In their classic work on monopoly capital, Paul A. Baran and Paul M. Sweezy argue that, in the era of monopoly capitalism, there has been a tendency for economic surplus to rise, making it necessary for capitalism constantly to find new ways to “absorb” the increasingly larger economic surpluses. Capitalist economic surplus may be absorbed by consumption, investment, or expenditures spent on various wasteful activities.1 In the 1950s and ’60s, the combination of several unsustainable factors, such as epoch-making innovations, new infrastructure development, rapid population growth, massive military expenditures, and unchallenged U.S. hegemony, created favorable conditions for surplus absorption and laid the foundation for the economic prosperity in the “golden age” of U.S. and global capitalism.2 In the 1970s and ’80s, as various favorable conditions that had helped absorb surplus began to fade away, Marxist scholars influenced by the tradition of monopoly capital theory argued that the United States and other advanced capitalist economies were likely to enter a new era of long-term stagnation.3

Since the global economic crisis of 2008–2009, some economists have revived the discussion about “secular stagnation.” Mainstream Keynesian economists, such as Paul Krugman and Larry Summers, argue that insufficient aggregate demand could lead to a prolonged period of secular stagnation for the U.S. economy.4 Furthermore, Robert Gordon, a leading economist of neoclassical growth theory, has argued that the end of historically exceptional technological revolutions will bring about a permanent deceleration of the U.S. economy in the coming decades.5

Since the 1960s, growth rates of advanced capitalist economies have slowed down substantially. For the U.S. economy, the average annual growth rate of real GDP declined from 4.1 percent in the 1960s to 3.2–3.3 percent in the ’70s and ’80s. After rising to 3.4 percent in the 1990s, the U.S. economic growth rate declined further, to 1.8 percent during the first decade of this century before recovering to 2.1 percent during 2011–2022.6

China has enjoyed rapid economic growth for several decades. However, in recent years, the Chinese economy has decelerated sharply. According to China’s official statistics, after peaking at 11.3 percent during 2006–2010, the average annual growth rate of China’s real GDP declined to 7.9 percent during 2011–2015, 5.7 percent during 2016–2020, and 5.2 percent during 2018–2022.7 In the future, China’s population and labor force are projected to decline.8 China’s growth in labor productivity is also expected to decelerate gradually in the coming decades.9 The combination of the declining labor force and decelerating labor productivity growth means that the Chinese economy could approach stagnation toward the mid-twenty-first century.Both Marxist political economists and mainstream economists have studied how difficulties in surplus absorption (or insufficient effective demand) have contributed to secular stagnation. But secular stagnation, or near-zero economic growth, could also create new contradictions for surplus absorption by undermining certain conditions required for maintaining stable effective demand. In this article, we argue that the U.S. economy in the early twenty-first century has depended on government deficits playing an indispensable role for the absorption of disposable capitalist surplus. However, persistently high government deficits, in combination with slow economic growth rates, have led to an unsustainable rise of the government debt to GDP ratio within existing social relations.

Conversely, China has depended heavily on investment for surplus absorption. Very high investment to GDP ratios in the context of decelerating economic growth have led to increasingly lower rates of return on newly invested capital. These developments eventually may lead to the collapse of private capitalist investment, creating a massive shortfall in surplus absorption. We argue that in the future, China may be compelled to increase state investment to make up for the gap in surplus absorption, creating favorable conditions for China’s transition to socialism.10

Surplus Absorption in the U.S. Economy: 2000–2022

Baran and Sweezy defined “economic surplus” as a society’s economic output, less the socially necessary costs of production and essential consumption. “Surplus absorption” is the process through which the economic surplus embodied in produced capitalist commodities is sold on the market and transformed into surplus in monetary form.11

The concept of surplus absorption originated with Karl Marx. Marx argued that the surplus value available for capitalists depended not only on how effectively the capitalists exploit the workers, but also on whether the surplus value produced can be “realized” in the market.12 Michał Kalecki famously postulated that while workers tend to spend what they earn, “capitalists earn what they spend.”13 That is, the total amount of capitalist surplus value that can be “realized” or “absorbed” largely depends on how much the capitalist class itself spends on capitalist consumption and investment.

Economic surplus as defined by Baran and Sweezy includes not only capitalist profits, but also government revenue. For individual capitalists, investment and consumption expenditures mainly are financed by disposable profits after taxes are paid and various transfer payments are accounted for. We call the total capitalist profit that is at the disposal of the capitalists after tax and transfer payments “disposable capitalist surplus.” Disposable capitalist surplus can be absorbed by capitalist spending (private capitalist consumption and net investment).14 Note that if the labor sector has a surplus instead of deficit (that is, if workers save more than they spend), the labor sector surplus is subtracted from the disposable capitalist surplus. Similarly, a government sector surplus or trade deficit would also be subtracted from the disposable capitalist surplus.

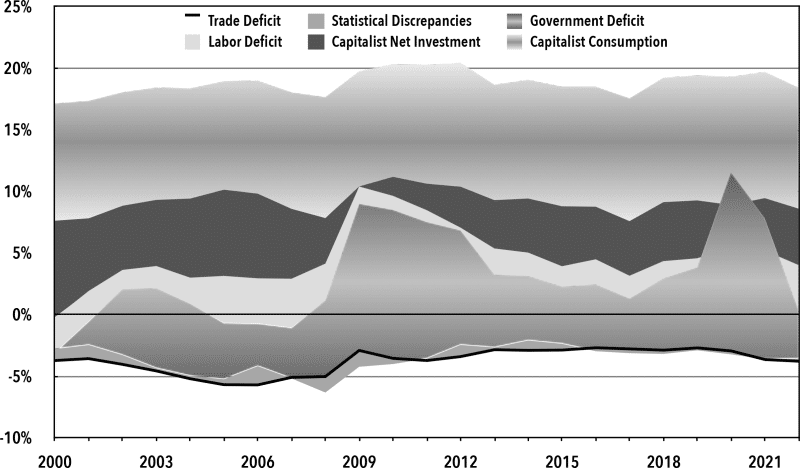

Chart 1 shows the contribution of private capitalist consumption, private capitalist net investment, labor sector deficits, and government sector deficits to surplus absorption for the U.S. economy from 2000 to 2022. The United States consistently has run trade deficits since the 1990s, which we have subtracted from the disposable capitalist surplus. Net investment by state-owned enterprises is negligible in the U.S. economy and not shown in Chart 1.

