The central problem in advanced monopoly capitalism is not one of scarce resources clashing against innate, insatiable wants. Rather, it is one of an abundance of production clashing against saturated consumption and investment markets. In order to absorb potential economic output and forestall excess capacity, business interests must continuously search for new markets to exploit or entice existing customers who stand ready to buy the latest product, iteration, or service, and to induce new investment. The key to business survival in a capitalist economy is continual expansion of market share and reach: grow or die.

The efforts applied to this relentless drive undermine the conventional wisdom of market-determined pricing—for were a competitive price system in place, the funds for these expenditures would not exist.1 As I will show, the resources and funds expended in this quixotic endeavor to grow can be broadly referred to as the “economic surplus.” Evidence of this surplus—and furthermore, that the competitive law of value is not operable under the context of monopoly capitalism—is obvious in the amounts spent on marketing and political maneuvering.

In Monopoly Capital, Baran and Sweezy dedicate four of the eleven chapters—over a third of the book—to exploring the “Absorption of Surplus.” Two of those four chapters, “Capitalists’ Consumption and Investment” and “The Sales Effort,” examine surplus exhaustion within the firm. The latter two chapters, “Civilian Government” and “Militarism and Imperialism,” examine how the government helps firms exhaust the surplus, with particular focus on the military-industrial establishment. With the rise of neoliberalism in the decades since its publication, the theoretical core of Monopoly Capital remains relevant, although the categories and means of absorption have shifted to accommodate this latest incarnation of monopoly capitalism. The present focus is on that of surplus absorption within the firm, for which two new categories for the neoliberal era are proposed: marketing efforts and political efforts.

The Economic Surplus

The concept of economic surplus, in its most basic form, consists of the difference between what a society produces and that quantity of production needed to reproduce the society in the next period. The economic surplus so defined is not contextually specific, and is therefore applicable to all societies and production forms.2 The production of an economic surplus hence requires production beyond the subsistence level of output for a society.3 Within the context of monopoly capitalism, the economic surplus is more specifically defined as what is left of the potential output once essential consumption—that is, the consumption necessary for social and material reproduction—has been met. Potential output is not the amount of output produced in a period, but rather a function of the total productive capacity, whether utilized or not, for the given level of capital stock and workforce talent in a society. In other words, potential output is the output that is attainable if all the available factors of production in a society are employed.4 That the actual output often falls short of the potential is a key tendency of monopoly capitalism—in other words, the system tends toward excess capacity.

Any expenditure that contributes to the social and material reproduction of society, including maintenance of individuals’ existing standards of living, as well as maintenance of the productive capacity, constitutes essential consumption. Consumption that increases capacity or that does more than merely reproduce society should be considered investment rather than consumption per se, and as such, a potential catalyst to economic growth and development. Since the economic surplus funds this investment, it is clear that the potential for the direction and content of growth resides in the deployment of the economic surplus.5 The economic surplus should therefore be considered a fund, regardless of what the fund might finance.

Crisis in Monopoly Capitalism

Because of the insatiability of the accumulation cycle which drives all capitalist systems, business interests must constantly and consistently expand production. Given the concurrent drive to contain costs—specifically labor costs—the gap between productive capacity and consumption limits creates a structural imbalance: the former is defined by the state of technology, the latter by the prevailing social and political institutions and the distribution of income.6 The structural inequality of the distribution of income endemic to all varieties of capitalism constrains the amount of production that can be consumed within a given society. The problem of ineffective demand plagues modern business, which, coupled with downwardly rigid pricing, forces cuts in productivity and poses the problem of excess capacity or “capital overhang.”7

