of that growth.14 The means of accomplishing this was an extraordinary increase in fixed investment, which served to fill the gap left by falling exports.

This can be seen in Table 1, which shows the percent contribution to China’s GDP of consumption, investment, government, and trade (net exports). The sharp increase in investment as a share of GDP, which rose 7 percentage points between 2007–10, mirrored the sharp decrease in the share of both trade and consumption over the same period, which dropped 5 and 2 percentage points, respectively. Meanwhile, the share of government spending in GDP remained steady. Investment alone now constitutes 46 percent of GDP, while investment plus trade equals 52 percent.

Table 1. Percent Contribution to China’s GDP, 2002–2010

|

A |

B |

C |

D |

B+D |

|

|

Consumption |

Investment |

Government |

Trade |

Investment |

|

|

2002 |

44.0 |

36.2 |

15.6 |

4.2 |

40.4 |

|

2003 |

42.2 |

39.1 |

14.7 |

4.0 |

43.1 |

|

2004 |

40.6 |

40.5 |

13.9 |

5.1 |

45.6 |

|

2005 |

38.8 |

39.7 |

14.1 |

7.4 |

47.1 |

|

2006 |

36.9 |

39.6 |

13.7 |

9.7 |

49.3 |

|

2007 |

36.0 |

39.1 |

13.5 |

11.4 |

50.5 |

|

2008 |

35.1 |

40.7 |

13.3 |

10.9 |

51.6 |

|

2009 |

35.0 |

45.2 |

12.8 |

7.0 |

52.2 |

|

2010 |

33.8 |

46.2 |

13.6 |

6.4 |

52.6 |

Sources: Pettis, “Lower Interest Rates, Higher Savings?” http://www.financialsense.com, October 16, 2011; China Statistical Yearbook.

As Michael Pettis, a professor at Peking University’s Guanghua School of Management and a specialist in Chinese financial markets, explained, the sharp drop in the trade surplus in the crisis might “have forced GDP growth rates to nearly zero.” However, “the sudden and violent expansion in investment” served as “the counterbalance to keep growth rates high.” Of course behind the dramatic ascent of the investment share of GDP, rising 10 percentage points during the years 2002–10, lay the no less dramatic descent of the consumption share, which dropped 10 perentage points over the same period, from 44 percent to 34 percent, the smallest share of any large economy.15

With investment spending running at close to 50 percent in this period the Chinese economy is facing widening overaccumulation problems. For New York University economist Nouriel Roubini:

The problem, of course, is that no country can be productive enough to reinvest 50% of GDP in new capital stock without eventually facing immense overcapacity and a staggering non-performing loan problem. China is rife with overinvestment in physical capital, infrastructure, and property. To a visitor, this is evident in sleek but empty airports and bullet trains (which will reduce the need for the 45 planned airports), highways to nowhere, thousands of colossal new central and provincial government buildings, ghost towns, and brand-new aluminum smelters kept closed to prevent global prices from plunging.

Commercial and high-end residential investment has been excessive, automobile capacity has outstripped even the recent surge in sales, and overcapacity in steel, cement, and other manufacturing sectors is increasing further…. Overcapacity will lead inevitably to serious deflationary pressures, starting with the manufacturing and real-estate sectors.

Eventually, most likely after 2013, China will suffer a hard landing. All historical episodes of excessive investment—including East Asia in the 1990’s—have ended with a financial crisis and/or a long period of slow growth.16

Overinvestment has been accompanied by increasing financial frailty raising the question of a “China Bubble.” The government’s fixed investment stimulus worked in part through encouragement of massive state bank lending and a local borrowing binge, resulting in further speculative boom centered primarily on urban real estate. China’s urban expansion currently consumes half of the world’s steel and concrete production as well as much of its heavy construction equipment. Construction accounts for about 13 percent of China’s GDP.

Although insisting that the bursting of China’s “big red bubble” still is “ahead of us,” Forbes magazine cautioned its readers in 2011 that “China’s real estate bubble is multiplying like a contagious disease,” asking: “China’s housing market: when will it pop, and how loud of an explosion will it make when it goes boom?” But for all of that, Forbes added reassuringly that “China’s property bubble is different,” since it is all under the watchful eyes of state banks that operate like extensions of government departments.

This notion of a visionary and wise Chinese state that can demolish any obstacles put before the economy on its current path, is the corollary of the notion that the Chinese economy as it now exists will grow at double-digit annual rates far into the future. It is an illusion—or delusion. The Chinese model of integration into global capitalism contains contradictions that will obstruct its extension.

This is certainly true in finance. While Forbes is hopeful, the Financial Times reports something quite different. State banks, supposedly at the center of the financial system, have been hemorrhaging in the last few years due to the loss of bank deposits to an unregulated shadow banking system that now supplies more credit to the economy than the formal banking institutions do. Indicative of a shift toward Ponzi finance, the most profitable activity of state banks is now loaning to the shadow banking system. A serious real estate downturn began in August 2011 when China’s top ten property developers reported that they had unsold inventories worth $50 billion, an increase of 46 percent from the previous year. Property developments are highly leveraged and developers have become increasingly dependent on underground (shadow) lenders, who are demanding their money. As a result, prices on new apartments have been slashed by 25 percent or more, reducing the value of existing apartments. China in late 2011 was experiencing a significant property price downturn, with sharp drops in home prices, which had risen by 70 percent since 2000.

Mizuho Securities Asia bank analyst Jim Antos, a close observer of the sector, estimated in July 2011 that bank lending doubled between December 2007 and May 2011, and although the rate of increase has declined over the last year, it remains far higher than the growth in GDP. As a result, Antos calculates that bank loans stood at $6,500 per capita in 2010 compared to GDP per capita of $4,400, and that the disproportion continues to increase, a situation he terms “unsustainable.” In addition there are unknown amounts of off-balance-sheet loans, and the current reporting of non-performing loans at 1 percent of total loans only serves to guarantee a sharp increase in this rate in the near future by 100 percent and up. Antos and other observers have noted that the banks’ capitalization was inadequate even prior to the break in real estate prices. Despite the vast financial resources that the Chinese government has in its role as lender of last resort, a sharp decline in real estate prices and in construction, and therefore in GDP, would produce a full-blown crisis of market confidence in a situation marked by great uncertainty and fear.17

Already in 2007 Chinese Premier Wen Jiabao declared that China’s economic model was “unstable, unbalanced, uncoordinated and ultimately unsustainable.” Five years later this is now more obvious than ever. The most intractable problem, the root cause of instability, is the low and declining share of GDP devoted to household consumption, which has dropped around 11 percentage points in a decade, from 45.3 percent of GDP in 2001 to 33.8 percent in 2010. All the calls for rebalancing thus boil down to the need for a massive increase in the share of consumption in the economy.