Chart 1. Disposable Capitalist Surplus, United States, 2000–2022 (percentage of GDP)

Notes and sources: The cumulative sum of the stacked areas equals the share of disposable capitalist surplus in GDP. Trade deficit as a share of GDP (with negative values) is represented by the lower boundary of the stacked areas, around which the statistical discrepancies fluctuate. Statistical discrepancies are caused by the differences between gross domestic income (the GDP by income approach) and the GDP by expenditures approach. Bureau of Economic Analysis, “National Income and Product Accounts,” Table 1.1.5, Table 1.10, Table 2.1, Table 3.1, and Table 5.1. Details of data sources and estimation methods are explained in the appendix.

U.S. disposable capitalist surplus rose from about 18 percent of GDP in the early 2000s to about 20 percent of GDP in 2010; since then, it has stabilized around 19 percent of GDP. Table 1 shows the individual components of surplus absorption as a percentage of U.S. GDP and their percentage contributions to disposable capitalist surplus for successive five-year periods.

Table 1. Contribution to Disposable Capitalist Surplus, United States, 2001–2022

| % GDP (% Disposable Surplus) |

2001–2005 | 2006–2010 | 2011–2015 | 2016–2020 | (2018–2022) |

| Capitalist Consumption | 9.1% (50.1%) |

9.4% (49.7%) |

9.7% (50.0%) |

10.1% (53.6%) |

10.2% (52.8%) |

| Capitalist Net Investment | 6.0% (32.7%) |

3.6% (19.2%) |

3.7% (19.4%) |

4.3% (23.0%) |

4.4% (22.7%) |

| Labor Deficit | 2.4% (13.0%) |

2.7% (14.3%) |

1.4% (7.2%) |

-0.0% (0.2%) |

-0.6% (-2.8%) |

| Government Deficit | 4.8% (26.3%) |

8.1% (42.2%) |

7.2% (36.8%) |

7.5% (39.4%) |

8.6% (44.5%) |

| Trade Deficit | -4.6% (-25.1%) |

-4.4% (-23.7%) |

-3.1% (-16.1%) |

-2.8% (-14.8%) |

-3.2% (-16.6%) |

| Disposable Surplus | 18.3% | 19.0% | 19.4% | 18.8% | 19.2% |

Notes and sources: See Chart 1. Because of statistical discrepancies, the sum of percentages of individual components does not necessarily equal the percentage of disposable surplus in GDP.

In twenty-first-century U.S. capitalism, only a small fraction of the disposable capitalist surplus has been used for net investment (including private capitalist business net investment and net investment on housing by individual capitalists). Private capitalist consumption has accounted for about one-half of the surplus absorption. Since the Great Recession of 2008–2009, the government deficit has been the second most important contributor to surplus absorption, accounting for about two-fifths of surplus absorption. Virtually the entire disposable capitalist surplus in the U.S. economy today depends on private capitalist consumption and wasteful activities (such as military expenditures), financed by government deficit spending in order to be “realized.”

Secular Stagnation and Unsustainable Debt

From 2001 to 2022, U.S. government sector deficits averaged about 7 percent of GDP. During the same period, interest payments made by the government sector on its debt averaged about 4 percent of GDP.15 This implies that the “primary deficits” of the government sector (the total deficit less interest payments) averaged about 3 percent of GDP.

Persistently high government deficits have led to a surge of government debt. The U.S. general government debt rose from 53 percent of GDP in 2001 to 95 percent of GDP in 2010 and 133 percent of GDP in 2020 before falling back to 121 percent of GDP in 2022.16 According to the Congressional Budget Office, federal government debt is projected to increase from about 100 percent of GDP in 2023 to about 180 percent of GDP by 2053.17 Assuming that the state and local government debts will be about 20 percent of GDP, the Congressional Budget Office’s projection implies that the U.S. general government debt will approach 200 percent of GDP by the mid-twenty-first century.

What will happen to U.S. government debt beyond the middle of the century? It has been established in the literature on debt dynamics that a country’s long-term government debt to GDP ratio depends on the following three factors: 1) the primary deficit to GDP ratio, 2) the long-term economic growth rate, and 3) the long-term average real interest rate. This can be illustrated by the following formula:

Long–term government debt to GDP ratio =

Primary deficit to GDP ratio / (Real GDP growth rate – Real interest rate)

Since 2000, U.S. government primary deficits have averaged about 3 percent of GDP, economic growth rates have averaged about 2 percent, and average real interest rates on ten-year treasury notes have averaged about 1 percent.18 If these numbers hold indefinitely, the U.S. government debt to GDP ratio eventually will approach 300 percent (since 3 percent / [2 percent – 1 percent] = 300 percent).

However, the U.S. economy may not be able to maintain a long-term growth rate of 2 percent. A country’s economic growth rate equals the growth rate of the labor force plus the labor productivity growth rate (labor productivity is here defined as real GDP per worker). According to United Nations population projections, the U.S. labor force will stop growing after 2050, then decline gradually over the second half of the twenty-first century.19

Robert Gordon argues that in the future, the U.S. annual labor productivity growth rate will slow to about 1 percent. Although new innovations such as artificial intelligence, robots, and 3D printing will help increase the level of labor productivity, there is no guarantee that these innovations will help significantly increase the rate at which average labor productivity grows.20

If the U.S. labor force stops growing and the labor productivity growth rate reaches about 1 percent, then the U.S. economic growth rate will slow down to about 1 percent by mid-century. In that case, if the financial capitalists continue to demand a real interest rate of 1 percent or more, then any positive primary deficit will lead to indefinite growth of the government debt to GDP ratio.

In reality, before government debt approaches two or three times the GDP (not to say infinity), the U.S. government may be forced to implement a fiscal austerity program, leading to economic crisis and social catastrophe. Alternatively, a failure to restrain the growth of government debt to GDP ratio could eventually lead to a financial crisis resulting from surging interest rates, the collapse of the dollar, or a combination of both, as domestic and foreign capitalists dump U.S. treasury securities when they lose confidence in U.S. capitalism.