The contemporary crisis of monopoly capitalism is thus the crisis of chronic excess capacity. This excess cannot be used to produce more consumer goods, given the ever-widening inequality of income distribution. Nor can it be used for investment—i.e., to produce productivity enhancing capital—since this would only compound the problem of excess capacity.8 Although the potential economic surplus consists of the gap between potential output and essential consumption, the gap between productive capacity and the limits to consumption might be conceptualized as the structurally determined portion of the economic surplus fund, and thus directly reflects the degree of excess capacity within a given time period. Under monopoly capitalism, the chronic excess capacity and idle capital stock that accompany the accumulation of surplus funds and problems of surplus absorption creates a systemic tendency towards stagnation.9 Cumulatively, this tendency, coupled with the power of monopoly capital to administer mark-up pricing (and by extension, downwardly rigid pricing) causes macroeconomic instability and a predisposition for stagflation.10

Compounding the problem of excess capacity and stagnation is the structural maladjustment that results from neo-Keynesian remedies for relieving excess capacity, which call for stimulating the economy through deficit-financed government investment. Government spending, especially within the growing movement toward privatization, seeks to exhaust the economic surplus fund by closing the gap between productive capacity and now increasing public-sector consumption.11 As early as 1957, Paul Baran pointed out that such stimulation within the monopoly capitalist system encourages business overestimation of demand elasticity, which in turn encourages production beyond the limits of consumption, thereby amplifying the economy’s tendency toward stagnation. The result is simply a circular drive for further government stimulus of the economy. Moreover, financing unstructured investment through government deficits, especially in non-capital-stock-increasing investment—such as military armaments and technological research—would result in a precarious inflationary overhang.12

The key consequences of monopoly capitalism are therefore structural maladjustment and stagnation.13 The systemic tendency towards stagflation arises from the underlying trend toward chronic excess capacity, idle capital stock, and frozen surplus funds awaiting government assistance, correlated with the tendency to inflationary overhang, and worsened by unstructured government deficit financing meant to forestall the threat of that overhang. Given all this, it would seem as though the modern monopoly capitalist system would eventually be swallowed by its own stagnation. As will become clear, however, the neoliberal social structure of accumulation has proven quite adept at forestalling such crises through the creation of non-productive venues for expending economic surplus funds.

Neoliberal Monopoly Capitalism

In the five decades since the publication of Monopoly Capital, neoliberalism has become the prevailing ideological force in the most recent stage of the evolution of monopoly capitalism. Neoliberalism marks a shift in the purpose of the state from the responsibility to insure full employment and protect its citizens against the exigencies of the market toward the imperative to protect the market itself.14 In the neoliberal era, both private life and public goods have been annexed to the market, while the subservience of politics to business interests has grown more total and transparent, particularly when examined in the context of economic surplus funds.

The primary purpose of neoliberalism is to empower the institutions of monopoly capital continually to increase their control over economic surplus funds. The neoliberal ideology proposes that the ultimate and only necessary regulator of economic activity is the market, that the economic sphere runs its course naturally and with ruthless, logical objectivity. Given the limits on consumption imposed by unequal income distribution, and the consequent need to expand productive capacity while avoiding the creation of idle capital—thereby compounding the problem of capacity overhang inhibiting investment—neoliberal monopoly capitalism can only sustain itself by creating new means of producing waste, as well as by expanding those that already exist. The concept of waste, used by Baran and Sweezy in Monopoly Capital, is not intentionally pejorative; “waste” specifically addresses those resources that are applied to the production or sale of goods and services that do not meet the needs of the general populace:

In general, the largest part of waste [in the business process] is associated with the process of selling the output of business. This includes much of such expenditures as advertising, market research, expense account entertaining, the maintenance of excessive numbers of sales outlets, and the salaries and bonuses of salesmen. Closely related are outlays for such activities as public relations and lobbying, the rental and maintenance of showy office buildings, and business litigation.15

As used by Baran and Sweezy—and even earlier by Veblen—the term “waste” underscores that economic surplus funds could be otherwise applied to the production of goods and services that sustain and enrich the lives of all, such as health care, housing, and education.16

Absorption of Surplus: Marketing Efforts

Under monopoly capitalism, price competition fades, and in its place emerges the competition to expand market share, as well as to open new markets and find new or more fiercely loyal consumers. An increasing portion of surplus funds is thus funneled into marketing efforts: research and development of new, marginally improved, or slightly more specialized products; packaging and re-packaging design and materials; and general promotional efforts such as advertising campaigns, public relations events, and consumer relationship management, to name but a few on the ever-lengthening list.17 Under consideration here are the trends within specific categories of advertising and product differentiation, leading up to and through the rise of neoliberal monopoly capitalism.

