Also in this issue

- Introduction to Special Issue on the Critique of Economics

- A Missing Chapter of Monopoly Capital: Introduction to Baran and Sweezy's 'Some Theoretical Implications'

- Last Letters: Correspondence on "Some Theoretical Implications"

- The Surplus in Monopoly Capitalism and the Imperialist Rent

- The GDP Illusion: Value Added versus Value Capture

- Keynes, Steindl, and the Critique of Austerity Economics

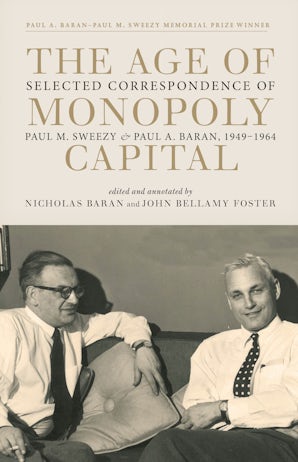

- Two Pauls

Books by Paul A. Baran

The Age of Monopoly Capital

Edited by John Bellamy Foster and Nicholas Baran

by Paul M. Sweezy and Paul A. Baran

Political Econ of Growth

by Paul A. Baran

Monopoly Capital

by Paul A. Baran

Longer View

by Paul A. Baran

Article by Paul A. Baran

- Freedom and Economics

- The Danger of Fascism in the United States: A View from the 1950s

- Listen to the Ecologists!

- The Ecological Crisis of Capitalism and Human Survival

- The Political Tragedy of Capitalist Rule

- The Puzzle of Financialization

- End of Cold War Illusions

- Monthly Review in Historical Perspective

- Oliver Cromwell Cox's Marxism

- The Quality of Monopoly Capitalist Society: Mental Health