Surplus Absorption in China: 2000–2021

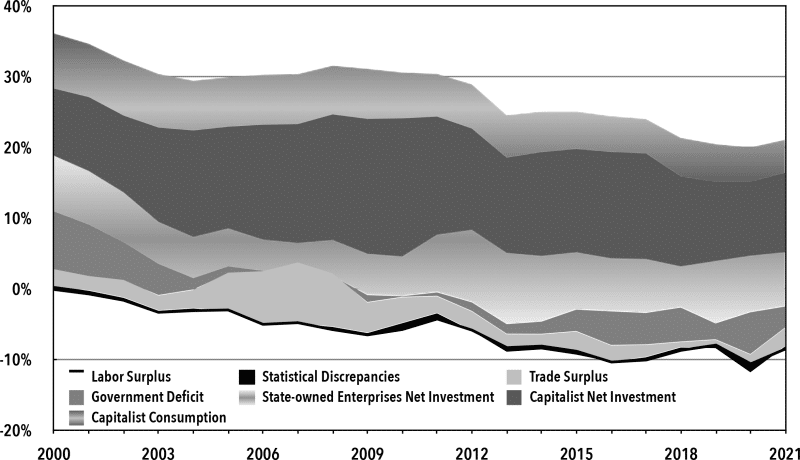

Chart 2 shows the contributions of private capitalist consumption, private capitalist net investment, net investment by state-owned enterprises, government sector deficit, and trade surplus to surplus absorption for the Chinese economy from 2000 to 2021. For the Chinese economy, the disposable income of the labor sector has consistently surpassed worker-household spending on consumption and net investment. The labor sector surplus is subtracted from disposable capitalist surplus.

Chart 2. Disposable Capitalist Surplus, China, 2000–2021 (percentage of GDP)

Notes and sources: The cumulative sum of the stacked areas equals the share of disposable capitalist surplus in GDP. Labor surplus as share of GDP (shown as negative values) is represented by the lower boundary of the stacked areas around which the statistical discrepancies fluctuate. Statistical discrepancies are caused by the differences between GDP by the value-added approach and GDP by the expenditures approach. National Bureau of Statistics of China, “National Data: Annual Data.” Details of data sources and estimation methods are explained in the appendix.

Interestingly, China’s disposable capitalist surplus declined from 31 percent of GDP in the early 2000s to 21 percent of GDP in 2021, suggesting that the Chinese economy may have had growing difficulties in surplus absorption. Table 2 shows the individual components of surplus absorption as a percentage of China’s GDP and their respective contributions to disposable capitalist surplus for successive five-year periods.

Table 2. Contribution to Disposable Capitalist Surplus, China, 2001–2021

| % GDP (% Disposable Surplus) |

2001–2005 | 2006–2010 | 2011–2015 | 2016–2020 | (2017–2021) |

| Capitalist Consumption | 7.4% (23.6%) | 6.9% (22.5%) |

5.9% (22.0%) |

5.1% (23.4%) |

5.1% (23.7%) |

| Capitalist Net Investment | 12.8% (41.1%) |

17.8% (57.8%) |

14.7% (54.9%) |

12.8% (57.6%) |

12.1% (56.0%) |

| State-Owned Enterprise Net Investment | 6.4% (20.3%) |

5.2% (16.7%) |

9.2% (34.6%) |

7.6% (34.7%) |

7.6% (35.8%) |

| Government Deficit | 3.9% (12.1%) |

-0.2% (-0.6%) |

1.6% (6.4%) |

4.5% (20.5%) |

4.2% (19.4%) |

| Trade Surplus | 3.0% (9.6%) |

6.4% (20.6%) |

2.6% (9.7%) |

1.7% (7.6%) |

1.8% (8.2%) |

| Labor Surplus | -2.3% (-7.5%) |

-5.5% (-17.8%) |

-7.0% (-26.8%) |

-9.5% (-42.9%) |

-9.1% (-42.5%) |

| Disposable Surplus | 31.4% | 30.9% | 26.9% | 22.1% | 21.5% |

Notes and sources: See Chart 2. Because of statistical discrepancies, the sum of percentages of individual components does not necessarily equal the percentage of disposable surplus in GDP.

Unlike the U.S. economy since the 1970s, the Chinese economy has depended primarily on investment for surplus absorption. Since 2006, private capitalist net investment has accounted for nearly three-fifths of total surplus absorption. In recent years, the share of private capitalist net investment in GDP has declined, and the state sector has played a growing role in stabilizing China’s surplus absorption. Since 2011, net investment by state-owned enterprises has accounted for more than one-third of China’s surplus absorption. Over the period of 2017–2021, total state sector net investment (including net investment by state-owned enterprises and the government sector) accounted for 58 percent of surplus absorption, surpassing the contribution of private capitalist net investment.

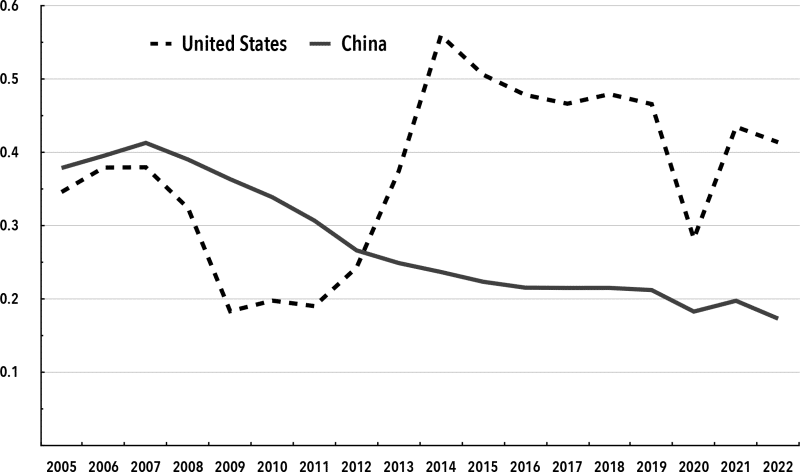

While U.S. dependence on government deficit for surplus absorption has led to an unsustainable rise of government debt, China’s heavy dependence on investment for surplus absorption has led to the rapid—and potentially disastrous—decline of rates of return on newly invested capital. Chart 3 compares the incremental output-capital ratio in China and the United States. The incremental output-capital ratio is defined as real GDP growth per unit of real net investment. This shows how much additional economic output can be brought about with each further yuan or dollar of new investment. In Chart 3, the incremental output-capital ratios are shown in five-year trailing averages to smooth out short-term fluctuations.