Such rebalancing has been a major goal of the Chinese government since 2005, and there is no shortage of proposals on how to accomplish it. But they all founder in the face of the underlying reality. As Michael Pettis states: “Low consumption levels are not an accidental coincidence. They are fundamental to the growth model.” First among the relevant factors is the (super)exploitation of workers in the new export sectors, where wages grow slowly while productivity with advanced technology grows rapidly. The rise in wages necessary to yield an increase in consumption as a share of GDP would drive the large foreign-owned assembly plants to countries with lower wages. And the surrounding penumbra of small- and middle-scale plants run by Chinese capitalists would also begin to disappear, squeezed by tightening credit and already increasingly prone to embezzlement and flight.18

The declining share of consumption in GDP is sometimes attributed to China’s high savings rate, largely associated with the attempts by people to put aside funds to safeguard their future due to the lack of national safety net. Between 1993 and 2008 more than 60 million state sector jobs were lost, the majority through layoffs due to the restructuring of state-owned enterprises beginning in the 1990s. This represented a smashing of the “iron rice bowl” or the danwei system of work-unit socialism that had provided guarantees to state-enterprise workers.19 Social provision in such areas as unemployment compensation, social insurance, pensions, health care, and education have been sharply reduced. As Minxin Pei, senior associate in the China Program at the Carnegie Endowment for International Peace, has written:

Official data indicate that the government’s relative share of health-care and education spending began to decline in the 1990s. In 1986, for example, the state paid close to 39 percent of all-health care expenditures…. By 2005, the state’s share of health-care spending fell to 18 percent…. Unable to pay for health care, about half of the people who are sick choose not to see a doctor, based on a survey conducted by the Ministry of Health in 2003. The same shift has occurred in education spending. In 1991, the government paid 84.5 percent of total education spending. In 2004, it paid only 61.7 percent…. In 1980, almost 25 percent of the middle-school graduates in the countryside went on to high school. In 2003, only 9 percent did. In the cities, the percentage of middle-school graduates who enrolled in high school fell from 86 to 56 percent in the same period.20

The growing insecurity arising from such conditions has compelled higher savings on the part of the relatively small proportion of the population in a position to save.

However, the more fundamental cause for rapidly weakening consumption is growing inequality, marked by a falling wage share and declining incomes in a majority of households. As The Economist magazine put it in October 2007, “The decline in the ratio of consumption to GDP does not reflect increased saving; instead, it is largely explained by a sharp drop in the share of national income going to households (in the form of wages, government transfers and investment income). Most dramatic has been the fall in the share of wages in GDP. The World Bank estimates that this has dropped from 53 percent in 1998 to 41 percent in 2005.”21

The core contradiction thus lies in the extreme form of exploitation that characterizes China’s current model of class-based production, and the enormous growth of inequality in what was during the Mao period one of the most egalitarian societies. Officially the top 10 percent of urban Chinese today receive about twenty-three times as much as the bottom 10 percent. But if undisclosed income is included (which may be as much as $1.4 trillion dollars annually), the top 10 percent of income recipients may be receiving sixty-five times as much as the bottom 10 percent.22 According to the Asian Development Bank, China is the second most unequal country in East Asia (of twenty-two countries studied), next to Nepal. A Boston Consulting Group study found that China had 250,000 U.S. dollar millionaire households in 2005 (excluding the value of primary residence), who together held 70 percent of the country’s entire wealth. China is a society that still remains largely rural, with rural incomes less than one-third those in cities. The majority of workers in export manufacturing are internal migrants still tied to the rural areas, who are paid wages well below those of workers based in the cities.23

China’s “Opening” and the Global Supply Chain

Today’s Chinese economy is a product of both the Chinese Revolution of 1949 and of what William Hinton called “The Great Reversal,” or what is more often referred to as the “reform period,” which began in 1978 under Deng Xiaoping, two years after Mao Zedong’s death. The Chinese Revolution introduced a massive land reform, the greatest in history, expropriating the land from the landlord class and creating a system of collective agriculture. Industry, meanwhile, came to be dominated by state enterprises. The twofold system of worker rights took the form of what Hinton called the “clay rice bowl” in the countryside, which guaranteed peasants a permanent relation to the land as usufruct, or user rights, organized in the form of collective agriculture; while workers in state enterprises benefitted from the “iron rice bowl” or a system of guaranteed lifetime jobs and benefits. (There was also what was called a “golden rice bowl,” representing the privileges of state bureaucrats.)24

Economic growth in the Mao period was impressive, despite periodic setbacks and internal struggle that developed within the Party itself (culminating in the Cultural Revolution). Economic growth during the entire 1966–76 period reached an annual average rate of 6 percent according to World Bank data, while industrial production grew at an annual average rate of around 10 percent. An immense industrial infrastructure, both heavy and light, was created virtually from scratch in these years, complete with a transportation and power network, that by the end of the Mao period employed 100 million people. This then was exploited in the market-reform period that followed. The output of Chinese agriculture was improved during the Cultural Revolution period and productivity reached remarkable levels. As Mark Selden, then coeditor of the Bulletin of Concerned Asian Scholars, wrote, “In 1977 China grew 30 to 40 percent more food per capita [than India] on 14 percent less arable land and distributed it far more equitably to a population…50 percent larger.”25

The market reforms associated with the Great Reversal were aimed at eliminating or expropriating collective agriculture and state enterprises, while proletarianizing the population by weakening both the iron rice bowl and the clay rice bowl, i.e., the economic gains made by peasants and workers in the revolution. In the countryside, collective farms were broken up and replaced with a family contract system. The land was divided into strips (still allocated by the collective) to which peasants had user rights. Each noodle-like strip of land was small and made working the land less efficient, providing a very marginal existence for peasant families. As Hinton wrote: “This was not ‘postage stamp’ land such as used to exist before land reform, but ‘ribbon land,’ ‘spaghetti land,’ ‘noodle land’—strips so narrow that often not even the right wheel of a cart could travel down one man’s land without the left wheel pressing down on the land of another.”26

Although some left analysts of China’s development, such as world-system theorist Giovanni Arrighi, have called China a case of “accumulation without dispossession,” the market reform period was in fact characterized from the start by massive accumulation by dispossession (primitive accumulation), and hundreds of millions of people were proletarianized.27 As geographers Richard Walker and Daniel Buck succinctly explained in New Left Review in 2007:

There are three major routes to proletarianization in China: from the farming countryside, out of collapsing state companies in the cities, and through the dissolution of former village enterprises. To take the first of these: rural displacement to the cities is vast, numbering roughly 120 million since 1980—the largest migration in world history. The abolition of the communes and instigation of the household responsibility system allowed some farmers to prosper in the richest zones, but it has left marginal producers increasingly exposed to low price, poor soils, small plots, lack of inputs, and the corruption of predatory local cadres. In the cities, peasant migrants do not have residency rights and become long-term transients. This is due to the household registration or hukou system, created in the Maoist era to limit rural-to urban migration….

A second route into the new wage-labour class is out of state owned enterprises (SOEs). These were the centerpiece of Maoist industrialization, accounting for nearly four-fifths of non-agricultural production. Most are in the cities, where they employed 70 million people in the 1980s. This form of employment has been steadily dismantled, starting with a law that allowed temporary hire without social protection [i.e. minus the iron rice bowl] and a 1988 bankruptcy law terminating workers’ guarantee of lifelong employment…. Most decisive was the massive layoffs at the end of the 1990s…. By the early 2000s employment in state-owned enterprises had halved, from 70 to 33 per cent of the urban workforce, with some 30 to 40 million workers displaced.