Advertising

Insofar as advertising shapes the needs and wants of consumers, it also plays a critical role in the socialization and education of the population.18 Within neoliberalism, advertising attempts to conflate individual agency and self-expression with consumer preferences among commodities, and personal identity with branding and trademarks.19 Through the medium of advertising, material goods become physical proof of an individual’s agency, identity, and belonging, which are both uniquely chosen by the individual and shared among a larger community with similar tastes and beliefs.

Furthermore, luxury brands and products are not just status symbols, but ethnographic markers of respectability.20 The commodification of respectability extends beyond the marketplace, into cultural institutions and social movements. For instance, the “prosperity gospel” and self-help industries insist that individuals can will their own wealth into being, not least by pre-emptively purchasing the outward symbols of success.21 The adage “dress for the job you want” communicates this imperative to consume in order to demonstrate respectability and express ambition—dressing well is considered a pre-requisite for achieving the means to pay for dressing well. Beginning in the 1970s, the neoliberal deregulation of credit markets, alongside advertising efforts and broader cultural reinforcement, encouraged consumption on credit cards and in the housing market beyond individuals’ immediate means, at least leading up to the 2008 financial crisis.22

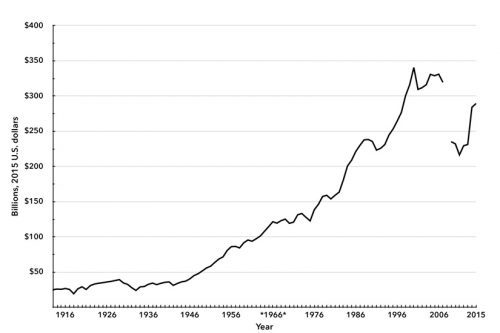

Culled and pieced together from different historical data sets, a century’s worth of data on advertising revenues (Chart 1) shows the growing role of advertising in the exhaustion of the surplus.23 During the first part of the twentieth century, advertising revenues exhibited slow but steady growth. Interestingly, it was not until 1966, the year of Monopoly Capital, that advertising revenues exceeded $100 billion (in 2015 dollars). In subsequent decades, advertising revenues grew at more than double the rate of the previous five decades. Absorption of the economic surplus through advertising has clearly intensified during the neoliberal era of monopoly capitalism.

Chart 1. U.S. Advertising Revenues, 1900–2013

Sources: 1900–2007: Douglas Galbi; 2007–2013: United States Census Bureau. Figures adjusted for inflation using Consumer Price Index from Bureau of Labor Statistics.

Product Differentiation

Another significant trend in the increasingly saturated neoliberal marketplace has been to increase market segmentation in order to sell ever more finely differentiated products. Such marketing endeavors serve a dual purpose: to expend economic surplus in a non-productive capacity, and to further commodify personal distinction and consumption-driven identities. Expenditure of surplus funds in research and development likewise sponsors the creation of new products, which in turn produces further monopoly profits and provides a venue for alleviating excess capacity.24 Such research and development enable the “new and improved” product differentiations that inundate consumers with choices, creating demand for previously non-essential or unknown options, devices, and accessories. The planned obsolescence and “creative destruction” of new, but more importantly, disposable products serve to relieve the economic surplus fund, all while threatening the ecological balance of the planet.25

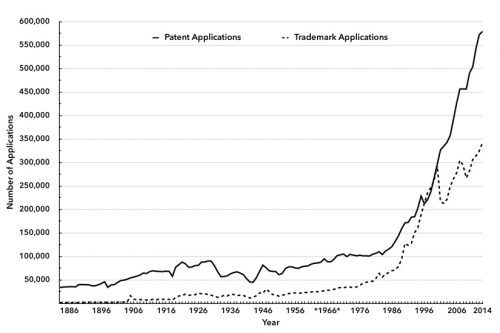

Although admittedly imperfect, patent and trademark applications stand as a reasonable proxy measure of product differentiation.26 Using data from the World Intellectual Property Office, it is possible to track the growth of patent and trademark applications in the United States throughout the twentieth century and into the present (Chart 2).