Chart 3. Incremental Output-Capital Ratio (5-Year Trailing Averages), China and the United States, 2000–2005 through 2018–2022

Sources: Bureau of Economic Analysis, “National Income and Product Accounts,” Table 1.1.5, Table 1.1.6, Table 5.1; National Bureau of Statistics of China, “National Data: Annual Data”; and the authors’ calculation.

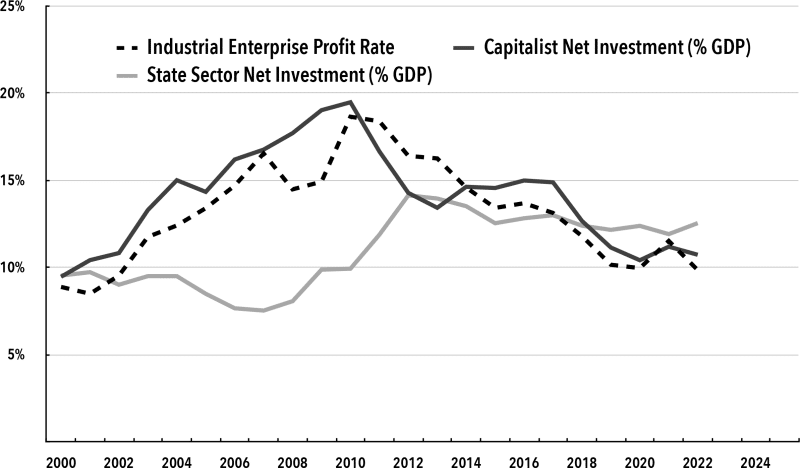

Chart 4. Industrial Enterprise Profit Rate and Net Investment, China, 2000–2022

Notes and sources: Industrial profit rate is defined as the ratio of profit before income tax over equity capital at replacement cost for industrial enterprises above designated sizes. National Bureau of Statistics of China, “National Data: Annual Data,” and the authors’ calculation.

Due to the Great Recession of 2008–2009, the incremental output-capital ratio of the United States fell to about 0.18 for the five-year period ending in 2009. After 2011, the incremental output-capital ratio surged. For the period of 2018–2022, the U.S. incremental output-capital ratio stood at 0.41. By comparison, China’s incremental output-capital ratio started at a relatively high level, around 0.4 percent in the early 2000s. Since then, China’s incremental output-capital ratio has declined substantially. By 2018–2022, China’s incremental output-capital ratio fell to 0.17.

After peaking at 19 percent in 2010, the average profit rate of industrial enterprises in China declined by nearly one-half, to just under 10 percent in 2022 (see Chart 4). Capitalist investment is driven by the pursuit of profit. Other things being equal, a lower average profit rate makes private investment less attractive and more risky (as a lower average profit rate increases the chance that an individual capitalist may suffer losses). Indeed, the share of China’s GDP of private capitalist net investment has moved almost in parallel with the industrial profit rate. After rising strongly in the early 2000s, private capitalist net investment peaked at 19 percent of GDP in 2010 before falling to 11 percent of GDP by 2022.

In comparison, state sector net investment rose from less than 8 percent of GDP in 2007 to 14 percent of GDP in 2012. Since then, state sector net investment has stabilized in the range of 12–13 percent of GDP. Had state sector net investment not played this stabilizing role, China’s disposable capitalist surplus as a share of GDP would have declined by a much larger margin than it has in recent years.

Secular Stagnation and Overinvestment

What will happen to China’s incremental output-capital ratio in the future? The incremental output-capital ratio is the ratio of real GDP growth over real net investment. Let real GDP growth be ∆Y, real net investment be NI, and real GDP be Y. The incremental output-capital ratio would be ∆Y / NI = (∆Y / Y) / (NI / Y). Therefore, the incremental output-capital ratio can be calculated as the ratio of real GDP growth rate (∆Y / Y) over the net investment share in GDP (NI / Y). If the share of net investment in GDP remains relatively stable but the economic growth rate declines, the incremental output-capital ratio will tend to fall. This is exactly what has happened to the Chinese economy in recent years. China’s incremental output-capital ratio in the future, therefore, depends on China’s future economic growth rate, which in turn depends on the growth rates of the labor force and labor productivity.

China’s population and labor force have already peaked and are projected to decline at an accelerating pace in the coming decades. The Chinese government began to relax the One-Child Policy in 2011, effectively abandoning it in 2015.21 Despite the change, China’s birth and fertility rates have continued to decline. From 2017 to 2021, China’s crude birth rate fell from 13.1 per thousand to 7.6 per thousand, and the total fertility rate (the average number of children born to a woman over her lifetime) fell from 1.8 children to 1.2.22 A total fertility rate of 2.1 is required to stabilize the population in the long run.

According to a report by the YuWa Population Research Institute, the average cumulative cost of raising a child from birth to 17 years old in China amounts to 540,000 yuan (about $80,000), or six times China’s per capita GDP. Relative to per capita GDP, China’s cost of raising children is among the highest in the world, partly because of inadequate government social expenditures on health care, education, and housing.23 Moreover, raising children demands substantial amount of time from parents. This is incompatible with China’s regime of exploitation, which requires excessively long working hours from workers.24 Without a major increase in government social expenditures and a substantial reduction of working time, China’s fertility rate is likely to decline further in the coming years.

According to UN projections, China’s prime working-age population (the population between 25 and 59 years old) is projected to decline from about 750 million in 2022 to 430 million in 2060. In terms of the average annual rate of change, China’s labor force is projected to decline at an annual rate of 0.6 percent in the 2030s, 1.7 percent in the 2040s, and 2.3 percent in the 2050s.25 Children who are born in 2024 will be 25 years old by 2049. Therefore, any improvement of the fertility rate in the coming years (if there is improvement at all) could only affect the labor force level in 2050 and later years. The declining trajectory of China’s labor force from now to the mid-twenty-first century largely has been determined.

