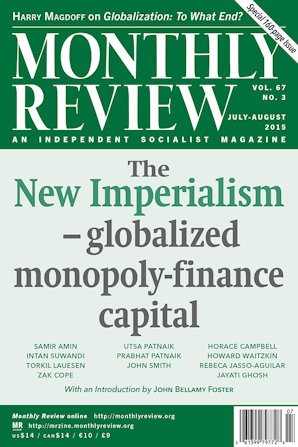

Also in this issue

- The New Imperialism of Globalized Monopoly-Finance Capital: An Introduction

- Contemporary Imperialism

- Behind the Veil of Globalization

- Imperialism and the Transformation of Values into Prices

- Imperialism in the Era of Globalization

- Imperialism in the Twenty-First Century

- Imperialism and Anti-Imperialism in Africa

- Imperialism's Health Component

- Resisting the Imperial Order and Building an Alternative Future in Medicine and Public Health

- The New Stage of Globalization

Books by Jayati Ghosh

Capital Accumulation and Women's Labor in Asian Economies

by Peter Custers

Introduction by Jayati Ghosh