Chart 2. U.S. Patent and Trademark Applications, 1883–2013

Source: World Intellectual Property Organization.

The growth of both patent and trademark applications, much like that of advertising revenues, appears steady and continual throughout the first part of the twentieth century, with minor fluctuations that appear to correlate with periods of economic crisis and the World Wars. During this period, the number of applications remained largely consistent, never exceeding 100,000 per year. What is remarkable in this data is the precipitous climb in patent and trademark applications, although more sharply for patents, in the decades since the publication of Monopoly Capital.

The number of applications starts to climb more steeply with the beginning of the Reagan administration, which logically correlates with the ideological drive toward deregulation. What is less obvious but of key consequence in these expenditures is the inherent waste of spending economic surplus funds on the development of non-quality-enhancing product features, such as a new scent of soap or color of paper towel, or in the creation of entirely new products that do not substantively enhance the quality of living.

Absorption of Surplus: Political Efforts

Business interests seek protection from the intensified market competition of neoliberal monopoly capitalism.27 Indeed, despite its free-market rhetoric, neoliberalism does not advocate complete abstention of government intervention in the market; business interests still rely upon the state to provide refuge from the exigencies of the market. To stem stagnation, corporations depend on the state to help exhaust excess capacity and to ameliorate surplus absorption problems through government-sponsored production, preferably contracted out to the private sector. Likewise, business interests pursue regulatory restructuring in order to pare away specific regulations that diminish profitability or impede the movement of capital, while maintaining interventions that support or create markets.

Businesses also rely on the state to contain labor costs. Depressed wages and rising inequality—products of the neoliberal project—work to the advantage of business interests by acting as a disciplinary device for labor, insuring loyalty and productivity and as a means of limiting inflation.28 Access to politicians and their advisers is not cheap, however, and thus represents a substantial outlet for economic surplus funds in itself. Two categories of spending—campaign contributions and lobbying—give an idea of the portion of surplus funds applied toward politics. The data come from the Center for Responsive Politics (CRP), which tracked campaign contribution figures made available through the Federal Election Commission (FEC) as well as the lobbying data reported to the Senate Office of Public Records. The CRP also classified both contributions and expenditures by assigning each to one of ten broadly defined “business sectors”: agribusiness; communications and electronics; construction; defense; energy and natural resources; finance, insurance, and real estate; health; lawyers and lobbyists; transportation; and “miscellaneous business.”

Campaign Contributions

Running a political campaign is an expensive prospect, particularly for a federal office in the U.S. government. The 2012 U.S. presidential campaign was especially pricey, ringing up a tab of over $2.5 billion between both parties’ candidates (CRP). Expensive campaigns necessitate relentless fundraising efforts. During the 2012 election cycle alone, election winners to the House of Representatives raised on average, $2,315 per day, while winners to the Senate raised on average $14,351 per day.29 For the present purposes—based on the amount of data available—political campaign contributions are examined through two categories of spending: political action committees (PACs) and outside spending groups.

PACs are sponsored by an organization that represents a body of people—whether a corporation, labor union, industry group, or advocacy organization. Contributions are collected from individuals, corporations, or other PACs; the funds are used for political activities, including issue or candidate advertisements, or can be contributed directly to the campaigns of a particular candidate or party. Under current law, PACs are required to disclose their donors and expenses, and regulations limit both the amount that an individual or organization can contribute to the PAC as well how much a PAC can contribute directly to political campaigns.