According to official statistics, China’s average annual growth rate of labor productivity was 10.9 percent in 2006–2010, but declined to 6.0 percent in 2018–2022.26 In the future, China’s labor productivity growth rate is likely to decline further.

According to the Penn World Table, China’s per capita real GDP reached about $14,000 (in constant 2017 international dollars) in 2019. In 1990, there were forty-one countries or regions that had a population of more than one million and a per capita real GDP that was higher than China’s in 2019. The average annual growth rate of labor productivity for these forty-one countries or regions from 1991 to 2019 was 1.8 percent. Out of those countries and regions, sixteen had an average annual growth rate of labor productivity greater than 2 percent during 1991–2019. None of these sixteen countries or regions had a population of more than fifty million in 1990, and only six countries had an average labor productivity growth rate higher than 2 percent for the period after 2000.27 International experience in the past suggests that after reaching China’s current level of per capita real GDP, a country’s long-term labor productivity growth rate is likely to slow down to about 2 percent or lower.

Several studies about the future prospects of China’s economic growth have concluded that China’s annual economic growth rate is likely to slow to about 2 percent by the late 2030s.28 China’s current share of net capital formation (including state sector, private capitalist, and worker-household net investment) in GDP is about 28 percent. If the net investment share of GDP were to stay at this level but the economic growth rate slowed to 2 percent, then the incremental output-capital ratio would decline to only 0.07 (2 percent / 28 percent ≈ 0.07).

Beyond 2050, China’s labor force will decline at an annual rate of more than 2 percent. In that case, if China’s labor productivity growth rate falls to about 2 percent, China’s annual economic growth rate will fall toward zero, and could even become negative. With a zero or negative economic growth rate, any positive net investment would result in a zero or negative incremental output-capital ratio.29 Under such a scenario, new investment could become completely unattractive for private capitalists, and private capitalist net investment may collapse completely.

Socialism Comes to the Rescue?

The analysis in the previous section has demonstrated that the Chinese economy will face a huge dilemma in the coming decades. Given its current economic structure, China’s economy heavily depends on investment for surplus absorption. If China were to maintain its current investment level relative to GDP, the incremental output-capital ratio would fall toward zero, and private capitalist investment eventually would collapse. However, if China were to make a downward adjustment of its investment level, it immediately would subtract from the disposable capitalist surplus and destabilize the economy.30

Could some other factors replace private capitalist investment and help absorb most of the disposable capitalist surplus? In the Chinese context, both capitalists and worker-households have high saving rates. If capitalists and worker-households can increase their consumption propensity, higher household consumption can help absorb some of the capitalist surplus.31

An International Monetary Fund working paper in 2018 studied the factors that have contributed to the very high saving rates of Chinese households. The working paper argued that demographic structure, the absence of a reliable and widespread social safety net, high levels of income inequality, and high housing prices relative to income are the most important factors that have contributed to China’s exceptionally high saving rates. Among these factors, the provisioning of a comprehensive social safety net would require a substantial increase in government spending, stabilizing and lowering housing prices would require major adjustments to economic policy and may reduce household net investment, and a meaningful reduction of income inequality would require major changes to China’s current economic and political system. This leaves changes in demographic structure as the only factor that could help reduce household saving without any major policy or institutional change. The paper estimated that because of population aging, Chinese households’ saving rate could decline by 5 percent of household disposable income between 2020 and 2040. Because household disposable income is about one-half of China’s GDP, this implies that household saving could decline (and household consumption could increase) by about 2–3 percent of GDP.32

Could China use larger government deficits to offset the decline of investment and stabilize the capitalist surplus? In the section on U.S. debt, we have shown that with a future economic growth rate of 1 percent, U.S. government debt would be on an unsustainable path. As China’s labor force is projected to decline rapidly, the Chinese economy is likely to experience zero or negative growth by the mid-twenty-first century. With zero or negative economic growth, any government deficit will translate into an indefinite growth of the government debt to GDP ratio, and only a fiscal balance or surplus could stabilize the debt to GDP ratio.

Since the 1990s, China has enjoyed three decades of large trade surpluses. China is already the world’s largest net exporter. Any further expansion of China’s trade surplus relative to the size of the Chinese and global economies is likely to cause serious trade and geopolitical tensions. In the future, it is unlikely that China will increase significantly its trade surplus as a share of GDP.

Thus, at best, increases in capitalist and worker-household consumption may help absorb a small fraction of the disposable capitalist surplus. However, this may be offset by reductions in the government deficit. China’s trade surplus as a share of GDP is unlikely to increase in any meaningful way, and may shrink in the future if trade and geopolitical conflicts intensify. This leaves state sector investment as the only possible tool through which the share of disposable capitalist surplus of GDP can be maintained at an acceptable level. Unlike government deficit, which needs to be financed by borrowing from capitalists, state sector investment can be self-financed by revenues from state-owned enterprises.33

In the future, if private capitalist net investment were to completely collapse, surplus absorption largely (or even completely) would depend on state sector net investment. To offset the collapse of private capitalist investment, it would be necessary for state sector net investment as a share of GDP to rise substantially. Under such a scenario, only the state sector would have net investment and the private capitalist sector would have zero or negligible net investment. In the long term, the state sector would be able to own most of society’s capital stock. This would help create the favorable economic conditions required for the transition to socialism.

When the political conditions are ripe, a progressive government could use state sector investment to raise aggregate demand to a level that is consistent with full employment. This would strengthen the power of the working class to demand higher labor income at the expense of capitalist profit. Moreover, a progressive government could increase taxes on the capitalists in order to finance programs that would help enhance working-class well-being and restore ecological sustainability. These measures gradually would help eliminate the disposable capitalist surplus.

