Also in this issue

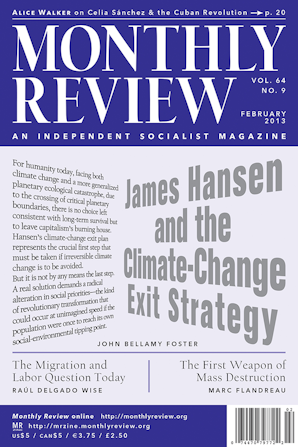

- James Hansen and the Climate-Change Exit Strategy

- Celia Sánchez and the Cuban Revolution

- The Migration and Labor Question Today: Imperialism, Unequal Development, and Forced Migration

- What Does Ecological Marxism Mean For China? Questions and Challenges for John Bellamy Foster

- Toward a Global Dialogue on Ecology and Marxism: A Brief Response to Chinese Scholars