Finally, a transition to wage-labour followed from the collapse of rural township and village enterprises (TVEs). These flourished in the wake of the dissolution of the communes, with the first phase of liberalization in the early 1980s, especially in Guangdong, Fujian, and around Tianjin and Shanghai. By the early 1990s, they had mushroomed to 25 million firms, employing well over 100 million people—with as much as 40 percent of the total manufacturing output. Owned and operated by local governments, they usually embodied socialist obligations to provide jobs, wages and social benefits to villagers, and to support agriculture and rural infrastructure. Many worked as subcontractors to urban state enterprises. Hence, when many lead-firm SOEs went bankrupt in the 1990s or found more cost-effective suppliers, thousands of TVEs were left in the lurch…. As these small enterprises imploded, millions of workers were stranded. The result has been a two-stage incorporation of peasants into the proletariat, first as TVE workers nominally protected by the obligations of local government, then as proletarians subject to the full force of the market—Marx’s shift from “formal” to “real” subsumption of labor.28

More recently, as we shall see in a later section of the paper, the robbing of many peasants (indeed entire villages) of the small plots that were allocated at the time of the breaking up of the collectives in the early 1980s, has now accelerated into a national struggle, leading to massive rural protests.

The privatization of state assets and the robbing of state enterprises have produced enormous wealth at the top in China, with the leading capitalists obtaining their wealth through cronyism. More than 90 percent of those in the richest 20,000 people in China are said to be “related to senior government or Communist Party officials,” creating a whole class of millionaire and billionaire “princelings,” the offspring of top officials.29 In addition, land expropriated from farmers for sale to developers has enriched an untold number of local officials.

The market reforms included what Deng called an “open door” policy, in which China put out the welcome sign for multinational corporations—in sharp contrast to other East Asian nations like South Korea, which at a similar stage in its development placed heavy restrictions on foreign direct investment in industry. Production in China was increasingly geared to exports of manufactured goods associated with the supply chains of Triad-based multinational corporations. China was the second biggest recipient of foreign direct investment in the world in 2009, after the United States. According to a 2006 report by the Development Research Center of the State Council (China’s cabinet), foreign capital (concentrated in the export sector) controlled 82 percent of market share in communications, calculator, and related electronics; 72 percent in instrumentation products, cultural, and office machinery; 48 percent in textile apparel, footwear, and hats; 49 percent in leather, fur, feather, and related industries; 51 percent in furniture; 60 percent in educational and sports products; 41 percent in plastics; and 42 percent in transport equipment.30

As indicated by Shaun Breslin, professor of politics and international studies at the University of Warwick, after factoring in re-exports through Hong Kong and elsewhere, roughly 30 percent of all exports from China in 1996–2005 ended up in the United States; about 26 percent in Japan; and around 16 percent in the European Union. Others, in determining the effects of re-exports, have estimated the U.S. share of China’s exports even higher, at 50 percent.31

In the complex global supply lines of multinational corporations, China primarily occupies the role of final assembler of manufactured goods to be sold in the rich economies. Export manufacturing is directed not at the actual production of goods, but at commodity assembly using parts and components produced elsewhere and then imported to China. The final commodity is then shipped from China to the developed economies.

China is the world’s biggest supplier of final information, communications, and technology goods, and multinational corporations accounted for about 87 percent of China’s high-tech exports at the beginning of 2006. But, the parts and components for these high-tech goods are almost all imported to China by multinationals for assembly prior to their export via multinationals to the markets within the Triad.32 Consequently, most of the costs of goods associated with exports from China typically do not represent value captured by the Chinese economy. According to the Federal Reserve Bank of San Francisco, “In 2009, it cost about $179 in China to produce an iPhone, which sold in the United States for about $500. Thus, $179 of the U.S. retail cost consisted of Chinese imported content. However, only $6.50 was actually due to assembly costs in China. The other $172.50 reflected costs of parts produced in other countries.”33

Within the East Asia region as a whole, China’s is the final production platform, with other East Asian nations, like Japan, South Korea, and Singapore producing the parts and components. China’s imports of parts and components increased almost twenty four times in 1992–2008, while its final goods trade increased only around twelve times in the same period. In 2009, 17 percent of its parts and components imports came from Japan, 17 percent from South Korea, 15 percent from the ASEAN6 (Brunei, Indonesia, Malaysia, Philippines, Singapore, and Thailand), 10 percent from Europe, and 7 percent from North America. Hence, it is not so much China that is the producer of electronic goods and information, communication, and technology products, but rather East Asia as a whole, within a global supply chain still dominated by multinational corporations within the Triad.34

The Chinese economy today is thus structured around the offshoring needs of multinational corporations geared to obtaining low unit labor costs by taking advantage of cheap, disciplined labor in the global South, a process known as “global labor arbitrage.” In this global supply-chain system, China is more the world-assembly hub than the world factory.

In an article written in 1997, Jin Bei, head of the Research Group for a Comparative Study of the International Competitiveness of China’s Manufactured Goods, Chinese Academy of Sciences, contended that most goods being exported from China were not Chinese domestically manufactured goods, but rather should be identified as “para-domestically manufactured goods” reflecting a supply chain under the control of foreign multinationals. “Foreign partners,” he wrote,

obtain the bulk of the direct economic benefits from manufactured goods turned out by wholly foreign-owned businesses and Sino-foreign joint ventures in which they have controlling shares. Such goods do not primarily involve the actualization of China’s productive forces, but the actualization of foreign productive forces in China, or the economic actualization achieved by turning Chinese resources into productive forces subject to the control of foreign capital owners. These goods should not, therefore, be identified in principle as manufactured goods made in China…. For example of the ten top brands of shirts in the world, seven are produced by the Beijing Shirt Factory, yet for producing a shirt bearing the Pierre Cardin label that retails for 300 yuan, the factory only receives three to four yuan in processing fees. How can these shirts be convincingly identified as Chinese-made?35

In order to illustrate the effects of global supply chains it is useful to look at the famous example of Barbie and the world economy. A Barbie doll (“My First Tea Party Barbie”) marketed in California in 1996 sold at a price of $9.99 and was labeled “Made in China.” Nearly all of the raw materials and parts that made up the doll, however, were imported, while Chinese workers put together the final Barbie. (At the time there were two Barbie factories in China and one each in Indonesia and Malaysia.) Each factory in China employed around 5,500 workers. Most of the plastic resin in the form of pellets or “chips” was probably imported via the Chinese Petroleum Corporation, Taiwan’s state-owned oil importer. The nylon hair came from Japan. The cardboard packaging and many of the paint pigments and oils used for decorating the dolls came from the United States. Only the cotton cloth for Barbie’s dress came from China, which otherwise simply supplied labor to assemble the dolls. The workers operated the plastic mold-injection machines, painted the details on the doll (requiring fifteen different paint stations), and sewed the clothing. Workers were paid around $40 a month. The total labor cost for each Barbie was a mere 35 cents, or 3.5 percent of the final retail price.36