Zero disposable capitalist surplus means zero profit available for capitalists. Since no capitalist enterprise would operate in an economy where the expected profit rate is zero, capitalists would respond to the steady decline of the profit rate by closing more and more existing enterprises. This would compel the society to either take over the remaining capitalist enterprises (perhaps by compensating the capitalists with payments of government bonds under a strategy of peaceful transition) or invest in new socially owned enterprises to replace the bankrupt capitalist enterprises. Eventually, this could pave the way for social control over economic surplus, to be used for the free development of all individuals in manners to be determined by the society’s democratic decisions. In an economy with zero capitalist profit, an economic surplus would continue to exist in the form of tax revenue or profits from socially owned enterprises appropriated by the society as a whole.

Concluding Remarks

We have used the United States and China as two examples to illustrate the economic contradictions under the condition of secular stagnation. U.S. capitalism has depended on government deficit to absorb a sizable portion of disposable capitalist surplus. The combination of large government deficits and slow economic growth has led to higher government debt to GDP ratios, which are expected to rise to unsustainable levels in the future. In contrast, the Chinese economy has relied primarily on private capitalist investment to absorb disposable surplus. China’s overinvestment has driven down the rate of return on newly invested capital.

By the mid-twenty-first century, the rapid decline of China’s labor force could drag China’s economic growth rate down to zero. If that happens, China’s rate of return on new investment is likely to be so low that private capitalist investment will completely collapse. Only much larger state sector investments can help stabilize the disposable capitalist surplus. Eventually, society may find it desirable to intentionally lower the disposable capitalist surplus until it is eliminated. This would necessitate the transition to socialism, because only socially owned means of production can operate sustainably in an economy with zero profit. In such a socially owned economy, all economic surplus would be appropriated by the society as a whole and used for purposes determined by democratic decisions.

Statistical Appendix: Estimating Surplus Absorption in the United States and China

Disposable Capitalist Surplus Absorption

In conventional national accounting, gross domestic income includes total labor income (W), total capitalist profit (π), net taxes on production and imports (Tindirect, also known as indirect taxes less subsidies), and depreciation (D, also known as consumption of fixed capital). Gross domestic expenditures include personal or household consumption (C), investment (I, also known as gross capital formation), government consumption (Gc), and net exports (NX). If there are no statistical discrepancies, gross domestic income should equal gross domestic expenditures:

W + π + Tindirect+ D = C + I + Gc + NX (1)

or

W + π + Tindirect = C + (I – D) + Gc + NX.

The sum of W, Π, and Tindirect equals net domestic income (that is, gross domestic income minus depreciation of fixed capital).

In equation (1), total labor income and total capitalist profit are calculated before income taxes. Both workers and capitalists would pay income taxes. Workers would make social insurance contributions, and both workers and capitalists would receive transfer payments from the government. Moreover, both workers and the government sectors need to pay interest on their debts, and capitalists would receive interest income by lending to the government and to worker-households. In addition, the government may receive revenue by selling nonproduced assets (such as land) and incur expenses by purchasing land. Capitalists may incur net expenses by purchasing land from the government or worker-households, and worker-households may earn net revenues by selling land to the government or the capitalists.

When income taxes, transfer payments, interest payments, and revenues from the net sale of nonproduced assets are taken into account, total labor income, total capitalist profit, and net taxes on production and imports can be replaced by disposable labor income (Wdisposable), disposable capitalist surplus (πdisposable), and disposable government revenue (Tdisposable), respectively.

Replacing W + π + Tindirect in equation (1) with Wdisposable + πdisposable + Tdisposable gives:

Wdisposable + πdisposable + Tdisposable = C + (I – D) + Gc + NX. (2)

Personal consumption (or household consumption) includes worker-household consumption (CW) and capitalist consumption (Cπ). (I – D) is net investment or net capital formation, which includes private capitalist net investment (NIπ), net investment by state-owned enterprises (NISOE), worker-household net investment (NIW; household purchases of new houses are considered investments in conventional national accounting), and government net investment (NIGOV). Therefore:

Wdisposable + πdisposable + Tdisposable = (CW + Cπ) + (NIπ + NISOE + NIW + NIGOV) + Gc + NX. (3)

Rearranging the terms results in:

πdisposable = Cπ + NIπ + NISOE + (CW + NIW – Wdisposable) + (Gc + NIGOV – Tdisposable) + NX. (4)

That is, disposable capitalist surplus equals the sum of capitalist consumption, private capitalist net investment, net investment by state-owned enterprises, the labor sector deficit, the government sector deficit, and the trade surplus (if net exports are positive).

Equation (4) illustrates the Marxian and post-Keynesian insight that “capitalists earn what they spend.” In fact, capitalists not only earn what they spend, but also earn from the deficit spending of other economic sectors. This equation may be called the “disposable capitalist surplus absorption equation.”34

Estimating Disposable Labor Income

For the United States, disposable labor income is total labor income plus government social benefits paid to individuals; minus social insurance contributions, personal current taxes paid from labor income, other transfer payments made by persons to the government, and personal interest payments; plus revenue from household net sale of nonproduced assets.

Total labor income is calculated as compensation of employees plus 70 percent of the proprietors’ income. Employee compensation and proprietor incomes are from the Bureau of Economic Analysis, “National Income and Product Accounts,” Table 1.10. Government social benefits paid to individuals, social insurance contributions, personal current taxes, and other transfer payments made by people to the government are from “National Income and Product Accounts,” Table 3.1.35

Personal current taxes are divided between the taxes paid from labor personal income and taxes paid from capitalist personal income by assuming that individuals at all personal income levels pay the same current personal tax rate (calculated as the ratio of personal current taxes over total personal income).36 Total personal income is from “National Income and Product Accounts,” Table 2.1. Labor personal income is total labor income plus government social benefits paid to individuals, minus social insurance contributions. Capitalist personal income is total personal income less labor personal income.

Personal interest payments are from “National Income and Product Accounts,” Table 2.1. We assume that all personal interest payments are made by worker-households, and worker-households receive no interest income.

Revenue from household net sale of nonproduced assets is from the Federal Reserve Bank at St. Louis.37 U.S. household revenue from the net sale of nonproduced assets is very small. We assume that all revenue from household net sale of nonproduced assets is a part of disposable labor income.

For China, disposable labor income is equal to total labor income; plus government social insurance and welfare payments; minus social insurance contributions, individual income taxes paid from labor income, other transfer payments made by households to the government, and household interest payments; plus revenue from household net sale of nonproduced assets.