With the 2010 ruling by the U.S. Supreme Court in SpeechNow.org v. FEC, the so-called Super PAC was born, and outside spending on political campaigns was unleashed.30 Super PACs are technically referred to as “independent-expenditure only” political action committees, which are designed to campaign for or against political issues, candidates, or parties independently of any particular candidate’s campaign. Super PACs are not allowed to contribute directly to political campaigns, but there are currently no limits to how much a Super PAC is allowed to spend on its independent campaigns nor are there limits to how much individuals and organizations can contribute to a Super PAC. Under current legislation, Super PACs must disclose their donors to the FEC.

Outside spending is not, however, solely relegated to the Super PAC. Non-profit organizations are allowed to receive unlimited donations and spend unlimited amounts on political campaigns for issues or candidates as long as those activities constitute only up to 49.9 percent of the organizations’ overall activities.31 Non-profits affiliated with business interests and trade associations are called 501.c.6 organizations, while those associated with labor unions are classified as 501.c.5. The final political non-profit category is that of “social welfare,” a catch-all category for 501.c.4-listed organizations, which do not fall into either of the former two. Out of these three groups, only the labor unions (501.c.5) are required to disclose their donors. For this reason, the other two are referred to in the press as “dark money” groups. It is important to remember, however, that the donor information is only released by Super PACs and those 501.c.6 associations that voluntarily disclose the sources of their donations.32

Lobbying

Despite the popular perception of campaign contributions as the price paid for political influence or power, the connection between the two is neither clear nor easily measured. It could reasonably be argued that campaign contributions represent a relatively weak version of economic surplus exhaustion. The most these donor groups, whether representing business interests, workers, or special interests, can accomplish with their contributions is to sway voters, and there is no promise of pay-out for these efforts, especially if the receiving candidate loses the election. Furthermore, winning politicians are not legally bound to the political pledges or promises made prior to the election. As such, it is clear that a more direct line, leading straight to politicians and policy decisions, is influence through lobbying.

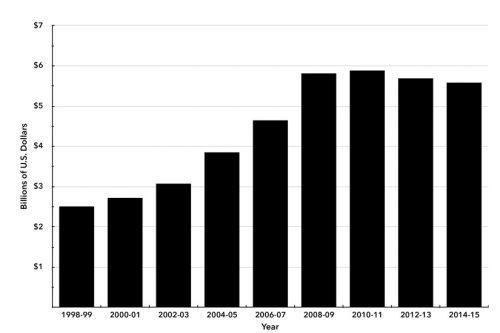

The complexity and volume of legislation that passes over a Congressperson’s desk—as well as all the many different drafts of any given piece of legislation—necessitates a reliance on other individuals, both inside and outside Congressional offices, for information and insight on the wide variety of issues that might be relevant to even a single legislative bill. Drawing on “industry expertise” to help legislators make informed decisions, representative advocates—lobbyists—are sent to policy makers to educate and to assist in the crafting, tweaking, or blockading of legislation that will affect their clientele. Such lobbying is big business. Business interests spend more on lobbying efforts than the combined money spent by PACs or donated to outside groups—by a vast margin. Over the eighteen-year period of study, from 1998 to 2015, business organizations and trade associations more than doubled the amount of money spent each year on lobbying, from $1.45 billion in 1998 to $3.2 billion in 2015 (see Chart 3). It is clear that business interests find lobbying to be a more direct means by which to craft and shape business-friendly legislation than campaign contributions. The persistent tendency of campaign contributions and lobbying money to climb, even in the wake of the financial crisis of 2008, strongly suggests that business interests find both of these means of economic surplus absorption lucrative.33

Chart 3. U.S. Spending on Lobbyists in Two-Year Election Cycles, 1998–2015

Source: Center for Responsive Politics.