In 2008 Chinese manufacturing workers on average, according to the U.S. Bureau of Labor Statistics, received only 4 percent of the wage compensation of manufacturing workers in the United States. Hence, the added margin of profit to be obtained by producing in China (with the same technology) instead of the United States or other developed countries can be enormous. Chinese workers that assemble iPhones for Foxconn, which subcontracts for Apple, are paid wages that only represent 3.6 percent of the final total manufacturing cost (shipping price), contributing to Apple’s huge 64 percent gross profit margin over manufacturing cost on iPhones, according to the Asian Development Bank.37

Work under these conditions, especially if it involves migrant labor, often takes the form of superexploitation, since the payment to workers is below the value of labor power (the costs of reproduction of the worker). The KYE factory in China produces manufactured goods for Microsoft and other U.S. factories, employing up to 1,000 “work-study” students 16–17 years of age, with a typical shift running from 7:45 A.M. to 10:55 P.M. Along with the “students,” the factory hires women 18–25 years of age. Workers reported spending ninety-seven hours a week at the factory before the recession, working eighty plus hours. In 2009, given the economic slowdown, the workers were at the factory eighty-three hours a week, and on the production line sixty-eight. Workers race to meet the requirement of producing 2,000 Microsoft mice per shift. The factories are extremely crowded; one workshop, 105 feet by 105 feet, has almost 1,000 toiling workers. They are paid 65 cents an hour, with 52 cents an hour take-home pay, after the cost of abysmal factory food is deducted. Fourteen workers share each dorm room, sleeping on narrow bunk beds. They “shower” by fetching hot water in a small plastic bucket for a sponge bath.38

Similar conditions exist at the Meitai Plastics and Electronics Factory in Dongguan City, Guangdong. There two thousand workers, mostly women, assemble keyboards and computer equipment for Microsoft, IBM, Hewlett-Packard, and Dell. The young workers, mostly under thirty, toil while sitting on hard stools as computer keyboards move down the assembly line, one every 7.2 seconds, 500 an hour. A worker is given just 1.1 seconds to snap each separate key into place, continuing the operation 3,250 times every hour, 35,750 times a day, 250,250 times a week, and more than a million times a month. Employees work twelve hour shifts seven days a week, with two days off a month on average. They are at the factory eighty-one hours a week, while working for seventy-four. They are paid 64 cents an hour base pay, which is reduced to 41 cents after deductions for food and room. Chatting with other workers during work hours can result in the loss of a day and half’s pay.

Meitai workers are locked in the factory compound four days of each week and are not allowed to take a walk. The food consists of a thin, watery rice gruel in the morning, while on Fridays they are given a chicken leg and foot as a special treat. Dorm rooms are similar to the KYE factory with bunks lined along the walls and small plastic buckets to haul hot water up several flights of stairs for a sponge bath. They do mandatory unpaid overtime cleaning of the factory and the dorm. If a worker steps on the grass on the way to the dorm she is fined. Workers are regularly cheated out of 14 to 19 percent of the wages due to them. The workers are told that “economizing on capital…is the most basic requirement of factory enterprise.”39

The Yuwei Plastics and Hardware Product Company in Dongguan pays its workers eighty cents an hour base pay for fourteen-hour shifts, seven days a week, making auto parts, 80 percent of which are sold to Ford. In peak season, workers are compelled to work thirty days a month. In March 2009 a worker who was required to stamp out 3,600 “RT Tubes” a day, one every twelve seconds, lost three fingers when management ordered the infrared safety monitors turned off so that the workers could work faster. The worker was paid compensation of $7,430, a little under $2,500 a finger.40

What drives the global labor arbitrage and the superexploitation of Chinese labor of course is the search for higher profits, most of which accrue to multinational corporations. This can be seen in a study carried out by the National Labor Committee and China Labor Watch of Pou Yuen Plant F in in Dongguan (owned by the Taiwanese Pou Chen Group). The vast majority of the production in Plant F is carried out for the German sports lifestyle corporation PUMA. Plant F in 2004 had around 3,000 workers with the median age twenty to twenty-two years. The base wage for these workers was 31 cents an hour, $12.56 a week. They worked 13.5–16.5 hour daily shifts from 7:30 A.M. to 9:00 P.M., 11:00 P.M, or midnight, with one, three, or four days off a month. Twelve workers share a crowded dorm room. The report found:

- From beginning to end the total cost of labor to make a pair of PUMA sneakers in China comes to just $1.16. The workers’ wages amount to just 1.66 percent of the sneakers’ $70 retail price. It takes 2.96 hours to make a pair of sneakers.

- PUMA’s gross profit on a pair of $70 sneakers is $34.09.

- PUMA’s hourly profit on each pair of sneakers is more than twenty-eight times greater than the wages workers received to make the sneaker.

- PUMA is making a net profit of $12.24 an hour on every production worker in China, which comes to an annual profit of $38,188.80 per worker. For Pou Yuen Plant F alone, PUMA’s net profit gained from the workers exceeds $92 million.

- Even after accounting for all corporate expenditures involved in running its business—which the workers in China are ultimately paying for—PUMA’s net profit on each $70 pair of sneakers is still $7.42, or 6.4 times more than the workers are paid to make the sneaker.

- In the first five days and two hours of the year—before the first week is even over—the workers in China have made enough PUMA sneakers to pay their entire year’s salary.41

In 2010 eighteen workers, aged eighteen to twenty-five, at the Foxconn factory complex in Shenzhen, which produces iPhones and iPads for Apple, attempted suicide, fourteen succeeding, the others injured for life. This created a national and international scandal, and brought world attention to these conditions of extreme exploitation.42

Although China has minimum-wage legislation and various labor regulations, more and more workers (primarily migrants) toil in an unregulated, informal sector within industry in which minimum wages do not apply and a portion of workers’ wages are withheld. According to Anita Chan in China’s Workers Under Assault: The Exploitation of Labor in a Globalizing Economy (2001), the minimum wage levels are set “at the lowest possible price…while maintaining [the] workers’ physical survival,” although many workers are denied even that. “Workers’ wages are eroded by a multitude of deductions” for such things as forgetting to turn off lights, walking on the grass, untidy dormitories, and talking to others at work. In a survey carried out by the Guangdong trade union, it was revealed that 32 percent of workers were paid below the legal minimum wage.43

The global labor arbitrage that lies behind this system of extreme exploitation is in fact a system of imperial rent extraction that feeds the profits of global monopoly-finance capital.44 China’s extraordinary growth is thus a product of a global system of exploitation and accumulation, the chief rewards of which have been reaped by firms located in the center of the world economy.