Total labor income is the sum of total wages of urban nonprivate units, total wages of urban private units, rural labor income, social insurance contributions, and other benefits paid by employers. Data are from the National Bureau of Statistics of China, “National Data: Annual Data.”38

Government insurance and welfare payments, social insurance contributions, individual income taxes, other transfer payments made by households to the government, household interest payments, and revenue from household net sale of nonproduced assets are from the National Bureau of Statistics of China, “National Data: Annual Data,” and “Flow of Funds Accounts.”

Individual income taxes are divided between taxes paid from labor household income and taxes paid from capitalist household income by assuming that all household incomes pay the same individual income tax rate (calculated as the ratio of individual income taxes over total household income). Total household income is from the National Bureau of Statistics of China, “Flow of Funds Accounts.” Labor household income is total labor income plus government social insurance and welfare payments, minus social insurance contributions. Capitalist household income is total household income minus labor household income.

Estimating Disposable Government Revenue

For the United States, disposable government revenue equals net taxes on production and imports plus personal current taxes, corporate income taxes, income taxes from the rest of the world, social insurance contributions and other transfer receipts, and income receipts on assets; minus government social benefits to persons, other government transfer payments, and interest payments; plus the current surplus of government enterprises and revenue from the net sale of nonproduced assets. Data for all government revenues and expenditures are from “National Income and Product Accounts,” Table 3.1.

For China, disposable government revenue is net producer taxes plus individual income taxes, business income taxes, social insurance contributions and other transfer receipts, and income receipts on assets; minus government social insurance and welfare payments, other government transfer payments, and interest payments; plus revenue from the net sale of nonproduced assets. Data for all government revenues and expenditures are from the National Bureau of Statistics of China, “Flow of Funds Accounts.”

Estimating Disposable Capitalist Surplus

Disposable capitalist surplus is net domestic income (or net domestic product), less disposable labor income and disposable government revenue.

Worker-Household and Capitalist Consumption

For the United States, personal consumption expenditures are from “National Income and Product Accounts,” Table 1.1.5. We assume that 60 percent of U.S. disposable capitalist personal income (disposable capitalist personal income is capitalist personal income minus personal current taxes paid by capitalists) is spent on consumption.39 The difference between total personal consumption expenditure and capitalist consumption is worker-household consumption.

For China, total household consumption is from the National Bureau of Statistics of China, “National Data: Annual Data.” We assume that 50 percent of disposable capitalist household income (disposable capitalist come taxes paid by capitalists) is spent on consumption.40 The difference between total household consumption and capitalist consumption is worker-household consumption.

Net Investment

For the United States, business net investment, household net investment, and government net investment are from “National Income and Product Accounts,” Table 5.1. Since 2000, U.S. worker-household consumption has often exceeded disposable labor income, meaning worker-households have had negative savings. We assume that all U.S. household net investment is made by capitalists. Thus, private capitalist net investment equals business net investment plus household net investment. We assume that the United States does not have net investment made by state-owned enterprises.

For China, total net capital formation is gross capital formation minus the consumption of fixed capital. Consumption of fixed capital is from the National Bureau of Statistics of China, “National Data: Annual Data,” Input-Output Tables.

We assume that the share of business net investment, household net investment, and government net investment in total net capital formation is the same as the share of business gross capital formation, household gross capital formation, and government gross capital formation in total gross capital formation. Business gross capital formation, household gross capital formation, and government gross capital formation are from the National Bureau of Statistics of China, “Flow of Funds Accounts.”

The National Bureau of Statistics of China provides data for total-society fixed investments, private fixed investments, and state sector fixed investments. We assume that the share of state sector net investment in total net capital formation is the same as the share of state sector fixed investment in total-society fixed investments. Net investment by state-owned enterprises is then calculated as the difference between estimated state sector net investment and government sector net investment. Private capitalist business net investment is calculated as the difference between business sector net investment and net investment by state-owned enterprises.

Household sector net investment is divided between worker-household net investment and capitalist household net investment in proportion with worker-household saving and capitalist household saving. Worker-household saving is disposable labor income minus worker-household consumption. Capitalist household saving is disposable capitalist household income less the capitalist consumption. Private capitalist net investment is the sum of private capitalist business net investment and capitalist household net investment.

Government Consumption and Net Exports

For the United States, government consumption and net exports are from “National Income and Product Accounts,” Table 1.1.5.

For China, government consumption and net exports are from the National Bureau of Statistics, “National Data: Annual Data.”

Notes

- ↩ Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966).

- ↩ Paul M. Sweezy and Harry Magdoff, The End of Prosperity (New York: Monthly Review Press, 1973).

- ↩ John Bellamy Foster, “What Is Stagnation?,” in Robert Cherry, ed., The Imperiled Economy, Book 1: Macroeconomics from a Left Perspective (New York: Monthly Review Press, 1987), 59–70; Paul M. Sweezy and Harry Magdoff, Stagnation and the Financial Explosion (New York: Monthly Review Press, 1987).

- ↩ Paul Krugman, “Bubbles, Regulation, and Secular Stagnation,” New York Times, September 25, 2013; Lawrence H. Summers, speech at the IMF Fourteenth Annual Research Conference, Washington, DC, November 8, 2013.

- ↩ Robert J. Gordon, The Rise and Fall of American Growth (Princeton: Princeton University Press, 2016).

- ↩ World Bank, “World Development Indicators,” databank.worldbank.org.

- ↩ National Bureau of Statistics of China, China Statistical Yearbook 2023 (Beijing: China Statistics Press), stats.gov.cn.

- ↩ United Nations Department of Economic and Social Affairs Population Division, “World Population Prospects 2022,” population.un.org.

- ↩ Matthew Higgins, “China’s Growth Outlook: Is High-Income Status in Reach?,” Economic Policy Review 26, no. 4 (2020): 69–98; Dominik Peschel and Wenyu Liu, “The Long-Term Growth Prospects of the People’s Republic of China,” Asia Development Bank East Asia Working Paper Series, December 2022, adb.org; Roland Rajah and Alyssa Leng, “Revising Down the Rise of China,” Lowy Institute, March 14, 2022.