Concluding Remarks

Exhausting the economic surplus through the production of waste by business enterprises may take many forms, but the most desirable is one that does not serve to create consumption goods or increase productive capacity. The threat of excess capacity and idle capital stock makes the creation of wasteful output—be it through marketing expenditures or political jockeying—a necessary and ultimately profitable endeavor. These outlets for economic surplus funds are made all the more attractive by virtue of their inability to expand productive capacity and compound the excess capacity problem.34

Inasmuch as neoliberalism produces waste as an attempt to exhaust the economic surplus through expansion of market share, waste is also deployed tactically to support the institutions of neoliberalism. With the assertion of the dominance of market priorities over those of the citizenry, business interests become the voice of authority that in previous generations belonged to the family, religion, and the state. That voice is communicated throughout media and popular culture, and more indirectly through marketing efforts and political activity.35

Indeed, if neoliberalism is the driving ideological force of monopoly capital, then marketing efforts are the main means of ideological management. The institutions of neoliberalism teach and socialize that material wealth and possession are a sign of the values to which all should aspire: hard work, ambition, and worship of power. Advertising is the medium of this message.36 Product differentiation reinforces the underlying neoliberal ethos of extreme individualism. With finer market segmentation and marketing directed with narrowing focus on ever more specific demographic targets, the ideology of individuation through commodity identification is reinforced and expanded. Nothing less than democracy is at stake when business interests can afford access to legislators and insure the maintenance and expansion of those institutions that sustain and support neoliberalism.

Waste is a necessary component of capitalism, but not of the economic surplus fund. The economic surplus of a society may be used to fund any number of possible projects. Economic surplus funds could be applied to public infrastructural and social needs, such as transportation, education, or health—but these, of course, are changes that would also increase productive capacity. Likewise, economic surplus funds might be directed to the improvement of qualitative aspects of everyday life: to increase leisure time by decreasing required workloads, for example, or to the development of culture through dance, theatre, or art. Economic surplus funds could also be directed towards ceremonial purposes, or to maintain a ruling or elite class, or be expropriated abroad—none of which would serve to expand productive capacity or improve the quality of life for the masses.

If economic policy is to serve the needs of society, progress should not be measured by the expansion of productive capacity, but by the expansion of human capacity for creativity, thought, and social relations. Instrumental economic policy should allocate the economic surplus fund to the social provision of individuals, including an individual’s development, which necessitates freeing the individual from the illusion of the disutility of work, creating space in which meaningful relationships with other individuals might form, as well as fostering creative and intellectual thought.37 The choice of how society might utilize the economic surplus was made clear by John Kenneth Galbraith—no enemy of capitalism—in 1958:

The family which takes its mauve and cerise, air-conditioned, power-steered and power-braked automobile out for a tour passes through cities that are badly paved, made hideous by litter, blighted buildings, billboards and posts for wires that should long since have been put underground. They pass on into a countryside that has been rendered largely invisible by commercial art. (The goods which the latter advertise have an absolute priority in our value system. Such aesthetic considerations as a view of the countryside accordingly come second. On such matters, we are consistent.) They picnic on exquisitely packaged food from a portable icebox by a polluted stream and go on to spend the night at a park which is a menace to public health and morals.38

Indeed, the economic surplus could instead easily represent a fund from which resources may be drawn to the benefit of society, to each individual, to individuals in need, or to specific individuals or groups. There is no law of nature or history that determines who should accumulate and control surplus funds, much less that, as in the modern, centralized capitalist system, surplus funds should accrue to those with already established political and corporate power.39 When the needs of society and individuals constitute the basis of the distribution of economic surplus funds, fetishized personal distinctions and meritocracy lose their power.40 In the end, the economic surplus fund represents a society’s potential. This potential can be directed toward change or to maintaining the status quo; to benefiting the masses or the privileged few; to redressing social problems and anxiety or to ignoring, distracting, and anesthetizing society to those crises.41

Notes

- ↩Ron Stanfield, “A Revision of the Economic Surplus Concept,” in John Bellamy Foster and Henryk Szlajfer, eds. The Faltering Economy: The Problem of Accumulation under Monopoly Capitalism, (New York: Monthly Review Press, 1984), 251–61; Hannah Holleman et al., “The Sales Effort and Monopoly Capital,” Monthly Review 60, no. 11 (April 2009): 1–23.