The Floating Population

In order to understand the extreme exploitation of labor in China, and the unique class contradictions associated with this, it is necessary to examine the role of its “floating population.” In the household registration (hukou) system set up in 1955–58, each individual was given a particular household registration in the locality of his/her birth. This places limitations on internal migration within the country. The “floating population” thus consists of those who live in an area outside their place of household registration, of which there are currently 221 million people, 160 million of which are said to be rural migrants outside their home county. This rural migrant labor population makes up almost 70 percent of the workers in manufacturing and 80 percent in construction. They occupy the lowest rungs in urban employment and are paid wages far less than the national urban average, while often working 50 percent longer hours. In Beijing around 40 percent of the population in 2011 were migrant workers, with temporary residence. In the city of Shenzhen nearly 12 million out of a total population of 14 million people are rural migrants. In addition to receiving much lower pay, rural migrants lack the benefits provided to urban-based workers in the cities, and frequently live and work at the factory in dormitory conditions. The vast majority of rural migrant laborers are under thirty-five-years of age—in 2004 the average age was twenty-eight. They work in industrial centers under superexploitative conditions (i.e., receiving wages below the normal reproduction costs of workers) for a few years and then typically return to the land and their peasant origins.

The enormously long hours worked under hazardous conditions in China, particularly by rural migrant workers, takes its toll in terms of industrial accidents. According to official data, there were 363,383 serious work-related accidents in China in 2010, which included 79,552 deaths. This represented a marked improvement since 2003, when there were 700,000 work-related accidents and 130,000 fatalities. Most of the victims are migrant workers.45

Although Western scholars have often treated migrant workers in China in terms of the standard model of surplus labor attracted to the cities (based on the development model associated with the work of W. Arthur Lewis and ultimately derived from Marx’s reserve army analysis) the conditions of the labor surplus in China are in many ways unique. China’s floating population can be seen as constituting a reserve army of labor in Marx’s terms but with a distinct difference. Its distinctiveness lies in the temporary and partial nature of proletaranization and in the permanent connection of migrants to the land—a product of the Chinese Revolution and the clay rice bowl. Peasants retain land use rights (a form of equity in that land), which are periodically reallocated by village collectives on a relatively egalitarian basis, taking into consideration their occupation of and work on the land. This provides an incentive for rural migrants to maintain a strong connection to their families and the land. The miniscule peasant holdings—on average 1.2 acres but as small as an eighth of an acre—offer a bare bones existence: a homestead with a roof overhead and food to eat. Although market reformers have sought to break up these plots, few families are willing to give up their clay rice bowl—their use rights to the land. However, in order to prosper under these conditions, peasant families must periodically seek nonfarm work to supplement their meager earnings. This gives rise to the growing phenomenon of rural migrant labor, which is intensified due to reductions in state support in rural areas during the market reform period.46

Rural migrants send remittances back to their families and attempt to save a part of their income to bring back with them. There is strong evidence to suggest that—above and beyond the enormous obstacles to obtaining permanent urban residence status—rural migrants have a strong desire to return to the countryside due to their continuing links to the land, which provides some security. Land is regarded as a permanent asset that can be passed on to future generations. Thus in a state survey in 2006 only 8 percent of rural migrants indicated that they planned to stay long-term in their urban destination. During the migratory stage of their lives rural migrants float back and forth. One survey in 2002 found that only 5 percent of migrants did not return home that year, while 60 percent spent less than nine months away from their home counties. The return migration serves to cushion the economy in a downturn. During the Great Financial Crisis of 2007–09, which resulted in a sharp drop in Chinese exports, there was a significant drop (14–18 million) in the number of migrant workers, as rural migrants who were unable to find employment returned to the land, and new outward migration decreased. The result of this reverse migration was to hold down unemployment—to the point that wages actually increased during the crisis due to labor shortages in industry (induced in part by China’s quick economic turnaround) and in response to food price inflation.47

Some analysts have commented on how the structural features of rural migration allow high-quality labor power to be reproduced in the rural regions, effectively outside of the capitalist market economy, which then becomes available on a floating basis for its intensive superexploitation in the cities—without urban industry having to foot the real costs of the reproduction of labor power.48 Costs are kept low and productivity high because production is carried out by young workers who can be worked extremely intensively—only to return to the countryside and be replaced by a new inflow of rural migrants to industry. The eighty hour plus work weeks, the extreme pace of production, poor food and living conditions, etc., constitute working conditions and a level of compensation that cannot keep labor alive if continued for many years—it is therefore carried out by young workers who fall back on the land where they have use rights, the most important remaining legacy of the Chinese Revolution for the majority of the population. Yet, the sharp divergences between urban and rural incomes, the inability of most families to prosper simply by working the land, and the lack of sufficient commercial employment possibilities in the countryside all contribute to the constancy of the floating population, with the continual outflow of new migrants.

Land, Labor, and Environmental Struggles

Although a number of left analysts, as we have seen, continue to point to Chinaas a case of “accumulation without dispossession,”49 primarily due to the rural peasantry’s retention of land use rights, in our view the evidence suggests that China is less of a departure from the standard pattern. Such an extreme, rapid development of a capitalist market economy is impossible without primitive accumulation, i.e., dispossessing the population of their assets and direct relation to the means of production. Hinton argued in The Great Reversal in 1990 that in order to carry out the primitive accumulation of capital in China it would be necessary for capitalists to weaken and then smash both the iron rice bowl and the clay rice bowl, the chief gains of the mass of the population in the Chinese Revolution.50 Both rice bowls have been under attack. In response to this—as well as to the driving exploitation of workers and growing inequality—the protests of workers and peasants have been increasing in leaps and bounds.

The number of large-scale “mass incidents” (petitions, demonstrations, strikes, and riots) in China has risen from 87,000 in 2005 to 280,000 in 2010, according to official Chinese sources.51 The two main sources of conflict are: (1) land disputes, especially in response to illegal land requisitions, regarded as attacks on the clay rice bowl; and (2) labor disputes, particularly the resistance of workers within state enterprises to relentless privatization and the smashing of the iron rice bowl. In addition, there are rapidly growing struggles by workers and peasants over environmental destruction.

In 2002–05 thousands of peasants were involved in protests in Dongzhou village in Guangdong against the building of an electricity plant that had resulted in a land requisition for which they were not fairly compensated. Workers built sheds outside the plant and attempted to block its construction. Conflict with the authorities led to a major part of the plant being blown away by explosives and the police opening fire on protesters in December 2005, leading to a number of deaths.

In December 2011 an uprising began in Wukan, a coastal village of about 20,000 in Guangdong. Villagers set up roadblocks, chased away government representatives, and began arming themselves with homemade weapons in protest over a land requisition, which appropriated their land with little or no compensation. After a ten-day standoff with the local government the villagers agreed to end their protest and reopen the village, when a number of their demands were met.

These cases reflect struggles going on all over China, increasingly threatening, as Bloomberg Businessweek states, “the reversal of one of the core principles of the Communist Revolution. Mao Zedong won the hearts of the masses by redistributing land from rich landlords to penniless peasants. Now, powerful local officials are snatching it back, sometimes violently, to make way for luxury apartment blocks, malls, and sports complexes in a debt-fueled building binge.” Local provincial, county, and city governments had accumulated debts of 2.79 trillion yuan ($412 billion) by the end of 2009, spurred on by government’s fiscal stimulus in response to the Great Financial Crisis. The local governments used land belonging to villagers to secure the debt in their localities, promising land sales. Hence, cities are grabbing land to finance their mushrooming debt.