- ↩ This would be China’s “second transition” to socialism, if one considers the Chinese Revolution of 1949 and the following years to be the first transition.

- ↩ Baran and Sweezy, Monopoly Capital.

- ↩ On how the failure of surplus value “realization” would lead to capitalist economic crisis, see Karl Marx, Capital, vol. 2 (New York: International Publishers, 1967), 396–527.

- ↩ See Michał Kalecki, “A Theory of Profits,” Economic Journal 52, no. 206/207 (1942): 258–67; Nicholas Kaldor, “Alternative Theories of Distribution,” Review of Economic Studies 23, no. 2 (1956): 83–100.

- ↩ For detailed explanations of how capitalist consumption, private capitalist net investment, net investment by state-owned enterprises, labor sector deficit, government sector deficit, and trade surplus help absorb disposable capitalist surplus, see the appendix to this article. The appendix also provides definitions and estimation methods for disposable labor income, disposable government revenue, and disposable capitalist surplus.

- ↩ U.S. Bureau of Economic Analysis, “National Income and Product Accounts,” Table 3.1.

- ↩ “General Government Gross Debt for United States,” Federal Reserve Bank of St. Louis Economic Data, updated October 12, 2023, fred.stlouisfed.org.

- ↩ U.S. Congressional Budget Office, The 2023 Long-Term Budget Outlook (Washington, DC: Congressional Budget Office, June 2023).

- ↩ Nominal interest rates on ten-year U.S. treasury notes are from Economic Report of the President and The Annual Report of the Council of Economic Advisors, March 2023, Table B-42, govinfo.gov. Real interest rates are nominal interest rates less inflation rates.

- ↩ United Nations, “World Population Prospects 2022,” medium variant.

- ↩ Gordon, The Rise and Fall of American Growth, 593–601, 637.

- ↩ Lin Ping, “Zhongguo Quanmian Fangkai Ertai [China Removes All Restrictions on Two Children],” Radio Free Asia, October 29, 2015.

- ↩ United Nations, “World Population Prospects 2022.”

- ↩ Liang Jianzhang, Huang Wenzheng, and He Yafu, Zhongguo Shengyu Chengben Baogao 2024 Ban [Report on Children Raising Cost in China, 2024 Edition], YuWa Population Research Institute, February 21, 2024.

- ↩ Many Chinese workers have to work more than 3,500 hours per year. By comparison, an average worker in a developed capitalist country works between 1,400 and 1,800 hours per year. See Minqi Li, “From ‘996’ to ‘Lying Flat’: China’s Regime of Accumulation,” in Greg Albo, Nicole Aschoff, and Alfredo Saad-Filho, eds., Socialist Register 2023: Capitalism and Politics (New York: Monthly Review Press, 2023), 190–209.

- ↩ United Nations, “World Population Prospects 2022,” low variant (consistent with China’s recent trend in fertility rates).

- ↩ National Bureau of Statistics of China, China Statistical Yearbook 2023.

- ↩ “Penn World Table, Version 10.01,” Groningen Growth and Development Centre, January 2023, rug.nl. The six countries that had a labor productivity growth rate higher than 2 percent for the period of 2001–2019 are Hungary, Ireland, South Korea, Lithuania, Saudi Arabia, and Singapore. Hungary’s and South Korea’s labor productivity growth rates were barely above 2 percent.

- ↩ See Higgins, “China’s Growth Outlook”; Peschel and Liu, “The Long-Term Growth Prospects of the People’s Republic of China”; Rajah and Leng, “Revising Down the Rise of China.”

- ↩ Since the incremental output-capital ratio equals (∆Y / Y) / (NI / Y), if the economic growth rate (numerator) becomes zero or negative, then any positive net investment as a share of GDP (denominator) would make the overall ratio zero or negative.

- ↩ It can be shown that if China were to reduce net investment to a level that helped to stabilize the incremental output-capital ratio in the context of slow economic growth, it would require such a massive subtraction from the surplus that virtually the entire disposable capitalist surplus would have to be eliminated. For example, to stabilize the incremental output-capital ratio at 0.2 with an economic growth rate of 2 percent, the net investment share in GDP would need to be lowered from the current level of 28 percent to 10 percent, implying a massive reduction of disposable capitalist surplus by 18 percent of GDP.

- ↩ In the context of disposable capitalist surplus absorption, higher household consumption can lead to either an increase in capitalist consumption or a smaller labor sector surplus, thereby helping absorb capitalist surplus.

- ↩ Longmei Zhang et al., “China’s High Savings: Drivers, Prospects, and Policies,” IMF Working Paper, WP/18/277, December 2018.

- ↩ If state sector investment is financed by the profits of existing state-owned enterprises, it is obviously self-financed. If state sector investment is financed by borrowing, the borrowing can be paid back using future revenues of state-owned enterprises.

- ↩ Hyman Minsky proposed a formula showing that total capitalist profit can be determined by the sum of capitalist investment and deficit spending by the household, government, and foreign sectors. See Hyman Minsky, Stabilizing an Unstable Economy (New Haven: Yale University Press, 1986), 160–65. Minsky’s formula did not take into account interest and transfer payments between workers, capitalists, and the government sector.

- ↩ S. Bureau of Economic Analysis, “National Data: National Income and Product Accounts.”

- ↩ After various tax deductions and evasions are taken into account, working-class households and wealthy capitalist households pay similar income tax rates. See Emmanuel Saez and Gabriel Zucman, “The Rise of Wealth and Income Inequality in America,” Journal of Economic Perspectives 34, no. 4 (2020): 3–26.

- ↩ “Households and Nonprofit Organizations; Acquisition of Nonproduced Nonfinancial Assets, Net, Transactions,” Federal Reserve Bank of St. Louis Economic Data, updated December 7, 2023.

- ↩ National Bureau of Statistics of China, “National Data: Annual Data.”

- ↩ The top income earners in the United States save nearly 40 percent of their income. See “The Average Saving Rate by Income (Wealth Class),” Financial Samurai, February 16, 2022.

- ↩ The top income earners in China save nearly 50 percent of their income. See Zhang et al., “China’s High Savings.”

Comments are closed.