- ↩Robert L. Heilbroner, The Nature and Logic of Capitalism (New York: Norton, 1985).

- ↩Peter M. Lichtenstein, An Introduction to Post-Keynesian and Marxian Theories of Value and Price (Armonk, NY: Sharpe, 1983).

- ↩Stanfield, “A Revision of the Economic Surplus Concept.”

- ↩Ron Stanfield, “The Fund for Social Change,” in J. B. Davis, ed., The Economic Surplus in Advanced Economies (Aldershot, UK: Elgar, 1992); Stanfield, “A Revision of the Economic Surplus Concept.”

- ↩Ron Stanfield, “Limited Capitalism, Institutionalism, and Marxism,” Journal of Economic Issues 11, no. 1 (1977): 61–71.

- ↩John Bellamy Foster, “Monopoly Capital at the Turn of the Millennium,” Monthly Review 51 (2000): 1–18. “Capital overhang” is the phrase used by the second Bush administration to describe excess capacity: “The U.S. economy made notable progress in 2003. The recovery was still tenuous going into the year…it was still struggling against powerful contractionary forces-the capital overhang, revelations about corporate scandals, and uncertainty about future economic and geopolitical conditions” (N. Gregory Mankiw, Chairman of the Council of Economic Advisers, testimony before the House Budget Committee, February 3, 2004).

- ↩Foster, “Monopoly Capital at the Turn of the Millennium.”

- ↩This is not to say that monopoly capital is able to exercise absolute and complete control over pricing; consumer demand still plays a role in the setting of price.

- ↩Mary V. Wrenn, “The Economic Surplus as a Fund for Social Change and Post-Neoliberal Governance,” Forum for Social Economics 40, no. 1 (2010): 99–117.

- ↩Mary V. Wrenn, “Immanent Critique, Enabling Myths, and the Neoliberal Narrative,” Review of Radical Political Economics 35, no. 3 (2015): 271–79.

- ↩Paul A. Baran, The Political Economy of Growth (New York: Monthly Review Press, 1957); Foster and Szlajfer, eds., The Faltering Economy.

- ↩Tracy Mott, “In What Sense Does Monopoly Capital Require Monopoly? An Essay on the Contribution of Kalecki and Steindl,” in Davis, ed., The Economic Surplus in Advanced Economies.

- ↩David. A Harvey, A Brief History of Neoliberalism (Oxford: Oxford University Press, 2005).

- ↩Joseph D. Phillips,. “Estimating the Economic Surplus,” appendix to Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966), 379–80.

- ↩Thorstein Veblen, The Theory of Business Enterprise (New York: Cosimo, 2005).

- ↩Victor D. Lippit, “Reevaluating the Concept of the Surplus,” in Davis, ed., The Economic Surplus in Advanced Economies; Dennis Adcock, Al Halborg, and Caroline Ross, Marketing: Principles and Practice, 4th edition (Harlow, UK: Prentice Hall, 2001).

- ↩For “A List of the Sample Advertisements Portraying Neoliberalism’s Vision,” see Robert L. Craig, “Advertising, Neoliberalism, and the Financial Collapse of 2008,” in Luigi Manca, Alessandra Manca, and Gail W. Pieper, eds., Utopian Images and Narratives in Advertising: Dreams for Sale (Plymouth, UK: Lexington, 2012), 247–48.

- ↩Craig, “Advertising, Neoliberalism, and the Financial Collapse of 2008,” 229–50; Gerald Sussman, “The Propaganda Society,” in Sussman, ed., The Propaganda Society: Promotional Culture and Politics in Global Context (New York: Peter Lang, 2011), 1–22; Mary V. Wrenn, “Agency and Neoliberalism,” Cambridge Journal of Economics 39, no. 5 (2015): 1231–43.