Falling real estate prices have accelerated the process, forcing local governments with inadequate tax bases to engineer more land sales. Land sales currently account for around 30 percent of total local government revenues, and in some cities make up more than half the revenue. Land is being sold without the support and at the expense of the villagers who have use rights to plots that are collectively owned; while the proceeds of such land sales are lining the pockets of local officials. Not only do the peasants lose their permanent relation to the land (and the clay rice bowl), they are being compensated at rates far below the value for which the land is being sold to developers by the local authorities. Some 50 million peasants lost their homes during the previous three decades, while the expectation is that some 60 million farmers will be uprooted over the next two decades.52

Labor disputes are still the most common form of mass incident, accounting for some 45 percent of the total according to one estimate. In the summer of 2010 China’s leading industries in auto, electronics, and textiles were hit by dozens of strikes. Although the role of state-owned enterprises (SOEs) in China has declined under the force of privatization, there still remain some 60 million employees of SOEs in urban areas.53 “In the Maoist socialist era,” as Minqi Li has written, “the Chinese [state] workers enjoyed a level of class power and dignity unimaginable by an average worker in a capitalist state (especially in the peripheral and semi-peripheral context).” In the period of market reforms these workers have been increasingly reduced to a state-sector proletariat, but with remnants of the iron rice bowl (or at least its ghostly memory) remaining where workers are strongest. This has led to intense class struggles. In 2009 workers at the Tonghua Iron and Steel Company in Jilin province revolted against privatization and massive layoffs, carrying out a general strike under the leadership of a Maoist-era worker known as “Master Wu.” When the general manager of a powerful private company that was taking over the enterprise threatened to fire all of the workers, the workers beat him to death. The government backed off and canceled the privatization plan.54

After land and labor disputes, the largest number of mass incidents in China are associated with environmental factors, particularly struggles over pollution. China’s environmental problems are massive and growing. It now has sixteen of the world’s twenty most polluted cities. Two-thirds of urban residents are breathing air that is severely polluted. Lung cancer in China has increased 60 percent over the last decade even though the smoking rate has remained unchanged. Desertification is leading to the loss of about 6,000 square miles of grasslands every year, around the size of Connecticut. This contributes to sandstorms, resulting in the dust that represents a third of China’s air pollution problem. Water shortages, especially in northern China, and water pollution are both growing. China has only 6 percent of the world’s freshwater but over three times that share of the world’s population. Its per capita water supply is down to a quarter of the global average, while 70 percent of the country’s rivers and lakes are severely polluted. Some 300 million people in the rural areas are drinking unsafe water, while one-fifth of the drinking water sources in the major cities are below standard. Massive dam projects designed to deliver electricity are leading to farmland loss, ecological damage, and the forced migration of millions. In 2008 China surpassed the United States as the leading emitter of greenhouse gases (although far below the latter in per capita emissions). Such conditions have led to an upsurge in environmental mass protests. Complaints to authorities increased by about 30 percent a year between 2002–04, reaching 600,000 annually, while the official tally of disputes in relation to environmental pollution hit 50,000 in 2005.55

Most of China’s manufacturing force, as we have seen, consists of a floating population which remains tied to the land and user rights (the clay rice bowl), while also experiencing extreme exploitation and degraded environmental conditions in the cities. Given this, the struggles over land, labor, and the environment are wedded in China as nowhere else—to the point that we may be witnessing the emergence of an environmental proletariat, along with a partially proletarianized, relatively independent, and egalitarian peasantry.56

As Samir Amin argues, urban China is incapable of absorbing the hundreds of millions of rural workers in China (a dilemma that exists at various levels throughout the global South). Hence, some 50 percent of the Chinese population will have to remain rural. China does not have the external outlet for surplus population that was available to industrializing Europe during the period of colonial expansion.

In China’s case, the legacy of its revolution has created an independent peasantry that feeds 22 percent of the world population with 7 percent of the world’s arable land, with an equitable land distribution. Rather than seeing this as an archaic weakness of the society, to be subjected to relentless primitive accumulation, it should be seen as a strength of Chinese society, which reflects the genuine need for access to the land on the part of half of humanity.57

China and the World Crisis

With the economic Triad of the United States (and Canada), Europe, and Japan caught in continuing economic stagnation—made more evident following the Great Financial Crisis—the focus has been increasingly on China as the means of lifting the world economy. Thus the Winter 2010 issue of the journal The International Economy carried the responses of more than fifty orthodox economists from various countries to the question: Can China Become the World’s Engine for Growth? The answers varied widely, but most of those questioned emphasized the internal contradictions of the Chinese economy, its tendency towards overinvestment and export dependency, its low consumption, and its need to rebalance.58 Recently, fears that the contradictions of the Chinese economy may further imperil the entire world accumulation process—if China is not able to rebalance toward higher consumption, lower debt, and a higher renminbi—are voiced daily by international capital. Worries that the days of China’s economic miracle are numbered and that it is headed towards a sharp slowdown in growth and financial crisis are now prevalent. As Paul Krugman wrote in a New York Times column entitled “Will China Break?” on December 18, 2011:

Consider the following picture: Recent growth has relied on a huge construction boom fueled by surging real estate prices, and exhibiting all the classic signs of a bubble. There was rapid growth in credit—with much of that growth taking place not through traditional banking but rather through unregulated “shadow banking” neither subject to government supervision nor backed by government guarantees. Now the bubble is bursting—and there are real reasons to fear financial and economic crisis.

Am I describing Japan at the end of the 1980s? Or am I describing America in 2007? I could be. But right now I’m talking about China, which is emerging as another danger spot in a world economy that really, really doesn’t need this right now…a new [potential] epicenter of crisis.59

But few mainstream analysts, Krugman included, recognize the true intensity of the economic, social, and environmental contradictions in China, which make its development pattern unsustainable in every respect. These contradictions are now giving rise to hundreds of thousands of mass protests annually, as peasants struggle to retain their use rights to the land, the floating population (itself still connected to the land) resists superexploitation, state workers defy privatization, and millions more struggle against environmental degradation.

The story usually presented in the U.S. media of a nation-state competition (and occasional collaboration) between the United States and China hides the deep and growing class inequities in a country where the golden rice bowl of the state bureaucrats has been so enlarged that the families of the most powerful Party members control billions of dollars in wealth. For example, the family of China’s Premier Wen Jiabao has a wealth estimated at $4.3 billion—in a country where wage income is among the lowest in the world, and where inequality is skyrocketing.60

Chinese low-wage exports have been almost entirely consumer durable goods (Department II in the Marxian reproduction schemes as opposed to Department I, investment goods), notably in the areas of information technology and communications, and electronics—but also including clothing, furniture, toys, and various household products. In 2010 “Made in China” goods accounted for 20 percent of furniture and household equipment sold in the United States, 12 percent of other durables, and 36 percent of clothing and shoes.61 Such Chinese imported commodities are referred to as “deflationary” goods in corporate lingo, since they reduce the cost of many goods usually purchased with wages, and offset higher prices on other items of mass consumption, such as gasoline. Wal-Mart, which alone accounts for 12 percent of the goods shipped to the United States from China, has even been called the greatest friend of the U.S. working class. Indeed, as W. Michael Cox, chief economist for the Federal Reserve Bank of Dallas put it, given its low prices, “Wal-Mart is the best thing that ever happened to poor people.”62 Yet, these same low-priced imported goods, which Wal-Mart exemplifies, make it possible for real wage levels in the United States and other rich countries to stagnate—as the relative shift of manufacturing employment to the global South, pulls down wages directly and indirectly (and as what were well paying jobs disappear).

The growth of cheap manufactured imports has often led to calls for protectionism on the part of U.S. labor groups. However, there is little acknowledgement that these cheap imports are produced by or for multinational corporations headquartered in the Triad. The real struggle, then, is one of creating international solidarity between Chinese workers, who are suffering from extreme forms of exploitation (even superexploitation), and workers in the developed world, who are currently losing ground in a race to the bottom. Today much of the basis for such international worker solidarity can be found in the struggles of workers and peasants in China; which could conceivably be strengthened further by the resurrection of the revolutionary process in China (a turn to the left).

For the New York Times, nothing but “Mao’s resurrection or nuclear cataclysm” is likely to arrest China’s current course. Yet, if what is meant by “Mao’s resurrection” is the renewal in some way of the Chinese Revolution itself—which would necessarily take new historical forms as a result of changing historical conditions—the potential remains, and is even growing under current conditions.63

In 1853, Karl Marx argued that the Chinese Revolution of those days (the famous Taiping Rebellion) might destabilize the financial conditions of the British Empire and hasten the possibilities of revolt in Europe.64 Although Marx’s expectations were disappointed, his notion that the fates of China and the West were tied together was in many ways prophetic. China’s deepening contradictions will undoubtedly have an effect on the Triad and on the world as a whole, in what now appears to be the descending phase of capitalism.

Notes

- ↩ “From the Great Recession to the Great Stagnation,” Forbes, October 10, 2011, http://forbes.com; Tyler Cowen, The Great Stagnation (New York: Penguin, 2010).

- ↩ Christine Lagarde, “An Address to the 2011 International Finance Forum,” Beijing, November 9, 2011, http://imf.org. See also C. Ryan Knight, “Dark Clouds, Over the Boat: On China, Production, and Financialization,” November 11, 2011, http://lecoupdoeil.wordpress.com.

- ↩ “IMF Sees Chinese Economy Avoiding Stagnation, El Comercio Says,” Bloomberg.com, November 30, 2011, http://bloomberg.com.

- ↩ Stephen Roach, “China’s Landing—Soft Not Hard,” September 30, 2011, http://project-syndicate.org.

- ↩ “Hangzhou Taxi Drivers Go on Strike,” The China Times, August 2, 2011, http://www.thechinatimes.com.

- ↩ “Calculating the Coming Slowdown in China,” New York Times, May 23, 2011, http://nytimes.com.

- ↩ “China’s Bumpy Road Ahead,” Wall Street Journal, July 9, 2011, http://online.wsj.com; Niall Ferguson, Civilization: The West and the Rest (New York: Palgrave, 2011), 307–8.

- ↩ See the comments by Paul J. Alapat, Fred Bergsten, Haruhiko Kuroda, Jim O’Neill, and Allen Sinai in “Can China Become the World’s Engine for Growth?” The International Economy (Winter 2010): 12-13, 17, 27, 31, www.international-economy.com.

- ↩ “China’s Bumpy Road Ahead,” Wall Street Journal, July 9, 2011, http://online.wsj.com; “Indifference as a Mode of Operation at China’s Schools,” New York Times, May 18, 2011, http://nytimes.com.

- ↩ “The Next China,” The Economist, July 29, 2010, http://economist.com.

- ↩ Michael Spence, The Next Convergence (New York: Farrar, Straus, and Giroux, 2011), 18-19.

- ↩ See John Bellamy Foster, “Monopoly-Finance Capital and the Paradox of Accumulation,” Monthly Review 61, no. 5 (October 2009): 1–20; John Bellamy Foster and Fred Magdoff, The Great Financial Crisis (New York: Monthly Review Press, 2009); “Calculating the Coming Slowdown in China,” New York Times; Christine Lagarde, “The Path Forward—Act Now and Act Together,” Opening Address to the 2011 Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund, September 23, 2011, http://imf.org.

- ↩ John Bellamy Foster, Robert W. McChesney, and R. Jamil Jonna, “The Global Reserve Army of Labor and the New Imperialism,” Monthly Review 63, no. 6 (November 2011): 1–31.

- ↩ Martin Hart-Landsberg, “China, Capitalist Accumulation, and the World Crisis,” Marxism 21 7, no. 1 (Spring 2010): 289; Zhang Hong, “Too Early to Hail China’s Stimulus Success,” Guardian, August 28, 2009, http://guardian.co.uk; “China’s Local Debts Threaten Crisis,” Asia Times, July 14, 2010, http://atimes.com.

- ↩ Michael Pettis, “Lower Interest rates, Higher Savings?” October 16, 2011, http://www.financialsense.com; “A Workers’ Manifesto for China,” The Economist, October 11, 2007, http://economist.com.

- ↩ Nouriel Roubini, “China’s Bad Growth Bet,” April 14, 2011, http://project-syndicate.org. See also Roach, “China’s Landing.”

- ↩ “Why China’s Big Red Bubble Is Ahead of Us,” Forbes, November 30, 2011, http://forbes.com; “China’s Housing Bubble Past, and Its Future,” Forbes, November 8, 2011, http://forbes.com; “Why China’s Property Bubble is Different,” Forbes, April 22, 2011; “Rise of the Asian Megacity,” BBC News, Asia Pacific, June 20, 2011; “Cracks in Beijing’s Financial Edifice,” Financial Times, October 9, 2011, http://ft.com; Patrick Choovanec, “China Data, Part 1: Real Estate Downturn,” December 12, 2011, http://chovanec.wordpress.com; Kate MacKenzie, “As China’s Apartments Go, So Goes China,” Financial Times blog, December 14, 2011, http://ftalphaville.ft.com; Michael Pettis, “How Do We Know that China is Overinvesting?” December 3, 2011, http://www.economonitor.com; Jim Antos, “China’s Debt Situation Not Far Off From Greece,” July 12, 2011, http://cnbc.com.

- ↩ Ian Bremmer and Nouriel Roubini, “Whose Economy Has it Worst?” Wall Street Journal, November 12, 2011; http://online.wsj.com; Michael Pettis, “Some Predictions for the Rest of the Decade,” August 28, 2011, http://carnegieendowment.org and “Lower Interest Rates, Higher Savings.”

- ↩ William Hurst, “Urban China: Change and Contention,” in William A. Joseph, ed., Politics in China: An Introduction (Oxford: Oxford University Press, 2010), 257.

- ↩ Minxin Pei, “The Color of China: Looming Stagnation,” The National Interest 100 (March/April 2009): 17.

- ↩ “A Workers’ Manifesto for China,” The Economist, http://economist.com.

- ↩ “China’s Growing Income Gap,” Bloomberg Businessweek, January 27, 2011, http://businessweek.com; “Country’s Wealth Divide Past Warning Level,” China Daily, May 12, 2010, http://chinadaily.com.cn.