- ↩Tressie McMillan Cottom, “The Logic of ‘Stupid Poor People:’ Status, Poverty, and Gatekeeping,” in Poverty/Privilege: A Reader for Writers (Oxford: Oxford University Press, 2014).

- ↩Barbara Ehrenreich, Smile or Die: How Positive Thinking Fooled America and the World (London: Granta, 2010).

- ↩Craig, “Advertising, Neoliberalism, and the Financial Collapse of 2008”; Brett Williams, Debt for Sale: A Social History of the Credit Trap (Philadelphia: University of Pennsylvania Press, 2004).

- ↩Douglas Galbi, “CS Ad Expenditure Dataset, v. 1.14,” http://galbithink.org; United States Census Bureau, “Estimated Revenue by Tax Status for Employer Firms: 2007 through 2014,” http://census.gov. The space that appears at the year 2007 represents the end of the Galbi data set and the beginning of the U.S. Census data set. The break is meant to emphasize that the two data sets measure advertising revenue according to different categories.

- ↩Heilbroner, The Nature and Logic of Capitalism; Holleman et al., “The Sales Effort and Monopoly Capital.” Profits accrued due to product differentiation or planned obsolescence are commonly referred to as “Schumpeterian profits” in heterodox circles and “technological rents” in conventional economics circles. See Heilbroner, The Nature and Logic of Capitalism, 73, for further detail.

- ↩Michael Dawson and John Bellamy Foster, “The Tendency of the Surplus to Rise, 1963–1988,” in Davis, ed., The Economic Surplus in Advanced Economies.

- ↩Philipp Schautschick and Christine Greenhalgh, “Empirical Studies of Trade Marks: The Existing Economic Literature,” Economics of Innovation and New Technology 25, no. 4 (2016): 358–90.

- ↩Prior to the rise of neoliberalism in the 1970s, Polanyi describes this phenomenon as the “protective counter-movement”: Karl Polanyi, The Great Transformation (Boston: Beacon,1944).

- ↩Frances Fox Piven, “Neoliberal Social Policy and Labor Market Discipline,” in Michael Zweig, ed., What’s Class Got To Do With It? American Society in the Twenty-First Century (Ithaca, NY: ILR, 2004), 113–24; Wrenn, “Agency and Neoliberalism.”

- ↩Jay Costa, “What’s the Cost of a Seat in Congress?” Maplight, March 10, 2016, http://maplight.org.

- ↩The March 2010 SpeechNow.org v. FEC U.S. Supreme Court case was an application of the January 2010 ruling in Citizens United v. FEC. The latter allowed traditional PACs to spend money on political issues or campaigns independently of specific political campaigns in addition to making direct contributions, while the former allowed for the creation of “super PACs”—independent expenditure-only political action committees.

- ↩Compliance with this rule falls under the jurisdiction of the Internal Revenue Service, which has not been active in monitoring or enforcing the 49.9 percent rule.

- ↩An additional complication with the reporting of 501 organization donations is that it is difficult to discern how much of the donations are spent on political campaigns.

- ↩Mary V. Wrenn, “Neoliberalism, Polanyi’s Protective Response, and Veblenian Waste,” Journal of Economic Issues 50, no. 2 (2016): 594–602.

- ↩The Faltering Economy; Holleman et al., “The Sales Effort and Monopoly Capital.”

- ↩Sussman, “The Propaganda Society.”

- ↩Vincent Gaddis, “Black Face—White Utopia: Reflections on African-Americans, Utopia, and Advertising,” in Manca, Manca, and Pieper, eds., Utopian Images and Narratives in Advertising, 193–212.

- ↩Stanfield, “A Revision of the Economic Surplus Concept.”

- ↩John K. Galbraith, The Affluent Society (New York: Houghton Mifflin, 1958), 199.

- ↩Stanfield, “The Fund for Social Change.”

- ↩Stanfield, “A Revision of the Economic Surplus Concept.”

- ↩Lichtenstein, An Introduction to Post-Keynesian and Marxian Theories of Value and Price.

Comments are closed.