- ↩ Wu Zhong, “China’s ‘Most Wanted’ Millionaires,” Asia Times Online, September 19, 2007, http://atimes.com; Hart-Landsberg, “China, Capitalist Accumulation, and the World Crisis,” 280.

- ↩ William Hinton, The Great Reversal (New York: Monthly Review Press, 1990), 168–71.

- ↩ World Bank, WDI Database, databank.worldbank.org; Martin Hart-Landsberg and Paul Burkett, China and Socialism: Market Reforms and Class Struggle (New York: Monthly Review Press, 2005), 37; William Hinton, Through a Glass Darkly (New York: Monthly Review Press, 2006), 130; Selden quoted in Hart-Landsberg and Burkett, China and Socialism, 38.

- ↩ Hinton, The Great Reversal, 16.

- ↩ Giovanni Arrighi, Adam Smith in Beijing (London: Verso, 2007), 389; Ho-fung Hung, “A Caveat: Is the Rise of China Sustainable?” in Ho-fung Hung, ed., China and the Transformation of Global Capitalism (Baltimore: Johns Hopkins University Press, 2009), 189.

- ↩ Richard Walker and Daniel Buck, “The Chinese Road: Cities in the Transition to Capitalism,” New Left Review 46 (July–August 2007): 42–44.

- ↩ Peter Kwong, “The Chinese Face of Neoliberalism,” CounterPunch, October 7, 2006, http://counterpunch.org; Martin Hart-Landsberg, “The U.S. Economy and China,” Monthly Review 61, no. 9 (February 2010): 26–27.

- ↩ Green Left, May 18, 2007, http://www.greenleft.org; Lan Xinzhen, “A Foreign China,” Beijing Review, January 11, 2007, http://bjreview.com.cn; Wenzhao Wang, “China New M&A Regulation and Its Impact on Foreign Business in China,” China Trade Law Report (American Lawyer Media), October 2006, http://avvo.com; “Foreign Direct Investment in China in 2010 Rises to Record $105.7 Billion,” Bloomberg News, January 17, 2011, http://bloomberg.com; “The Next China,” The Economist.

- ↩ Shaun Breslin, China and the Global Political Economy (New York: Palgrave Macmillan, 2007), 110; Jephraim P. Gundzik, “What a US Recession Means for China,” Asia Times Online, September 27, 2006, http://atimes.com.

- ↩ Martin Hart-Landsberg and Paul Burkett, “China, Capitalist Accumulation, and Labor,” Monthly Review 59, no. 1 (May 2007): 20–22.

- ↩ Galvin Hale and Bart Hobijn, “The U.S. Content of ‘Made in China’,” Federal Reserve Board of San Francisco, FRBSF Economic Letter, August 8, 2011. http://frbsf.org.

- ↩ Hyun-Hoon Lee, Donghyun Park, and Jing Wang, The Role of the People’s Republic of China in International Fragmentation and Production Networks, Asian Development Bank, ADB Working Paper Series on Regional Economic Integration, 87 (September 2011): 5, 15–16.

- ↩ Jin Bei, “The International Competition Facing Domestically Produced Goods and the Nation’s Industry,” Social Sciences in China 12, no. 1(Spring 1997): 65–71.

- ↩ “Barbie and the World Economy,” Los Angeles Times, September 22, 1996, http://articles.latimes.com.

- ↩ See Foster, McChesney, and Jonna, 15–16.

- ↩ Institute for Global Labour and Human Rights, China’s Youth Meet Microsoft: KYE Factory in China Produces for Microsoft and Other Companies, April 13, 2010, http://globallabourrights.org; “Microsoft Supplier in China Forces Teenagers to Work 15-hour Shifts Under Sweatshop Conditions,” China Labour Net, April 17, 2010, http://globallabourrights.org.

- ↩ Institute for Global Labour and Human Rights, High-Tech Misery in China: The Dehumanization of Young Workers Producing Our Computer Keyboards, February 2, 2009, http://globallabourrights.org.

- ↩ Institute for Global Labour and Human Rights, Dirty Parts: Where Lost Fingers Come Cheap; Ford in China, March 22, 2011, http://globallabourrights.org.

- ↩ National Labor Committee and China Labor Watch, PUMA Workers in China, November 4, 2004, http://globallabourrights.org.

- ↩ “Foxconn Worker Plunges to Death at China,” Reuters, Nov. 5, 2010, http://reuters.com; “Struggle for Foxconn Girl Who Wanted to Die,” South China Morning Post, December 22, 2011, http://scmp.com; “Inside Foxconn’s factory,” The Huffington Post, July 6, 2011, http://huffingtonpost.com.

- ↩ Anita Chan, China’s Workers’ Under Assault: The Exploitation of Labor in Globalizing Economy (New York: M.E. Sharpe, 2001), 11–13; Hart-Landsberg and Burkett, “China, Capitalist Accumulation, and Labor,” 27–29. But see “Beijing to Raise Minimum Wage,” December 29, 2011, http://www.chinadaily.com.cn, for evidence of high level concern with these questions.

- ↩ Samir Amin, The Law of Worldwide Value (New York: Monthly Review Press, 2010).

- ↩ “Migrant Workers in China,” China Labour Bulletin, June 6, 2008, Migrant workers in China; “China’s ‘Floating Population’ Exceeds 221 Million,” Peoples’ Daily Online, February 28, 2011, http://english.peopledaily.com.cn; Rachel Murphy, How Migrant Labor is Changing Rural China (Cambridge: Cambridge University Press, 2002), 44, 204, 216; Ke-Qing Han, Chien-Chung Huang, and Wen-Jui Han, “Social Mobility of Migrant Peasant Workers in China,” Sociology Mind 1, no. 4 (2011): 206.

- ↩ Hinton, The Great Reversal, 172, Through a Glass Darkly, 128; Murphy, How Migrant Labor is Changing Rural China, 218; On the Lewisian model see Foster, McChesney, and Jonna, 17–18; Ted C. Fishman, “The Chinese Century,” New York Times, July 4, 2004, http://nytimes.com.

- ↩ Maëlys de la Rupelle, Deng Quheng, Li Shi, and Thomas Vendryes, Land Rights Insecurity and Temporary Migration in Rural China, IZA Discussion Paper Series, Institute for the Study of Labor (Bonn), December 2009, 2–7, ftp.iza.org; Ke-Qing Han, et. al., “Social Mobility of Migrant Peasant Workers,” 209; Xin Meg, Tao Kong, and Dandan Zhang, “Searching for Adverse Labour Market Effects of the GFC in China,” Research School of Economics, Australian National University, oecd.org.

- ↩ See He Xuefeng, “New Rural Construction and the Chinese Path,” Chinese Sociology and Anthropology 39, no. 4 (Summer 2007): 29-30; Murphy, How Migrant Labor is Changing Rural China, 200, 214–18.

- ↩ Arrighi, Adam Smith in Beijing, 389; Ho-fung Hung, “A Caveat,” 189.

- ↩ William Hinton, The Great Reversal, 168–71.

- ↩ See “Hangzhou Taxi Drivers Go on Strike”; “Indifference as a Mode of Operation at China’s Schools.”